I’m starting to see some developments in equities that are becoming concerning. What I see taking place could lead to a market top in the next few days/weeks or could be worked through by some form of consolidation that equity bulls follow-up with a continuation of the current uptrend.

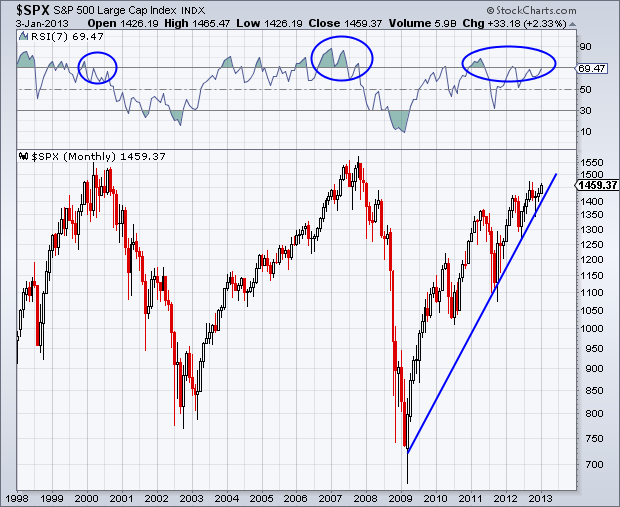

The first chart I want to show is the monthly S&P 500. By taking a step back and looking at a longer-term chart of this index we can compare past market tops to the current environment. What I want to focus on here is the lower highs that took place in the 7-period Relative Strength Index at the top in 2000 and again in 2007. Being still in the first week of January we can’t come to a complete conclusion if we get another lower low in momentum, we must be patient and let price dictate our actions. What we would be looking for is a solid break of the rising blue trend line that the $SPX has treated as support since the bull market began in 2009 in order to get a type of confirmation that equity bulls have lost their grip.

The next chart I want to take a look at is the ratio between the 10-year Treasury Note and the S&P 500. This chart looks at the weekly price ratio between bonds and equities. This is not a science, there is not a magical level that triggers the top based on this relationship. However, the ratio is now at a similar level that we saw in September ’12 and early 2011. We can also see that each rally off the lows in 2010, 2011, and 2012 put in lower highs for the bond-equity ratio. While stocks advanced they did not do so with the same gusto as each previous move. Is this a sign that the Fed’s QE programs are having less of an impact? Maybe.

The next chart I want to take a look at is the ratio between the 10-year Treasury Note and the S&P 500. This chart looks at the weekly price ratio between bonds and equities. This is not a science, there is not a magical level that triggers the top based on this relationship. However, the ratio is now at a similar level that we saw in September ’12 and early 2011. We can also see that each rally off the lows in 2010, 2011, and 2012 put in lower highs for the bond-equity ratio. While stocks advanced they did not do so with the same gusto as each previous move. Is this a sign that the Fed’s QE programs are having less of an impact? Maybe. Looking at a lot of daily charts, I’m noticing quite a few divergences. At this point they are small, but still present. These types of things can be easily worked through, and I hope they do. I’d much rather see prices continue their advance. While we are still in an uptrend (as the monthly chart shows) it appears to be getting weak.

Looking at a lot of daily charts, I’m noticing quite a few divergences. At this point they are small, but still present. These types of things can be easily worked through, and I hope they do. I’d much rather see prices continue their advance. While we are still in an uptrend (as the monthly chart shows) it appears to be getting weak.

You’ll notice there’s nothing I’ve said that pinpoints the date of a market top or a call for equities to come crashing down. Could it happen? Sure. What I’m looking for is a trend change or more signs of weakness in order to become bearish on the equity market. In the end I remain faithful to price action and what it tells me. I think the next few weeks will be very telling for how things will shape up for 2013.

Going forward we must contend with the debt ceiling, Q4 earning session, and potentially more whispers of the Fed ending or pulling back on its market intervention. This is a lot for the market to take on, we’ll see how traders react and if the above mentioned concerns are able to be extinguished or if we begin to see a shift in the capital markets….Time shall tell.

No comments:

Post a Comment