Posted by JC Parets on July 30th, 2013

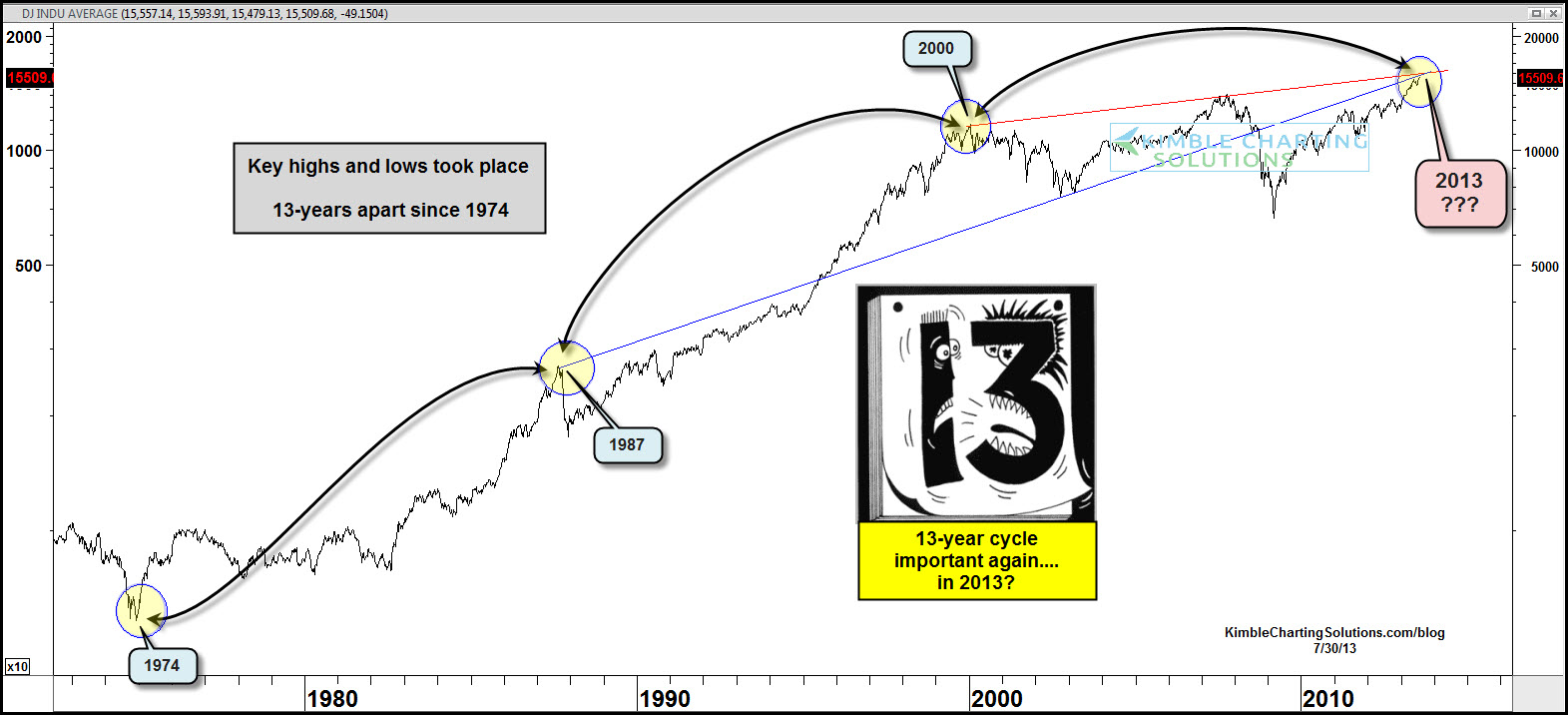

As you guys know, I take a look at a lot of charts every day. I mean, I literally look at thousands of charts daily. But this one from Chris Kimble takes the cake as the best chart I’ve seen all week. And by best I mean the most interesting, not necessarily the most bullish.

The first thing you notice is the 13 year cycle of major tops and bottoms that have been put in for the Dow Jones Industrial Average going back to 1974. Currently we’re in the 13th year after a major top was put in during the year 2000. So cyclically, the market is vulnerable according to this chart:

But the two trendlines that go back to the 1987 and 2000 tops are just fascinating.

Make what you will of this chart. Call it a coincidence if you want. But tell me this isn’t the chart of the day?

http://allstarcharts.com/chart-of-the-day-dow-cycles/

As you guys know, I take a look at a lot of charts every day. I mean, I literally look at thousands of charts daily. But this one from Chris Kimble takes the cake as the best chart I’ve seen all week. And by best I mean the most interesting, not necessarily the most bullish.

The first thing you notice is the 13 year cycle of major tops and bottoms that have been put in for the Dow Jones Industrial Average going back to 1974. Currently we’re in the 13th year after a major top was put in during the year 2000. So cyclically, the market is vulnerable according to this chart:

Click chart to embiggen

But the two trendlines that go back to the 1987 and 2000 tops are just fascinating.

Make what you will of this chart. Call it a coincidence if you want. But tell me this isn’t the chart of the day?

http://allstarcharts.com/chart-of-the-day-dow-cycles/