Investment and Humor Blog Devoted to Lost Souls Searching For a Home.

Total Pageviews

Saturday, May 31, 2014

Friday, May 30, 2014

Thursday, May 29, 2014

Monday, May 26, 2014

Sunday, May 25, 2014

Saturday, May 24, 2014

Friday, May 23, 2014

Bad Ass

Thor Heyerdahl

Badassitude isn’t always about killing other human beings and using your enemies’ severed heads to play two-on-two pickup hoops with hot topless bikini babes. Sometimes it’s about going on crazy adventures and using your intellect and your bravery to go the extra mile and prove to everyone in the world just how massive your nuts are. Norwegian archaeologist Thor Heyerdahl falls in to the second category – the man wasn’t the sort of guy who could crush human skulls into giant piles of bone dust with his bare hands, but in his lifetime he explored uncharted territories, returned unscathed from several expeditions deemed “suicidal” by the scientific community, and had some of the most amazing adventures this side of Indiana Jones. Plus, he was named after the fucking Norse God of Thunder, and it’s a little-known fact that it is against the law in Norway for you to be named Thor and not be totally fucking awesome. Seriously, if your name is Thor and you totally suck ass, then you are bound by law to change your name to something less ball-rockingly awesome. Like Alfred.

As a young man, Thor was really into zoology and animals and shit. He used to wander around Norway and capture armfuls of indigenous fucking poisonous vipers Steve Irwin-style, putting together a large private collection of venomous snakes which he could potentially have used to wipe out the entire populations of small rural villages. He didn’t though, turning away from a live of evil genius-caliber crime to go to Oslo University and study Zoology, Geography, and Polynesian Culture. He was so fascinated with the culture and history of the Polynesian people that when he graduated college and married his first mega-hottie wife in 1937, they immediately set sail together for the remote South Pacific island of Fatu Hiva.

Now, when most people honeymoon in French Polynesia, they spend their afternoons leisurely reclining under a palm tree on the beach outside their post five-star resorts, sipping Mai Tais and checking out hula-dancing fire-twirling babes in grass skirts and coconut bikinis. Not the Heyerdahls. They settled in a vast, green valley located near an ancient tribe of goddamned Polynesian cannibals, built a thatched-roof hut out of shit they foraged from the underbrush, and dedicated their free time to studying the local fauna and excavating the nearby ruins of a long-dead civilization. They ate from fruit trees, drank out of rivers, and got it on like ALL THE FUCKING TIME because let’s be honest here it was their honeymoon. During his adventures learning from the indigenous peoples and wandering around never-before explored ancient ruins in Fatu Hiva, Thor began developing a theory that was completely radical at the time – he found evidence that led him to believe that the Polynesian Islands had been settled in an East-to-West fashion by ancient South American peoples, not West-to-East by Asian peoples as all Ethnographers of the time believed. This was a balls-out, over-the-top theory that would eventually drive Heyerdahl to do some insane, awesome shit.

After a year and a half living off the land, discovering new shit, and returning to nature on Fatu Hiva, Thor returned to Norway because there was a little thing called fucking World War II going on. He joined the Free Norway military, and served in a Parachute Infantry regiment against the Nazis. No big deal, just helping to liberate the free world from the oppression of Fascist dictators. All in a day’s work for a badass archaeologist.

After the war, Thor finally got around to publishing his theory that Polynesia was settled by South American peoples who sailed West from Peru. While this might not seem like that big a deal, it was fucking huge shit to the anthropological community, who widely attempted to discredit Heyerdahl’s theories, saying that such a migration was impossible and he was a total dumbshit asshole for even suggesting it. Well Thor wasn’t the sort of badass who was going to sit around and let a bunch of numbnuts professors tell him that he was full of crap – he organized an expedition to Peru and decided to give those motherfuckers a proverbial scientific kick in the nards.

101 days on this fucking thing.

In shark-infested waters.

So Thor Heyerdahl went to Peru and build a goddamned raft out of flimsy-ass balsa wood in 1947. Most dipshit “experts” thought that the raft, named “Kon-Tiki” after an ancient Incan mariner god, would probably spontaneously combust, collapse, sink into the Pacific about two hundred yards from the shore, and the entire crew would be swallowed up by a great white whale. Heyerdahl used any research on ancient seafaring he could find to build a completely accurate vessel out of materials and technology available to the ancient Incan peoples, and pushed off for Polynesia as soon as possible. For months, Thor and his crew sailed on this barely-seaworthy vessel through shark-infested waters on a seemingly impossible mission, but after 101 days and 4,300 miles of water he successfully set foot on Polynesian soil. Then he published a scientific paper called, “Eat Shit, Motherfuckers: The True Story of How Thor Heyerdahl Made You Assholes Look Like a Bunch of Fucking Morons”, which stated that his adventure proved that it was in fact scientifically possible for the Incans to have settled in Polynesia. Now that’s how a badass handles criticism when he knows he’s right – he goes on a balls-out suicide mission just to shove it in his detractors’ stupid faces.

After Kon-Tiki, Heyerdahl went on expeditions to study the moai on Easter Island, where he explored ruins, sought out ancient archaeological discoveries, battled the Ghosts of the Twelve Ancients with a legendary magical sword crafted from the bones of fallen angels, and punched a llama in the face for no reason at all. His work in the field of population migration and ethnography were groundbreaking, but his theories were still considered by many scientists to be more radical than jumping over the flaming wreckage of an oil tanker on a bitchin’ surfboard with skulls and ninjas airbrushed on it. However, after reading about all of his awesome adventures across the globe, many people began to appreciate his work and open their minds to the research he was performing.

Thor’s adventures in building crazy boats and going on bizarre-o suicide Mr. Toad Wild Rides wasn’t over after Kon-Tiki however. No, his quest for awesome balls-out shit was only just beginning. At one point he came up with a theory that the ancient African peoples could have sailed to the New World before Christopher Columbus, another theory which was widely criticized by jackasses who didn’t know the difference between a discovery of great archaeological significance and a twenty year-old toaster. So Heyerdahl built a huge boat out of these weak-ass papyrus reeds, and decided to sail it across the Atlantic Ocean. Most nautical experts at the time thought the reeds would get water-logged and the ship would collapse after about two weeks in open water, but of course Thor didn’t even give a crap. He put together a multi-national crew and shoved off … FOR ADVENTURE! His rinky-dink ancient ship, “Ra”, left Morocco and covered 2,700 miles in 56 days, but was ultimately destroyed by a storm only one week away from its final destination. Of course, Thor never fucking half-assed anything in his entire life, so he built a SECOND ship only ten months later, and this time he covered 3,200 miles in 57 days, finally landing in Barbados and proving the plausibility that there were pre-Columbus voyages to the New World.

In 1978 he once again built a boat out of reeds and set sail from Iraq to prove that people could have migrated by sea from Iraq to Pakistan. However, Thor and his crew were getting pissed off because every port they stopped at on the African coast was a fucking warzone with jerks shooting each other in the groins for no reason at all. So five months into their journey, Thor and his crew set fire to their ship out of protest for how fucked-up the world is. And because setting huge bonfires is awesome. Heyerdahl continued his research into his 80s, studying Norse Myth, green politics, archaeology and eco-conservation right up until his death at age 87. His life is probably best summed up by the e-mailer who suggested this particular article, when he wrote:

“Thor Heyerdahl guy was the MacGyver of impossible voyages. He could probably have crafted an oceanliner out of tree bark and his own manly sweat. He even burned perfectly good boats of his own making to protest the shit that didn't fly with him. He was a relentless adventurer and an example to everyone, everywhere. In an age of intolerance, he made friends across all boundaries, exhorted people to travel and learn new tongues, taught the value of our natural environment, and never stopped in his pursuit of knowledge. He was a free spirit who refused to be bound by convention and he made the world a better place.”

www.badassoftheweek.com/heyerdahl.html/

Thursday, May 22, 2014

Wednesday, May 21, 2014

Red Flags Everywhere

If you believe that the U.S. economy is heading in the right direction, you really need to read this article. As we look toward the second half of 2014, there are economic red flags all over the place. Industrial production is down. Home sales are way down. Retail stores are closing at the fastest pace since the collapse of Lehman Brothers. U.S. household debt is up substantially, and in 20 percent of all U.S. families everyone is unemployed. In so many ways, what we are witnessing right now is so similar to what we experienced during the build up to the last great financial crisis. We are making so many of the very same mistakes that we made the last time, and yet our "leaders" seem completely oblivious to what is happening. But the warning signs are very clear. All you have to do is open your eyes and look at them. The following are 27 huge red flags for the U.S. economy...

#1 Despite endless assurances from the Obama administration that we are in an "economic recovery", the number one concern for U.S. voters is "Unemployment/Jobs" according to a recent Gallup survey.

#2 Historically, sales for construction equipment manufacturer Caterpillar have been a pretty good indicator of where the global economy is heading next. Unfortunately, sales were down 13 percentlast month and have now experienced year over year declines for 17 months in a row.

#3 During the first quarter of 2014, profits at office supply giant Staples fell by 43.5 percent.

#4 Foot traffic at Wal-Mart stores fell by 1.4 percent during the first quarter of 2014. Analysts seem puzzled as to why Wal-Mart is "underperforming". Perhaps it is because the U.S. middle class is being steadily destroyed and U.S. consumers are tapped out at this point.

#5 It is being projected that Sears will soon close hundreds more stores and will eventually go out of business altogether...

The company said this week that it may sell its 51% stake in Sears Canada, which operates nearly 20% of the company's stores worldwide. It has quietly closed nearly 100 U.S. stores in the last year. Next week, it's expected to announce dismal fiscal first quarter results and possibly yet more store closings."They have too many stores and they're losing a lot of money, burning cash," said John Kernan, an analyst with Cowen.

Kernan expects the company to close 500 of its 1,980 U.S. stores in a few years and, ultimately, to go out of business."The lights are going off at Sears and Kmart," he said. "There are tumbleweeds blowing through the parking lots at Kmart. They're basically completely irrelevant."

The "retail apocalypse" just continues to roll on, but the mainstream media is treating this like it is not really a big deal.

#6 The labor force participation rate for Americans from the age of 25 to the age of 29 has fallen to an all-time record low.

#7 According to official government numbers, everyone is unemployed in 20 percent of all American families.

#8 As families struggle to pay their bills, many of them are increasingly turning to debt in order to make ends meet. Earlier this month we learned that total U.S. household debt has increased for three quarters in a row. And as I noted in one recent article, total consumer credit in the United States has increased by 22 percent over the past three years, and 56 percent of all Americans have "subprime credit" at this point.

#9 Interest rates on student loans are scheduled to increase substantially on July 1st...

As of July 1, federal student loan rates will edge up. Rates overall will be up 0.8% compared to current rates.Federal Stafford Loans for undergraduate students will be 4.66% — up from 3.86%. Federal Stafford Loans for graduate students will be 6.21% — up from 5.41%.Federal Grad PLUS and Federal Parent PLUS Loans will be at 7.21% — up from 6.41%.

This is going to put even more pressure on the growing student loan debt bubble.

#10 U.S. industrial production fell by 0.6 percent in April. This should not be happening if the economy truly was "recovering".

#11 Manufacturing job openings in the United States have declined for four months in a row.

#12 Existing home sales have fallen for seven of the last eight months and seem to be repeating a pattern that we witnessed back in 2007 prior to the last financial crash.

#13 In the real estate bubble market of Phoenix, sales in April were down 12 percent year over year, and active inventory was up 49 percent year over year. In other words, there are tons of homes on the market, but sales are going down.

#14 The homeownership rate in the United States has dropped to the lowest level in 19 years.

#15 Trading revenue at big banks all over the western world is way down...

Late Friday, it was JPMorgan who said trading revenues will be down 20 percent this quarter. Now Barclays says trading revenues in the first three months were down 41 percent. The company cited "challenging trading conditions resulting in subdued client activity." Like JPMorgan, Barclays also warned they were seeing no improvement in trading in the second quarter.

#16 Jan Loeys, JPMorgan's head of global asset allocation, is warning that the Federal Reserve is creating a huge financial bubble which could "push us into a credit crisis"...

Where do we go from here? To this analyst, still very subdued economic growth, both at the US and global level, implies continued easy monetary policy. The risk is that bond yields rise no faster than the forwards. Financial overheating (asset inflation) proceeds much faster than economic overheating (CPI inflation). Before CPI inflation has a chance to emerge, and before monetary policy is truly above neutral, a financial bubble will have popped up somewhere and will have corrected, pushing the economy down. That is what has happened in the past 25 years. The behavior of central banks gives us no confidence that this time will be different: Central banks talk about financial instability, but appear to define this mostly in term of bank leverage. Each successive boom and bust is always in another place. A bubble can emerge without leverage. It is not possible to project exactly where this boom and bust cycle will take place as knowing where it will be would induce evasive actions that should prevent it from occurring. One possible ending, among many, is that ultra-easy rates having induced credit markets to grow much faster than equity markets, combines with reduced market making by banks (many of whom have become like brokers) to create a liquidity crisis when the Fed starts the first set of rate hikes. This could then be bad enough to close primary markets, and thus push us into a credit crisis.

#17 Peter Boockvar, the chief market analyst at the Lindsey Group, is warning that the U.S. stock market could experience a 20 percent decline once quantitative easing completely ends.

#18 A lot of other big names are telling CNBC that they expect a significant stock market "correction" very soon as well...

A bevy of high-profile names have warned lately that the market is on the doorstep of a major move lower. From long-term market bulls such as Piper Jaffray to short-term traders such as Dennis Gartman, expectations are high that the major averages are poised for a big dip, with calls varying from 10 percent or so all the way up to 25 percent.

#19 The number of Americans enrolled in the Social Security disability program exceeds the entire population of the nation of Greece and has just hit another brand new record high.

#20 Poverty continues to grow all over the country, and right now there are 49 million Americans that are dealing with food insecurity.

#21 According to Pew Charitable Trusts, tax revenue in 26 U.S. states is still lower than it was back in 2008 even though tax rates have gone up in many areas since then.

#22 Barack Obama is doing his best to keep his promise to destroy the U.S. coal industry...

The EPA is about to impose a new regulation that will reduce carbon emissions from existing power plants starting June 2 and will become permanent in 2015. The new regulation, according to Politico, is the “most dramatic anti-pollution regulation in a generation.” Because the new regulation will further cripple the coal industry, as coal-burning plants will be severely affected, American power will become more dependent on natural gas, solar and wind.

#23 Climatologists are now saying that the state of Texas is going through the worst period of drought that it has experienced in 500 years.

#24 It is being reported that "dozens of Texas communities" are less than 90 days away from being completely out of water.

#25 It is being projected that the drought in California will cost the agricultural industry 1.7 billion dollars and that approximately 14,500 agricultural workers will lose their jobs.

#26 Due in part to the drought, the price of meat rose at the fastest pace in more than 10 years last month.

#27 According to recent surveys, only about a quarter of all Americans believe that the country is heading in the right direction.

http://theeconomiccollapseblog.com/archives/27-huge-red-flags-for-the-u-s-economy

Monday, May 19, 2014

Sunday, May 18, 2014

Friday, May 16, 2014

Thursday, May 15, 2014

Wednesday, May 14, 2014

Monday, May 12, 2014

Oversold

http://www.silverdoctors.com/big-move-coming-silver-is-more-oversold-than-at-any-time-in-the-last-20-years/#more-42358

Sunday, May 11, 2014

Friday, May 9, 2014

Thursday, May 8, 2014

Tuesday, May 6, 2014

Monday, May 5, 2014

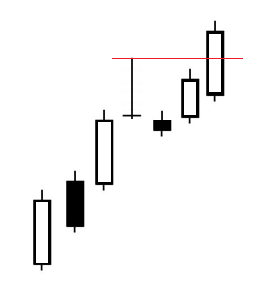

Candlestick Reversal Fails

One of the most valuable tools that we have as technicians is the ability to visualize price data in a variety of ways. Japanese Candlesticks tell a story about how a market behaved during any given period: a day, a week, month, 10-minutes, etc. The color of the candle, the size of the body, the length of the shadows (“wicks”), and the location of the candle along with its surroundings also factor into the story telling.

Today I want to discuss long shadows, their implications, and what happens when they fail to confirm. You see, whenever we have a large candlestick dominated by a long shadow, we know that the bulls (or the bears) could not hold on to control for that given period.

Today I want to discuss long shadows, their implications, and what happens when they fail to confirm. You see, whenever we have a large candlestick dominated by a long shadow, we know that the bulls (or the bears) could not hold on to control for that given period.

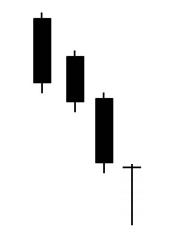

Let’s use an example of a long lower shadow after prices have been trending down. This tells us that the market opened near its highs and then sold off throughout this particular timeframe only to recover and close back at or near the highs. This is what it looks like:

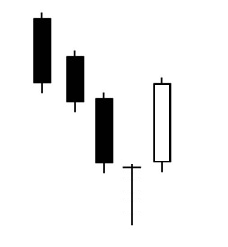

Whenever we see something like this, all of these bullish implications start to pop into our heads. The Japanese would call this fourth candlestick, the one with the long lower shadow, “a hammer”. They call it this because the candlestick suggests that the market is “hammering in a bottom”. For confirmation of this reversal, the next period should follow through with a hollow candle to the upside. The stronger the follow through, the more powerful the bullish signal:

The best part about these candlesticks is the fact that they present great entry points. The risk becomes well defined, because if it rolls over back below the low for that reversal period, all bets are off.

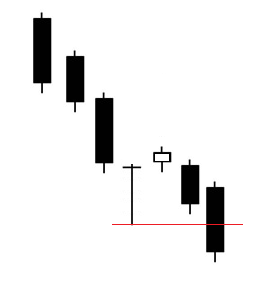

But today I just want to focus on what happens when these reversal candlesticks fail. These, to me, are some of the most powerful signals in the market. The long shadows are supposed to be important reversals. However, when these types of candles are taken out to the downside and that reversal fails to hold, the market is telling us there are larger forces at work. At this point we know the selling is so strong, that a short position or at least avoiding a long position is our best bet. Here is what that might look like:

This is a very powerful sell signal. When the reversals fail, look out below.

Now, remember that these scenarios can take place in both directions. Some of the most bullish signals are when a reversal candle with a long upper shadow (in an uptrend) gets taken out to the upside. It’s the same idea, just in the opposite direction:

In these examples, the reversal candles are immediately taken out after a couple of periods. In other cases, however, we could see some sideways action for 5-8 periods and then take out the reversal candlestick. There are many ways to use this particular signal. I’ve used it for many years and see it all the time. This is especially true in a trending market. Quite often we’ll get a reversal candle that then gets taken out confirming the bull (or bear) trend.

A good friend of mine told me recently that his technical analysis has improved tremendously since he added Japanese Candlesticks to his arsenal. Candles really do tell interesting stories, and I think it’s advantageous to use them regularly.

I don’t just use candles, I also look at line charts and bar charts for different reasons. I personally like to use line charts for ratios or if I’m just trying to clear out some of the noise. Bars are also great for cleaning up the charts in order to focus just on price. Too often we get so caught up in our moving averages and momentum indicators, that we forget about the only thing that actually matters: price. Candles are just another way to visualize that price data.

I’ve wanted to touch on this topic of failed long shadows for a while now but hadn’t gotten around to it. I hope this sparks a conversation about other potential patterns that can help us with our entry and exit points.

What do you guys think?

http://allstarcharts.com/long-shadows-fail/

Sunday, May 4, 2014

Saturday, May 3, 2014

Friday, May 2, 2014

The Real Story

And so the BLS is back to its old data fudging, because while the Establishment Survey job number was a whopper, and the biggest monthly addition since 2012, the Household Survey showed an actual decline of 73K jobs. What is much worse, is that the reason the unemployment rate tumbled is well-known: it was entirely due to the number of Americans dropping out of the labor force. To wit, the labor force participation rate crashed from 63.2% to 62.8%, trying for lowest since January 1978! And why did it crash so much - because the number of people who dropped out of the labor force soared by a near record 988K, the second highest only since January 2012 (curiously the one month when the establishment survey reported a 360K increase in jobs).

End result: the number out of the labor force is now an all time high 92 million. What is most amusing is that the "persons who currently want a job" was unchanged at 6,146K - even the BLS said it was "puzzled why so many unemployed people are not looking for jobs." We have some ideas, and no, they don't include the addition of 234K "birth/death adjustment" jobs.

Participation Rate:

People not in the labor force:

http://www.zerohedge.com/news/2014-05-02/one-million-people-dropped-out-labor-force-april-participation-rate-plummets-lowest-

Subscribe to:

Posts (Atom)