Investment and Humor Blog Devoted to Lost Souls Searching For a Home.

Total Pageviews

Saturday, April 30, 2011

Friday, April 29, 2011

Thursday, April 28, 2011

Wednesday, April 27, 2011

Low Sentiment in US Dollar = Crowded Trade?

"It’s the U.S. Dollar. And yet, despite the lowest sentiment reading in recent history, the greenback has failed to take out the previous low. In the strange realm of technical analysis this is known as a positive divergence — positive for the dollar, that is.

Yeah, I know. It’s hard to believe, isn’t it? How could anything be positive for this sad little currency, so unwanted and alone? Well, here it is on the chart below from SentimenTrader. The worst sentiment reading ever accompanied by a slightly higher low in the dollar (compared to the 2008 low).

Tuesday, April 26, 2011

Diving Dollar

The euro struck a 16-month high against the dollar and the Swiss franc notched a record high versus the US unit Tuesday amid heightened investor nerves over this week's busy economic calendar.

The European single currency hit $1.4653 in morning trade, the highest point since mid-December 2009, as many dealers returned from a long holiday weekend. It later stood at $1.4619, compared with $1.4572 late in New York on Monday.

The dollar meanwhile tumbled to an all-time low point of 0.8745 Swiss francs.

http://www.breitbart.com/article.php?id=CNG.566d80b1e85ec3f4dbdf9df60aec90c4.501&show_article=1

Monday, April 25, 2011

China Take Down

"The International Monetary Fund has just dropped a bombshell, and nobody noticed.

For the first time, the international organization has set a date for the moment when the “Age of America” will end and the U.S. economy will be overtaken by that of China.

And it’s a lot closer than you may think.

According to the latest IMF official forecasts, China’s economy will surpass that of America in real terms in 2016 — just five years from now.

Put that in your calendar.

It provides a painful context for the budget wrangling taking place in Washington, D.C., right now. It raises enormous questions about what the international security system is going to look like in just a handful of years. And it casts a deepening cloud over both the U.S. dollar and the giant Treasury market, which have been propped up for decades by their privileged status as the liabilities of the world’s hegemonic power.

According to the IMF forecast, whoever is elected U.S. president next year — Obama? Mitt Romney? Donald Trump? — will be the last to preside over the world’s largest economy. . . .

Some years ago I was having lunch with the smartest investor I know, London-based hedge fund manager Crispin Odey. He made the argument that markets are reasonably efficient, most of the time, at setting prices. Where they are most likely to fail, though, is in correctly anticipating and pricing big, revolutionary, “paradigm” shifts — whether that be the rise of disruptive technologies or revolutionary changes in geopolitics. We are living through one now.

The U.S. Treasury market continues to operate on the assumption that it will always remain the global benchmark of money. Business schools still teach students, for example, that the interest rate on the 10 Year Treasury bond is the “risk-free rate” on money. And so it has been for more than a century. But that’s all based on the Age of America.

No wonder so many have been buying gold. If the U.S. dollar ceases to be the world’s sole reserve currency, what will be? The euro would be fine if it acts like the old Deutschemark. If it’s just the Greek drachma in drag ... not so much.

The last time the world’s dominant hegemon lost its ability to run things single-handed was early in the past century. That’s when the U.S. and Germany surpassed Great Britain. It didn’t turn out well."

http://www.marketwatch.com/story/imf-bombshell-age-of-america-about-to-end-2011-04-25?pagenumber=1

Sunday, April 24, 2011

Thursday, April 21, 2011

Uhhh...Yeahhh...We Don't Trust Bernanke, Dimon and Blankfein

" Even as stocks have returned to lofty heights from their March 2009 lows, the percentage of Americans saying they hold individual stocks, stock

http://www.gallup.com/poll/147206/Stock-Market-Investments-Lowest-1999.aspx

The following are 20 signs that a horrific global food crisis is coming....

#1 According to the World Bank , 44 million people around the globe have been pushed into extreme poverty since last June because of rising food prices.

#2 The world is losing topsoil at an astounding rate. In fact, according to Lester Brown, "one third of the world's cropland is losing topsoil faster than new soil is forming through natural processes".

#3 Due to U.S. ethanol subsidies, almost a third of all corn grown in the United States is now used for fuel. This is putting a lot of stress on the price of corn.

#4 Due to a lack of water, some countries in the Middle East find themselves forced to almost totally rely on other nations for basic food staples. For example, it is being projected that there will be no more wheat production in Saudi Arabia by the year 2012.

#5 Water tables all over the globe are being depleted at an alarming rate due to "overpumping". According to the World Bank, there are 130 million people in China and 175 million people in India that are being fed with grain with water that is being pumped out of aquifers faster than it can be replaced. So what happens once all of that water is gone?

#6 In the United States, the systematic depletion of the Ogallala Aquifercould eventually turn "America's Breadbasket" back into the "Dust Bowl".

#7 Diseases such as UG99 wheat rust are wiping out increasingly large segments of the world food supply.

#8 The tsunami and subsequent nuclear crisis in Japan have rendered vast agricultural areas in that nation unusable. In fact, there are many that believe that eventually a significant portion of northern Japan will be considered to beuninhabitable. Not only that, many are now convinced that the Japanese economy, the third largest economy in the world, is likely to totally collapse as a result of all this.

#9 The price of oil may be the biggest factor on this list. The way that we produce our food is very heavily dependent on oil. The way that we transport our food is very heavily dependent on oil. When you have skyrocketing oil prices, our entire food production system becomes much more expensive. If the price of oil continues to stay high, we are going to see much higher food prices and some forms of food production will no longer make economic sense at all.

#10 At some point the world could experience a very serious fertilizer shortage. According to scientists with the Global Phosphorus Research Initiative, the world is not going to have enough phosphorous to meet agricultural demand in just 30 to 40 years.

#11 Food inflation is already devastating many economies around the globe. For example, India is dealing with an annual food inflation rate of 18 percent.

#12 According to the United Nations, the global price of food reached a new all-time high in February.

#13 According to the World Bank, the global price of food has risen 36% over the past 12 months.

#14 The commodity price of wheat has approximately doubled since last summer.

#15 The commodity price of corn has also about doubled since last summer.

#16 The commodity price of soybeans is up about 50% since last June.

#17 The commodity price of orange juice has doubled since 2009.

#18 There are about 3 billion people around the globe that live on the equivalent of 2 dollars a day or less and the world was already on the verge ofeconomic disaster before this year even began.

#19 2011 has already been one of the craziest years since World War 2. Revolutions have swept across the Middle East, the United States has gotten involved in the civil war in Libya, Europe is on the verge of a financial meltdown and the U.S. dollar is dying. None of this is good news for global food production.

#20 There have been persistent rumors of shortages at some of the biggest suppliers of emergency food in the United States. The following is an excerpt from a recent "special alert" posted on Raiders News Network....

Tuesday, April 19, 2011

HOPE! LOL

Some non-surgical methods for increasing the length of the male sex organ do in fact work, while others are likely to result only in soreness and disappointment, a review of medical literature has shown.

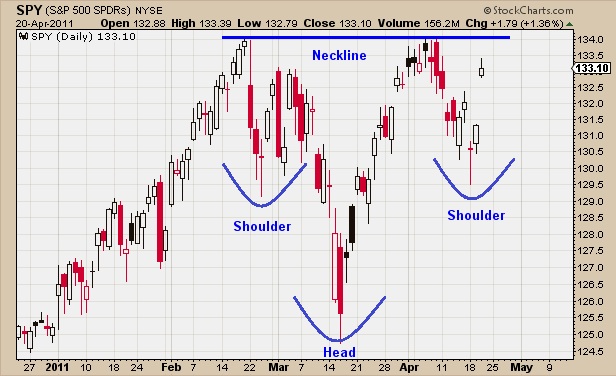

Old Bull Market

It is a rule-of-thumb that the average bull/bear cycle lasts about four years trough to trough -- 2.5 years of bull market followed by 1.5 years of bear market. Like most of these kinds of rules, it is good to keep them in mind, but don't try to set your watch by them. For example, the last bull market lasted five years, and the bear market that preceded it lasted two years. As it so happens, the last bear market lasted almost 18 months, which makes it fit the template almost exactly.

http://blogs.stockcharts.com/chartwatchers/2011/04/aging-bull.html

Monday, April 18, 2011

Easter Musing

Christians have long celebrated Jesus Christ's Last Supper on Maundy Thursday but new research released Monday claims to show it took place on the Wednesday before the crucifixion.

Professor Colin Humphreys, a scientist at the University of Cambridge, believes it is all due to a calendar mix-up -- and asserts his findings strengthen the case for finally introducing a fixed date for Easter.

Humphreys uses a combination of biblical, historical and astronomical research to try to pinpoint the precise nature and timing of Jesus's final meal with his disciples before his death.

Sector Rotation

" . . . As I explained on Tuesday, materials and energy were the two top sectors entering the month of April. Over the last week, energy and materials have reversed to the two weakest sectors. Right on cue, staples and healthcare have reversed to the two strongest. That doesn't necessarily mean that a major top is forming. It does suggest, however, that market sentiment has turned more defensive which usually suggests a market correction or a period of consolidation."

http://blogs.stockcharts.com/chartwatchers/2011/04/the-sector-rotation-model.html

Saturday, April 16, 2011

Gold / Wheat Ratio

There is an interesting cycle evident in the tops for this ratio, with important highs appearing about 42-47 years apart. Tops appear at other times too, but without the same regular periodicity of around 45 years. That same approximate cycle length also shows up in the stock market, economic wars, gold rushes, and other social phenomena. The next peak is therefore due sometime in the 2020s, at which time it would be the smart decision for investors to rotate out of overvalued gold and into food (or into the capacity to grow food).

http://www.mcoscillator.com/index.php?/learning_center/weekly_chart/the_gold_wheat_ratio/#When:03:09:28Zthe_gold_wheat_ratio

Thursday, April 14, 2011

Light Bulb Moment

I have been trading live for a month today...And my results have been decent....But this week a light went on for me....Everything became lucid...I have been told correctly what to do all along but it never resonated when I actually needed it.....It all started with a little introspection....You have to be honest with yourself and figure what you are doing that isn't right...I did...I figured out what was wrong with my trading...I was trading with FEAR....Dangerous game...

I realized I was not getting the proper results because I was too scared to hold onto a trade properly or too scared to get into a good setup...This didn't happen all the time as I said, as my results were decent...but it was a battle I was having mentally...My good friend Dutch said to me...let your plan take the heat NOT YOU!...Trust your plan and roll with it...Don't worry about getting stopped out...Next trade...When your plan gives you 75-85% positive trades there is no need to sweat a stop or a temporary loss of capital.

Well I did it this week and what a difference...Green every day and not a bad pay day either...I won't say I made it yet...Got a lot more to do...but I feel I cleared my first hurdle in the 110 meter hurdle race!

Wednesday, April 13, 2011

Fukishima Fallout

The EPA has finally released some of the radiation data it has been collecting:

- Little Rock milk radiaton – 3 times the EPA Maximum

- Radiation in Philly Drinking Water 73% of federal drinking water standards.

- Los Angeles milk radiation was above federal drinking water standards.

- Radiation found in Phoenix milk was almost at the federal drinking water standard.

- Radioactive Iodine in Boise Idaho rainwater was 130 times above Federal Drinking Water standards.

- Radioactive Caesium was 13.66 times above federal limit for Caesium-134, 2 year half-life.

- Radioactive Caesium was 12 times federal limit for Caesium-137, 30 year half-life.

- Tennessee drinking water was detected with radiation slightly above 1/2 the federal maximum.

- Radioactive Iodine has been detected in the drinking water across the entire US in the following states: California, Washington, Oregon, Idaho, Tennessee, Montana, Pennsylvania, Ohio, Michigan, New Jersey, and Alabama, as well as in Canada.

- Cesium and Tellurium were found in Boise, Las Vegas, Nome and Dutch Harbor, Honolulu, Kauai and Oahu, Anaheim, Riverside, San Francisco, and San Bernardino, Jacksonville and Orlando, Salt Lake City, Guam, and Saipan.

- Uranium-234, with a half-life of 245,500 years has been found in Hawaii, California, and Washington."

Tuesday, April 12, 2011

Bucket List?

First, a little word association.

I say: “Iceland.”

You say: “Penis”, right?

Of course you do. That’s because Iceland has allegedly cornered the market on phallic museums. Literally.

USA...USA

I love the Pirates. And I love people getting tased. So this is a total chocolate in my peanut butter moment. This happened at PNC park. Apparently a fan got a little too unruly and cops were forced to club him in the face. And this was after they fired a taser into his Shrek body and it only made him more powerful. USA!!!

Monday, April 11, 2011

Reason To Be Concerned?

"What about last week’s eye-popping pop in the Bull/Bear Ratio to 3.65, the highest reading since June 17, 2003? The bull market is more than two years old, and now the ratio is the highest it has been over the entire period. That is a bit worrisome."

http://blog.yardeni.com/2011/04/bullbear-ratio.html

Suicidal

Nearly 75 years ago (when Welfare was introduced) Roosevelt said, "Lay down your shovels, sit on your asses, and light up a Camel, this is the Promised Land."

Today, Obama has stolen your shovels, taxed your asses, raised the price of camels and mortgaged the Promised Land!

I was so depressed last night thinking about Health Care Plans, the economy, the wars, lost jobs, savings, Social Security, retirement funds, etc ........

I called a Suicide Hotline. I had to press 1 for English and was connected to a call center in Pakistan . I told them I was suicidal. They got excited and asked if I could drive a truck.

Saturday, April 9, 2011

Why So Puzzled...Don't You Have A Penis Park In Your Neighborhood?

Thirty(ish) minutes South of the port town of Samcheok, you can discover one of the strangest places in Korea. Haesindang, or Penis Park. Why is it called “Penis Park” you might ask? Easy. Its full of statues of Penises.

http://orcim.org/2009/12/04/peculiar-places-of-korea-penis-park/

Exciting Auto News

New engine sends shock waves through auto industry

Prototype could potentially decrease auto emissions up to 90 percent

Friday, April 8, 2011

Thursday, April 7, 2011

This is the Appendix to Ron Paul's New Book, "Liberty Defined"

- Rights belong to individuals, not groups; they derive from our nature and can neither be granted nor taken away by government.

- All peaceful, voluntary economic and social associations are permitted; consent is the basis of the social and economic order.

- Justly acquired property is privately owned by individuals and voluntary groups, and this ownership cannot be arbitrarily voided by governments.

- Government may not redistribute private wealth or grant special privileges to any individual or group.

- Individuals are responsible for their own actions; government cannot and should not protect us from ourselves.

- Government may not claim the monopoly over a people's money and government's must never engaged in official counterfeiting, even in the name of macroeconomic stability.

- Aggressive wars, even when called preventative, and even when they pertain only to trade relations, are forbidden.

- Jury nullification, that is, the right of jurors to judge the law as well as the facts, is a right of the people and the courtroom norm.

- All forms of involuntary servitude are prohibited, not only slavery but also conscription, forced association, and forced welfare distribution.

- Government must obey the law that it expects other people to obey and thereby must never use force to mold behavior, manipulate social outcomes, manage the economy, or tell other countries how to behave." http://www.lewrockwell.com/paul/paul732.html

Wednesday, April 6, 2011

Tuesday, April 5, 2011

Central Banking Talk...Guess Who Said It?

“While the strong increase in commodity prices has been driven by global economic growth propelled by emerging economies, speculative investment flows into commodity markets have amplified the intensity of the price surge. The dynamics of global commodity prices has been changing as well, in accordance with the growing presence of financial investors in commodity markets. The entry of new financial investors has paved the way for the “financialization of commodities”. Consequently, global commodity markets have become more sensitive to portfolio rebalancing by financial investors, which has made commodity markets more correlated with other asset markets, including major equity markets. Furthermore, globally accommodative monetary conditions have played an important role in the surge in commodity prices, both by stimulating physical demand for commodities and driving more investment flows into financialized commodity markets.”

a) The Fed

b) IMF

c) China

d) Japan

e) Greenspan

a) The Fed

b) IMF

c) China

d) Japan

e) Greenspan

Monday, April 4, 2011

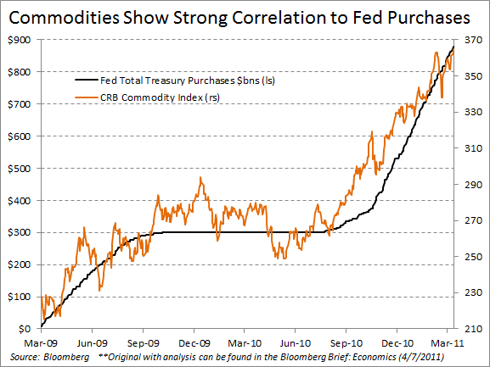

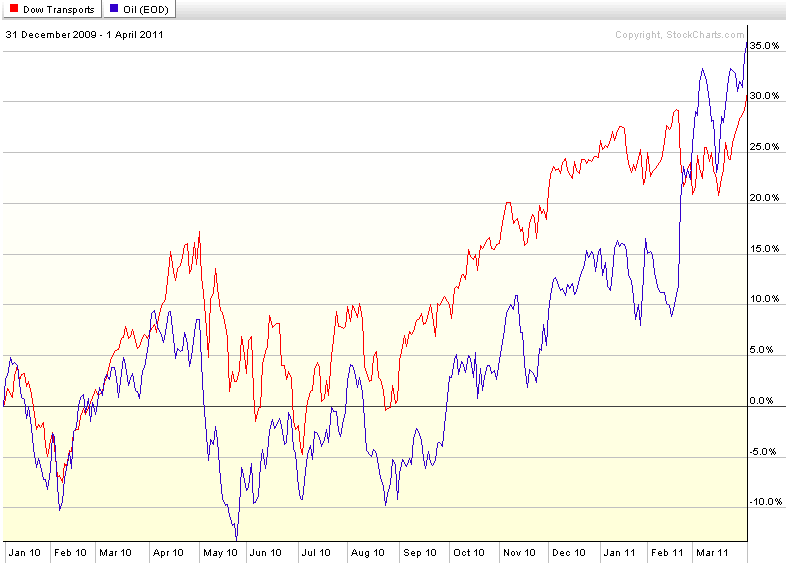

Correlation To End Soon?

Can't see this correlation lasting too much longer. Will be interesting to keep an eye on this for market direction.

http://vixandmore.blogspot.com/2011/04/chart-of-week-crude-oil-and-transports.html

Thoughts From Pragcap

"1) How will Ben let the market down softly?

How will Bernanke let this market down softly with the end of QE2? Mr. Bernanke has done something that Alan Greenspan always attempted, but never made so explicit – he has kept asset prices “higher than they otherwise would be”. It’s a dangerous precedent to set. It’s a lot like giving your children a treat every time they start to cry. After awhile they become conditioned to believe they will always get their treat so long as they cry long enough. The result is a child who never actually earns the treat and instead becomes spoiled rotten. Similarly, market prices no longer have to rise on fundamentals alone. So long as the Fed is there with their safety net speculators can feel confident that they will be rewarded with a treat every time the market declines and they begin to cry.

The result has been obvious – equity investors are eager to take excessive risk by buying every dip in the market with the knowledge that the market can no longer decline. It’s a lot like walking a tightrope knowing that there is a cushion just 5 feet beneath you. There is no need to be overly careful. The problem arises when too many people start jumping on the tightrope with you and create a disequilibrium in the system. At some point the rope becomes unstable and possibly snaps. Except this time your cushion isn’t a soft padding, but someone else’s head. People get hurt. You get the picture. What Bernanke has created is not all that different. It’s an environment of spoiled tightrope walkers who are conditioned to take risk and believe they will always receive their treat when they begin to cry. It might be “working” for speculators, but is it good for the US economy?

The problem for Mr. Bernanke is that he must take the pacifier out of the baby’s mouth without causing a temper tantrum. And yes, Wall Street will throw a temper tantrum when the pacifier is removed. If I had to venture a guess I’d guess that Mr. Bernanke will end QE2, continue reinvesting interest payments, thus slowly removing the pacifier. But that’s just a guess. Either way, he will tread carefully and likely remain close at hand with the pacifier at the ready just in case the baby begins to throw a temper tantrum.

In a similar note to thought #1 – there is the potential for a very frightening market development in the coming years (work with me through this hypothetical). Let’s say the Bernanke Put continues to cause asset prices to deviate from their fundamentals – the economy continues to recover (marginally), but the Bernanke Put becomes so ingrained in market perception that the disequilibrium in markets expands. This results in an imbalance so severe that market bubbles appear (could already be occurring in the commodity space). What happens to the market if the disequilibrium Ben Bernanke causes results in some sort of serious market dislocation similar to 2000 or 2008? All it would take is a minor exogenous threat to cause a global panic. It could be surging oil, a slow-down in China, a repeat of the Euro scares….The result would not only be economic slow-down (into an already weak developed market), but potentially crashing asset prices as bubbles have a tendency to overshoot on the downside. But it’s not the recession that would scare the markets. It is the potential backlash against the Fed.

After three bubble implosions in less than 15 years (all somehow directly tied to Fed intervention), I think the public would call on Congress to revisit the Fed’s dual mandate, its impact on markets and whether their actions over the last 20 years have been appropriate. The rational response would be to reduce the Fed’s role in markets. From a societal perspective I think this is an enormous long-term positive. The sooner we get the Fed out of the market manipulation game the sooner this economy can stabilize, definancialize and get back to becoming the economic growth machine that it has been for so long. For the markets, however, this would be a traumatic event. Imagine 20 years of Greenspan/Bernanke Put being sucked out of the market…it might sound far fetched right now, but I have a feeling the Fed will be far less involved in markets at some point in my lifetime. It might be wishful thinking, but I am confident that America will wise up to the destruction this institution causes by constantly distorting our markets and economy.

Sunday, April 3, 2011

Thing To Keep An Eye On In 2nd Quarter

"Earnings

First-quarter earnings season is coming up and by all accounts should be pretty good. S&P 500 companies are projected to report profits up 14%, according to Thomson Reuters, with materials, industrials and energy companies leading the way. FactSet expects growth of about 12%.

Those aren’t stunning growth rates but they are fairly steady. So any surprises could be interpreted with more panic than usual, threatening to hurt investor sentiment.

The Fed

The Federal Reserve’s buying of Treasury bonds is expected to conclude around the end of the second quarter, which will cause a surge in speculation about whether the economy and markets can ride on their own without the training wheels of quantitative easing, or QE2.

Remember, last year in the weeks leading up to the start of QE2, the markets were weak on concern about more money flooding in, then soared once the buying started, against most expectations. As we near the end of June, more trading strategies will become tied to this event.

Europe

Europe is still a shambles, with Ireland’s news Thursday that its banks need more money only the latest headline reminding us that the debt crisis isn’t over, at least in some countries. My sense is that stocks have moved past concerns about European banks and worries about an imminent collapse of the euro, but bailouts in Ireland and Portugal and any sense that things might spread to Spain or Italy could lead to some profit-taking ahead of the European summer vacation.

China

Everybody thinks China is tightening its grip on bank lending and rates and that will lead a slowdown in economic growth there this summer that might affect commodities prices, from oil to rare earths. Since when did anybody ever call China right? The surprising correlation in expectations exposes investors to a big surprise, especially if it’s political or social. Also, The Chinese tech companies are hugely overpriced compared to their Western rivals, so either they will come down or our own domestic tech stocks have a way to go. See story on Qihoo IPO Wednesday.

Oil

Oil prices continue to be volatile on Middle East and North Africa turmoil, particularly these days in Libya. While not enough to derail the economy, this highly unpredictable situation could still leap to the forefront of investor concerns if for some reason oil really spikes.

Washington

Finally, our own U.S. budget turmoil, with the U.S. government in danger of shutting down next week, remains a concern. While stocks rose the last time the government shut down in the 1990s — hey, at least they can’t cause trouble when they’re closed — Washington’s debt problems remain a big concern for markets. Ditto what happens to financial reform now that the big guns of the banking industry have turned their forces on weakening or killing Dodd-Frank. . . ."

Friday, April 1, 2011

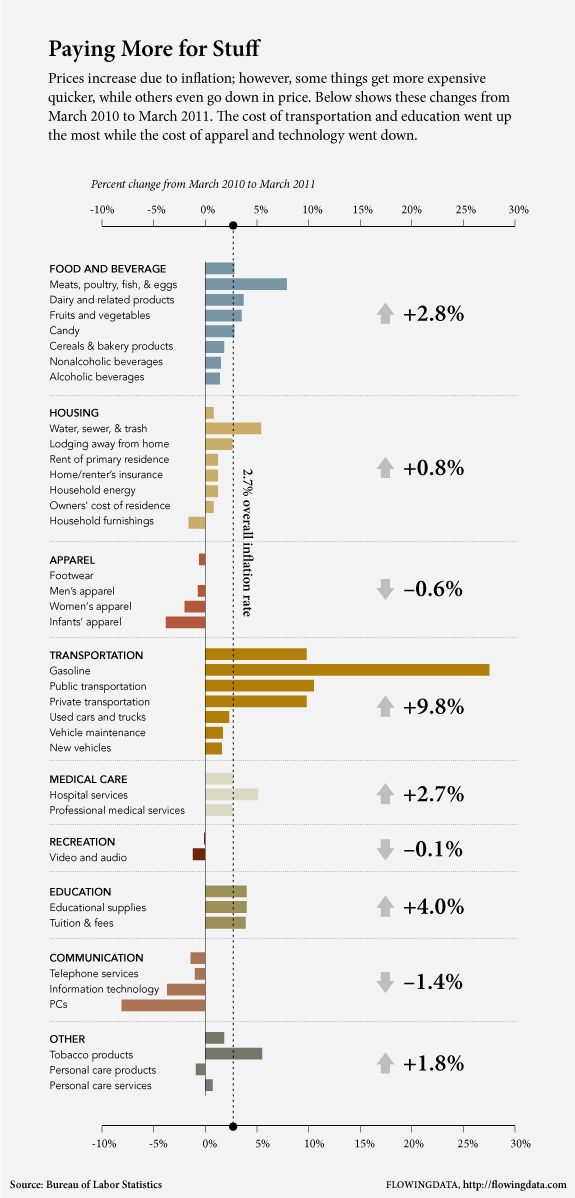

Need I Say More...

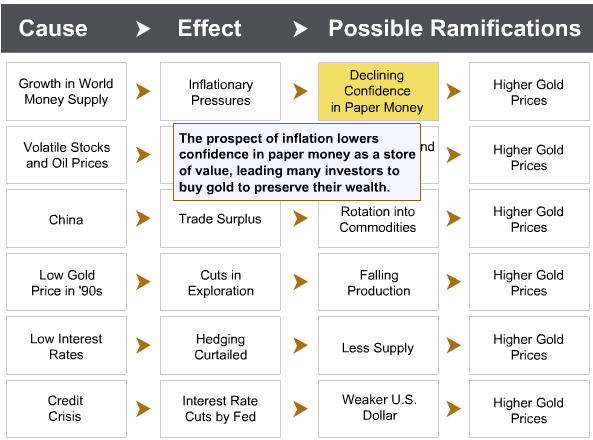

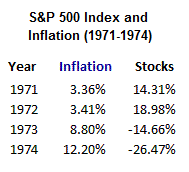

Not sure anything else needs to be said other than it will be extremely odd if the market keeps going up in the face of inflationary pressures. If the past is to be trusted keep your longs light and nimble...

Data courtesy of http://www.greenfaucet.com/

Subscribe to:

Posts (Atom)