Investment and Humor Blog Devoted to Lost Souls Searching For a Home.

Total Pageviews

Sunday, June 29, 2014

Saturday, June 28, 2014

Friday, June 27, 2014

Thursday, June 26, 2014

SWAT

The number of SWAT team raids in the United States every year is now more than 25 times higher than it was back in 1980. As America has conducted wars overseas in recent years, our police forces have become increasingly militarized as well. And without a doubt, many of our cities have become much more dangerous places. Thanks to relentless illegal immigration, drug cartels are thriving and there are now at least 1.4 million gang members living in the United States. But there are many that believe that the militarization of our police forces has gone way too far. Almost weekly, SWAT team brutality somewhere in America makes national headlines.

You are about to read about a couple of horrific examples of this below. Once upon a time, police in America were helpful and friendly and the public generally trusted them. But now our police forces are being transformed into military-style units that often act like they are in the middle of Iraq or Afghanistan. The following are 10 facts about the SWATification of America that everyone should know…

#1 In 1980, there were approximately 3,000 SWAT raids in the United States. Now, there are more than 80,000 SWAT raids per year in this country.

#2 79 percent of the time, SWAT teams are deployed to private homes.

#3 50 percent of the victims of SWAT raids are either black or Latino.

#4 In 65 percent of SWAT deployments, “a battering ram, boot, or some sort of explosive device” is used to gain forced entry to a home.

#5 62 percent of all SWAT raids involve a search for drugs.

#6 In at least 36 percent of all SWAT raids, “no contraband of any kind” is found by the police.

#7 In cases where it is suspected that there is a weapon in the home, police only find a weapon 35 percent of the time.

#8 More than 100 American families have their homes raided by SWAT teams every single day.

#9 Only 7 percent of all SWAT deployments are for “hostage, barricade or active-shooter scenarios”.

#10 Even small towns are getting SWAT teams now. 30 years ago, only 25.6 percent of communities with populations between 25,000 and 50,000 people had a SWAT team. Now, that number has increased to 80 percent. And thanks to the wars in Iraq and Afghanistan, police forces all over the nation are being showered with billions of dollars of military equipment that is coming home from overseas.

The following is what a recent Time Magazine article had to say about this phenomenon

… As the Iraq and Afghanistan wars have wound down, police departments have been obtaining military equipment, vehicles and uniforms that have flowed directly from the Department of Defense. According to a new report by the ACLU, the federal government has funneled $4.3 billion of military property to law enforcement agencies since the late 1990s, including $450 million worth in 2013. Five hundred law enforcement agencies have received Mine Resistant Ambush Protected (MRAP) vehicles, built to withstand bomb blasts. More than 15,000 items of military protective equipment and “battle dress uniforms,” or fatigues worn by the U.S. Army, have been transferred. The report includes details of police agencies in towns like North Little Rock, Ark., (pop: 62,000), which has 34 automatic and semi-automatic rifles, a Mamba tactical vehicle and two MARCbots, which are armed robots designed for use in Afghanistan. But when you start arming the police like military units and your start training them like military units, eventually they start acting like military units and the results are often quite frightening. For example, just check out what happened when a SWAT team in Florida raided the home of one young couple earlier this month…

At approximately 6:16 am on June 10th, 2014, Kari Edwards and her live-in boyfriend were seized upon by a SWAT team who smashed in the door and using flashbangs and armed to the teeth, swarmed upon the couple and even stripped Ms. Edwards naked in the process. The couple says that the group entailed personnel from DHS, for whom Edwards once worked. After smashing in the door, the tactical team threw in flashbang grenades, traumatizing their cat and swarmed upon Edwards’s boyfriend and Edwards who had just gotten out of the shower. “They busted in like I was a terrorist or something,” Edwards said. “[An officer] demanded that I drop the towel I was covering my naked body with before snatching it off me physically and throwing me to the ground.” “While I lay naked, I was cuffed so tightly I could not feel my hands. For no reason, at gunpoint,” Edwards said. “[Agents] refused to cover me, no matter how many times I asked.” That is the kind of thing that I would expect to happen in Nazi Germany, not the United States of America. But this next example is even more horrifying.

The following is what one mother says happened to her 2-year-old son when a SWAT team raided her home… After the SWAT team broke down the door, they threw a flashbang grenade inside. It landed in my son’s crib. Flashbang grenades were created for soldiers to use during battle. When they explode, the noise is so loud and the flash is so bright that anyone close by is temporarily blinded and deafened. It’s been three weeks since the flashbang exploded next to my sleeping baby, and he’s still covered in burns. There’s still a hole in his chest that exposes his ribs. At least that’s what I’ve been told; I’m afraid to look. My husband’s nephew, the one they were looking for, wasn’t there. He doesn’t even live in that house. After breaking down the door, throwing my husband to the ground, and screaming at my children, the officers – armed with M16s – filed through the house like they were playing war. They searched for drugs and never found any. I heard my baby wailing and asked one of the officers to let me hold him. He screamed at me to sit down and shut up and blocked my view, so I couldn’t see my son. I could see a singed crib. And I could see a pool of blood. The officers yelled at me to calm down and told me my son was fine, that he’d just lost a tooth.

Does that make you angry? It should. That young child is probably going to be disfigured for the rest of his life because of the brutality and the carelessness of that SWAT team. Yes, we live in perilous times and many of our communities would rapidly descend into anarchy if there were no police. But that does not mean that they have to act like Nazis. They should be able to protect us while treating us with dignity and respect at the same time.

http://endoftheamericandream.com/archives/10-facts-about-the-swatification-of-america-that-everyone-should-know

Wednesday, June 25, 2014

Interesting Chart...Time To Become Careful?

http://www.factset.com/insight/2014/6/quarterly-share-repurchases-m-and-buyback-yield-jun-18-14.png

Tuesday, June 24, 2014

Monday, June 23, 2014

Sunday, June 22, 2014

Saturday, June 21, 2014

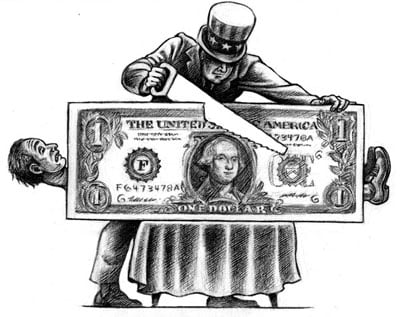

Looming Inflation

Have you noticed that prices are going up rapidly? If so, you are certainly not alone. But Federal Reserve chair Janet Yellen, the Obama administration and the mainstream media would have us believe that inflation is completely under control and exactly where it should be. Perhaps if the highly manipulated numbers that they quote us were real, everything would be fine. But of course the way that the inflation rate is calculated has been changed more than 20 times since the 1970s, and at this point it bears so little relation to reality that it is essentially meaningless. Anyone that has to regularly pay for food, water, gas, electricity or anything else knows that inflation is too high. In fact, if inflation was calculated the same way that it was back in 1980, the inflation rate would be close to 10 percent right now.

But you would never know that listening to Federal Reserve chair Janet Yellen. In the video posted below, you can listen to her telling the media that there is absolutely nothing to be concerned about...

After all, she reminds many people of a sweet little grandmother.

But the reality of the matter is that she is simply not telling us the truth. Everywhere we look, prices are aggressively moving higher.

Just the other day, the Bureau of Labor Statistics announced that the price index for meat, poultry, fish, and eggs has just soared to a new all-time high.

This is something that I have repeatedly warned would happen. Just check out this article and this article.

And it isn't just meat prices that are going up. One of the largest coffee producers in the entire world just announced that it is going to be raising coffee prices by 9 percent...

It took the Fed long enough but finally even it succumbed to the reality of surging food prices when, as we reported previously, it hiked cafeteria prices at ground zero: the cafeteria of the Chicago Fed, stating that “prices continue to rise between 3% and 33%.” So with input costs rising across the board not just for the Fed, but certainly for food manufacturers everywhere, it was only a matter of time before the latter also threw in the towel and followed in the Fed’s footsteps. Which is what happened earlier today when J.M. Smucker Co. said it raised the prices on most of its coffee products by an average of 9% to reflect higher green-coffee costs.

Not that coffee isn't expensive enough already. It absolutely stuns me that some people are willing to pay 3 dollars for a cup of coffee.

I still remember the days when you could get a cup of coffee for 25 cents.

Also, I can't get over how expensive groceries are becoming these days. Earlier this month I took my wife over to the grocery store to do some shopping. We are really ramping up our food storage this summer, and so we grabbed as much stuff on sale as we could find. When we got our cart to the register, I was expecting the bill to be large, but I didn't expect it to be over 300 dollars.

And remember, this was just for a single shopping cart and we had consciously tried to grab things that were significantly reduced from regular price.

I almost felt like asking the cashier which organ I should donate to pay the bill.

Sadly, this is just the beginning. Food prices are eventually going to go much, much higher than this.

Also, you should get ready to pay substantially more for water as well.

According to CNBC, one recent report warned that "your water bill will likely increase" in the coming months...

U.S. water utilities face a critical economic squeeze,according to a new report—and that will likely mean higher prices at the water tap for consumers.A survey by water-engineering firm Black & Veatchof 368 water utility companies across the country shows that 66 percent of them are not generating enough revenue to cover their costs.To make up for the financial shortfall, prices for water are heading upward, said Michael Orth, one of the co-authors of the report and senior vice president at Black & Veatch.“People will have to pay more for water to make up the falling revenues,” he said. “And that’s likely to be more than the rate of inflation.”

Of even greater concern is what is happening to gas prices.

According to Bloomberg, the price of gasoline hasn't been this high at this time of the year for six years...

Gasoline in the U.S. climbed this week, boosted by a surge in oil, and is expected to reach the highest level for this time of year since 2008.The pump price averaged $3.686 a gallon yesterday, up 1.2 cents from a week earlier, data posted on the Energy Information Administration’s website late yesterday show. Oil, which accounts for two-thirds of the retail price of gasoline, gained $2.49 a barrel on the New York Mercantile Exchange in the same period and $4.88 in the month ended yesterday.The jump in crude, driven by concern that the crisis in Iraq will disrupt supplies, may boost pump prices by 10 cents a gallon at a time when they normally drop, according to forecasts including one from the EIA.

And the conflicts in Iraq, Ukraine and elsewhere could potentially send gas prices screaming far higher.

In fact, T. Boone Pickens recently told CNBC that if Baghdad falls to ISIS that the price of a barrel of oil could potentially hit $200.

Of course the big oil companies are not exactly complaining about this. This week energy stocks are hitting record highs, and further escalation of the conflict in Iraq will probably send them even higher.

Meanwhile, a "bipartisan Senate proposal" (that means both Democrats and Republicans) would raise the gas tax by 12 cents a gallon over the next two years.

Our politicians have such good timing, don't they?

Ugh.

And our electricity rates are going up too. The electricity price index just set a brand new record high and there are no signs of relief on the horizon...

The electricity price index and the average price for a kilowatthour (KWH) of electricity both hit records for May, according to data released today by the Bureau of Labor Statistics.The average price for a KWH hit 13.6 cents during the month, up about 3.8 percent from 13.1 cents in May 2013.The seasonally adjusted electricity price index rose from 201.431 in May 2013 to 208.655 in May 2014—an increase of about 3.6 percent.

If our paychecks were increasing at the same rate as inflation, perhaps most families would be able to weather all of this.

Unfortunately, that is not the case at all.

As I wrote about recently, median household income in the U.S. is nowabout 7 percent lower than it was in the year 2000 after adjusting for inflation.

And if realistic inflation numbers were used instead of the government-manipulated ones, it would look a lot worse than that.

Inflation is a hidden tax that all of us pay, and it is systematically eviscerating the middle class.

So what are prices like in your neck of the woods?

Is your family feeling the pain of inflation?

http://theeconomiccollapseblog.com/archives/inflation-only-if-you-look-at-food-water-gas-electricity-and-everything-else

Friday, June 20, 2014

Saturday, June 14, 2014

Friday, June 13, 2014

Tuesday, June 10, 2014

Founding Fathers On Gov't And Capitalism

In America today, government just keeps getting bigger and the banksjust keep getting bigger. Meanwhile, the percentage of self-employed Americans is at an all-time low and the middle class is steadily dying.

What we are doing right now is clearly not working.

So why don't we go back and do the things that we were doing when we were extremely successful as a nation?

In case you don't know what those things were, here are some clues...

#1 "A wise and frugal government… shall restrain men from injuring one another, shall leave them otherwise free to regulate their own pursuits of industry and improvement, and shall not take from the mouth of labor the bread it has earned. This is the sum of good government." — Thomas Jefferson, First Inaugural Address, March 4, 1801

#2 "A people... who are possessed of the spirit of commerce, who see and who will pursue their advantages may achieve almost anything." - George Washington

#3 "Government is instituted to protect property of every sort; as well that which lies in the various rights of individuals, as that which the term particularly expresses. This being the end of government, that alone is a just government which impartially secures to every man whatever is his own." – James Madison, Essay on Property, 1792

#4 "Banks have done more injury to the religion, morality, tranquility, prosperity, and even wealth of the nation than they can have done or ever will do good." - John Adams

#5 "To take from one, because it is thought his own industry and that of his fathers has acquired too much, in order to spare to others, who, or whose fathers, have not exercised equal industry and skill, is to violate arbitrarily the first principle of association, the guarantee to everyone the free exercise of his industry and the fruits acquired by it." — Thomas Jefferson, letter to Joseph Milligan, April 6, 1816

#6 "The moment the idea is admitted into society that property is not as sacred as the laws of God, and that there is not a force of law and public justice to protect it, anarchy and tyranny commence. If ‘Thou shalt not covet’ and ‘Thou shalt not steal’ were not commandments of Heaven, they must be made inviolable precepts in every society before it can be civilized or made free." — John Adams, A Defense of the Constitutions of Government of the United States of America, 1787

#7 "I place economy among the first and most important virtues, and public debt as the greatest of dangers to be feared. To preserve our independence, we must not let our rulers load us with perpetual debt. If we run into such debts, we must be taxed in our meat and drink, in our necessities and in our comforts, in our labor and in our amusements." - Thomas Jefferson

#8 "Beware the greedy hand of government thrusting itself into every corner and crevice of industry." - Thomas Paine

#9 "If we can but prevent the government from wasting the labours of the people, under the pretence of taking care of them, they must become happy." - Thomas Jefferson to Thomas Cooper, November 29, 1802

#10 "All the perplexities, confusion and distress in America arise not from defects in the Constitution or Confederation, not from a want of honor or virtue so much as from downright ignorance of the nature of coin, credit and circulation." - John Adams, at the Constitutional Convention (1787)

#11 "The principle of spending money to be paid by posterity, under the name of funding, is but swindling futurity on a large scale." - Thomas Jefferson

#12 "Liberty must at all hazards be supported. We have a right to it, derived from our Maker. But if we had not, our fathers have earned and bought it for us, at the expense of their ease, their estates, their pleasure, and their blood." – John Adams, 1765

#13 "If ever again our nation stumbles upon unfunded paper, it shall surely be like death to our body politic. This country will crash." - George Washington

#14 "I wish it were possible to obtain a single amendment to our Constitution. I would be willing to depend on that alone for the reduction of the administration of our government to the genuine principles of its Constitution; I mean an additional article, taking from the federal government the power of borrowing." - Thomas Jefferson

#15 "When the people find that they can vote themselves money, that will herald the end of the republic." — Benjamin Franklin

http://theeconomiccollapseblog.com/archives/15-quotes-from-our-founding-fathers-about-economics-capitalism-and-banking

Monday, June 9, 2014

Sunday, June 8, 2014

Saturday, June 7, 2014

Thursday, June 5, 2014

Wednesday, June 4, 2014

Tuesday, June 3, 2014

Monday, June 2, 2014

Velocity of Money

When an economy is healthy, there is lots of buying and selling and money tends to move around quite rapidly. Unfortunately, the U.S. economy is the exact opposite of that right now. In fact, as I will document below, the velocity of M2 has fallen to an all-time record low. This is a very powerful indicator that we have entered a deflationary era, and the Federal Reserve has been attempting to combat this by absolutely flooding the financial system with more money. This has created some absolutely massive financial bubbles, but it has not fixed what is fundamentally wrong with our economy. On a very basic level, the amount of economic activity that we are witnessing is not anywhere near where it should be and the flow of money through our economy is very stagnant. They can try to mask our problems with happy talk for as long as they want, but in the end it will be clearly evident that none of the long-term trends that are destroying our economy have been addressed.

When an economy is healthy, there is lots of buying and selling and money tends to move around quite rapidly. Unfortunately, the U.S. economy is the exact opposite of that right now. In fact, as I will document below, the velocity of M2 has fallen to an all-time record low. This is a very powerful indicator that we have entered a deflationary era, and the Federal Reserve has been attempting to combat this by absolutely flooding the financial system with more money. This has created some absolutely massive financial bubbles, but it has not fixed what is fundamentally wrong with our economy. On a very basic level, the amount of economic activity that we are witnessing is not anywhere near where it should be and the flow of money through our economy is very stagnant. They can try to mask our problems with happy talk for as long as they want, but in the end it will be clearly evident that none of the long-term trends that are destroying our economy have been addressed.

Discussions about the money supply can get very complicated, and that can cause people to tune out, but it doesn't have to be that way.

To put it very basically, when there is lots of economic activity, there is lots of money changing hands.

When there is not very much economic activity, the pace at which money circulates through our system slows down.

That is why what is happening in the U.S. right now is so troubling.

First, let's look at M1, which is a fairly narrow definition of the money supply. The following is how Investopedia defines M1...

A measure of the money supply that includes all physical money, such as coins and currency, as well as demand deposits, checking accounts and Negotiable Order of Withdrawal (NOW) accounts. M1 measures the most liquid components of the money supply, as it contains cash and assets that can quickly be converted to currency. It does not contain "near money" or "near, near money" as M2 and M3 do.

As you can see from the chart posted below, the velocity of M1 normally declines during a recession. Just look at the shaded areas in the chart. But a funny thing has happened since the end of the last recession. The velocity of M1 has just kept falling and it is now at a nearly 20 year low...

Next, let's take a look at M2. It includes more things in the money supply. The following is how Investopedia defines M2...

A measure of money supply that includes cash and checking deposits (M1) as well as near money. “Near money" in M2 includes savings deposits, money market mutual funds and other time deposits, which are less liquid and not as suitable as exchange mediums but can be quickly converted into cash or checking deposits.

In the chart posted below, we can once again see that the velocity of M2 normally slows down during a recession. And we can also see that the velocity of M2 has continued to slow down in the "post-recession era" and has now dropped to the lowest level ever recorded...

This is a highly deflationary chart.

It clearly indicates that economic activity in the U.S. has been steadily slowing down.

And if we are honest, we have to admit that we are seeing signs of this all around us. Major retailers are closing down stores at the fastest pace since the collapse of Lehman Brothers, consumer confidence is down, trading revenues at the big Wall Street banks are way down, and the steady decline in home sales is more than just a little bit alarming.

In addition, the employment situation in this country is much less promising than we have been led to believe. According to a report put out by the Republicans on the Senate Budget Committee, an all-time record one out of every eight men in their prime working years are not in the labor force...

"There are currently 61.1 million American men in their prime working years, age 25–54. A staggering 1 in 8 such men are not in the labor force at all, meaning they are neither working nor looking for work. This is an all-time high dating back to when records were first kept in 1955. An additional 2.9 million men are in the labor force but not employed (i.e., they would work if they could find a job). A total of 10.2 million individuals in this cohort, therefore, are not holding jobs in the U.S. economy today. There are also nearly 3 million more men in this age group not working today than there were before the recession began."

Never before has such a high percentage of men in their prime years been so idle.

But since they are not counted as part of "the labor force", the government bureaucrats can keep the "unemployment rate" looking nice and pretty.

Of course if we were actually using honest numbers, the unemployment rate would be in the double digits, our economy would be considered to have been in a recession since about 2005, and everyone would be crying out for an end to "the depression".

And now we are rapidly approaching another downturn. In my recent articles entitled "Has The Next Recession Already Begun For America’s Middle Class?" and "27 Huge Red Flags For The U.S. Economy", I detailed much of the evidence for why this is true.

And those that run the Federal Reserve know all of this.

That is one of the reasons for all of the "quantitative easing" that they have been doing. The folks at the Fed know that the U.S. economy would probably drift into a deflationary depression if they just sat back and did nothing. So they flooded the system with money in a desperate attempt to revive economic activity. But instead, most of the new money just ended up in the pockets of the very wealthy and further increased the divide between those at the top and those at the bottom in this country.

And now Fed officials are slowly scaling back quantitative easing because they apparently believe that the economy is getting "back to normal".

We shall see.

Many are not quite so optimistic.

For example, the chief market analyst at the Lindsey Group, Peter Boockvar, believes that the S&P 500 could plummet 15 to 20 percentwhen quantitative easing finally ends.

Others believe that it will be much worse than that.

Since 2008, the size of the Fed balance sheet has grown from less than a trillion dollars to more than four trillion dollars. This unprecedented intervention was able to successfully delay the coming deflationary depression, but it has also made our long-term problems far worse.

So when the inevitable crash does arrive, it will be much, much worse than it could have been.

Sadly, most Americans do not understand these things. Most Americans simply trust that our "leaders" know what they are doing. And so in the end, most Americans will be completely blindsided by what is coming.

http://theeconomiccollapseblog.com/archives/the-velocity-of-money-in-the-u-s-falls-to-an-all-time-record-low

Sunday, June 1, 2014

Subscribe to:

Posts (Atom)