Investment and Humor Blog Devoted to Lost Souls Searching For a Home.

Total Pageviews

Monday, December 31, 2012

Sunday, December 30, 2012

Predictions for 2013

This past year, 2012, was an eventful year. We had another Olympics, a U.S. presidential election, the warmest year on record, and lived through the Mayan apocalypse. However, many things did not occur that many of the trend seers predicted, especially dramatic events that made the boldest predictions.

As we enter 2013, time itself seems to be speeding up or condensing to make the potential for dramatic events more likely. Tipping points appear to have been breached on many fronts, and what waits on the other side is difficult to know.

But let’s break out the crystal ball here and make some bold predictions for 2013.

These predictions weren’t acquired by some esoteric powers to see the future; rather they’re derived from riding the current wave of information and guessing where that flow may lead. They may seem bold to some, while the most aware readers may recognize them as foregone conclusions.

So without further ado, here are our top 10 predictions for 2013:

1. Stock market decline: Many economic forecasters have been predicting a stock market crash every year since the financial crisis of 2008. Yet, it has remained strong and even hit a 3-year high in September, 2012. There are many false reasons for this strength that don’t have to do with real economic growth; devalued dollars, cheap money for Wall Street banks, corporations hoarding cash and investments, etc. It’s a false bull market. That is why we feel comfortable predicting a significant decline in the stock market during 2013.

The real economy has been papered over for decades, but the numbers in the false economy can no longer dam the wave of reality. Endless quantitative easing, a quadrillion in world derivatives, over-extended personal debt, lowest ever percentage of the population working, and increased social burden of record food stamps and other programs will finally burst the dam in 2013.

The Baltic Dry index, which is believed to be the best indicator of our consumer economy, suffered a dramatic loss in December. Some say a new recession is already here and the stock market will soon reflect that with a crash in 2013. Look for the Dow Jones to dip below the 10K mark (around 30% or more) next year.

2. Precious metals rise over 50%: Using the same data points as the previous prediction, we predict gold and silver to rise at least 50%.

As the mass exodus from the stock market and other paper investments takes place, individual and institutional investors will start a new gold rush. Indeed, this is already happening.

Central banks around the world are snatching up new gold and moving to secure their foreign gold, while investment titans like George Soros have been increasing their positions where they previously denounced gold as a viable investment.

3. Schools start to install body scanners: Since these recent shootings actually resulted in horrific deaths of innocent people including children, the public is scared enough to accept just about anything. So we predict naked body scanners will begin to appear in schools and other public venues in 2013. There are several reasons for this prediction. The public is clamoring for protection and many inner-city schools already have metal detectors, so the upgrade will be acceptable if not preferred in suburban areas.

Next, the body scanner companies who lobby the government need more customers, and they usually get what they want. And, finally, the authorities love to remove our rights in the name of security, making this move a no-brainer.

4. European Union announces central Treasury: The Eurozone debt crisis will once again flare up particularly within the PIIGS (Portugal, Ireland, Italy, Greece, Spain), as well as in new countries. Instead of resorting to constantly increasing their “rescue fund” to bail out ailing European nations, the European Central Bank announced unlimited bond purchasing of any member state in need this September. This action of issuing new debt-based money for the sole purpose of buying debt has become known as quantitative easing by the Federal Reserve. The EU has repeatedly stated the need to form a central Treasury that has the power to collect direct taxes from member states, essentially turning the Eurozone into the United States of Europe. Look for this to come into reality in 2013 with possibly the first EU president elected as well.

5. Marijuana legalization sweeps America and the world: After Colorado and Washington voters proved it can be done, marijuana legalization is an idea whose time has finally come. No amount of fear mongering or lies will stop its liberation now. Although 15 states have decriminalized marijuana possession, along with 18 states with legal medical cannabis, this past election will be viewed as the tipping point in the full-scale legalization of weed. The ripple effects are already traveling quickly as at least 7 more states are considering legalization. Meanwhile, Mexico is reconsidering its war on weed and Uruguay is already designing its regulatory rules for legalization, which will make it the first country with full legalization. Expect 2013 and beyond for marijuana legalization to be a foregone conclusion with anyone standing in the way looking extremely foolish.

6. Major cyber attack hits America: All governments and many large corporations want to put more controls on the Internet. However, the general population does not want to see their beloved Internet change, so there must be an event that sways the public to believe that Internet “security” is a priority. This can’t just be some minor attack that hits a small business sector. It would have to be something that inflicts pain on the public; perhaps an extended Internet outage or electric grid crash that’s blamed on cyber terrorists would do the trick.

Many officials have been predicting a cyber 9/11 or “Pearl Harbor” event for some time, claiming it’s not a matter of if but when. That “when” will be 2013. Major antivirus companies such as McAfee are also warning of just such an event in 2013, labeled Project Blitzkrieg. And just like prior to 9/11, there is freedom-crushing legislation sitting on the shelf just waiting to be enacted if a cyber version of 9/11 were to take place.

The level playing field of information on the Internet poses a huge threat to all regimes and their puppet media corporations around the world. They can’t wait much longer before putting a stop to the free flow of information; therefore, this attack will be a classic false flag operation. Mark it down, this will happen in 2013.

7. Syria’s Assad is toppled: Many pundits predicted this would have happened already, but without a NATO no-fly zone (aka massive air strikes on Assad in a Libya-style destruction) the ragtag rebels have proven to be no match for the Syrian government thus far.

However, we have seen that when there is full-scale commitment by NATO, as with Libya, it's virtually guaranteed. Since the West has increased their support of the Jihadist rebels with training, arms, money, and Patriot missiles in Turkey, their commitment is clear.

Furthermore, the UN has warned of sectarian genocide, and U.S. officials have clearly stated the ultimate line in the sand: Assad's use of chemical weapons. As if on cue, PressTV and Fars News are reporting that militants have indeed used chemical weapons. Whether or not this particular event is confirmed, expect it to happen at some point in 2013 to be spun as justification to take out the Assad regime -- it's been in the cards for years.

8. West attacks Iran, starts WW3: The toppling of Syria will leave Iran as the only nation in the Middle East not controlled by the West. Besides having vast oil reserves, Iran also has the last strategic public central bank not run by the international banking cartel -- and they want it. It is the endgame written about by many think tanks.

The war with Iran has been years in the making and has already technically begun with crippling economic sanctions and strategic military bases surrounding it. Indeed, World War 3 already began as well when America invaded Afghanistan and Iraq, but this decade-plus-long war is about to get much more intense. Additionally, the establishment will need a distraction from the economic crisis of 2013, and only a large new war will effectively serve that purpose.

The West has been goading Iran into an attack for years to justify further aggression. Iran, to their credit, has failed to take the bait. But once Syria falls, the full force of pressure will become too much for Iran to bear and they’ll be forced to defend themselves. The West will portray it as aggression against them and launch their attack. The question will be how other super powers like China and Russia react to this aggression against their ally?

9. Food and oil prices break records, again: This might have the highest guarantee of coming true, since it is mathematically impossible for it not to in an era of unlimited money creation, expanding conflicts in oil regions, and record demand but unstable climates for food production. Some food and commodity prices set new record highs in 2012, while oil is still chasing its 2008 high of $147/bbl.

First, let’s look at oil since it is also a major contributor to the price of food. Oil will have conflicting price pressures in 2013. There will be reduced demand due to a sharp economic downturn, but that will be more than offset by the devalued petrodollar and the fallout of regional conflicts. We predict oil will soar past its previous high to over $150/bbl.

This high price of oil will cause food prices to rise significantly since industrial agriculture is utterly dependent on oil from plowing, fertilizing, pesticides, harvesting, processing, to transport. Couple this very real cost to the rush away from stocks into more tangible assets like commodities that are also traded in rapidly devaluing dollars. This speculation will lead to much higher food prices. Throw in more extreme weather, and we have a recipe for a major food crisis. Food will hit new all-time highs in 2013.

Average citizens will spend a much higher percentage of their salaries on food in 2013 which will put further pressure on the rest of economic output. Most extremely, a large portion of the population may realize starvation for the first time in their lives. Certainly, we can expect food stamp usage to explode even faster than it has in the last five years.

On the upside, bulk food will be one of the best investments for 2013.

10. More extreme weather and earth changes: Extreme weather appears to be the new norm. In 2012 we saw the warmest year on record, record droughts in America’s bread basket, and an odd super storm Hurricane Sandy which still has thousands without power more than two months later. However, the jury is still out on what’s causing our extreme weather. Since the climates appear to be changing on all of the celestial bodies in our solar system, it seems unlikely that increased CO2 is the primary cause of climate change.

Many experts point to the rapidly shifting North Pole and the sun’s awakening to a new solar maximum as major contributors to our changing climate. And speaking of celestial weather, two great comets will appear in 2013 close to Earth whose impact on our weather, if any, is impossible to predict. Additionally, it appears that the Ring of Fire is awakening with increased earthquake and volcanic activity.

For 2013, we predict more super storms starting with winter storms that will now be named for the first time, and an even bigger increase in earthquake activity, and more devastating crop damage.

Many of these predictions seem negative and scary, but with awareness of their possible outcomes, one can prepare and position themselves to survive and even thrive under conditions which might seem horrific. It is also never to late to reach out to your local community by sharing information in a positive way, and encourage discussion of strategies for enhancing local resistance to larger global events.

http://www.activistpost.com/2012/12/10-predictions-for-2013.html

Dollar Head and Shoulders!

The US Dollar Index ($USD) was all over the place in 2012, but ended the year slightly lower than where it started. The index started the year around 80, surged to 84 and closed at 79.62 on Friday. From February to December, a large head-and-shoulders reversal formed with a rising neckline. Overall, I would use the 2012 lows to mark a support zone in the 78-79 area. A break below this zone would confirm the head-and-shoulders pattern and target further weakness towards the 74 area. Such a move would be bullish for stocks because the Dollar and S&P 500 move in opposite directions. Weakness in the Dollar would suggest a strong appetite for risk, which would bode well for risky assets, such as stocks. A close above the December high would call for a reassessment of this bearish head-and-shoulders pattern.

Click this image for a live chart

Click this image for a live chart

Well, that does look like a potential head and shoulders top, but it is not necessarily bullish for US stocks. Can anyone else visualize the US dollar and the US stock market collapsing simultaneously if the government fails to address the fiscal cliff situation?

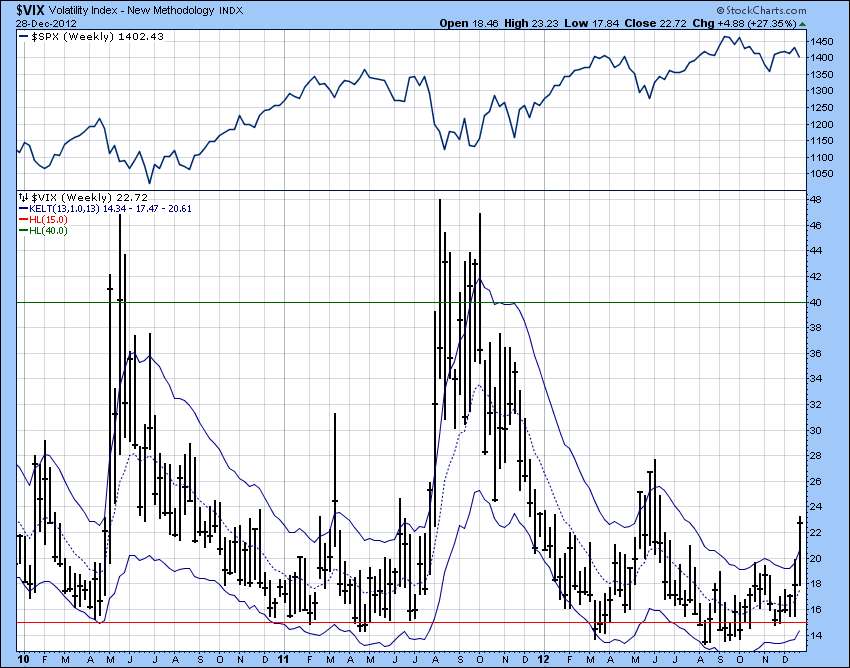

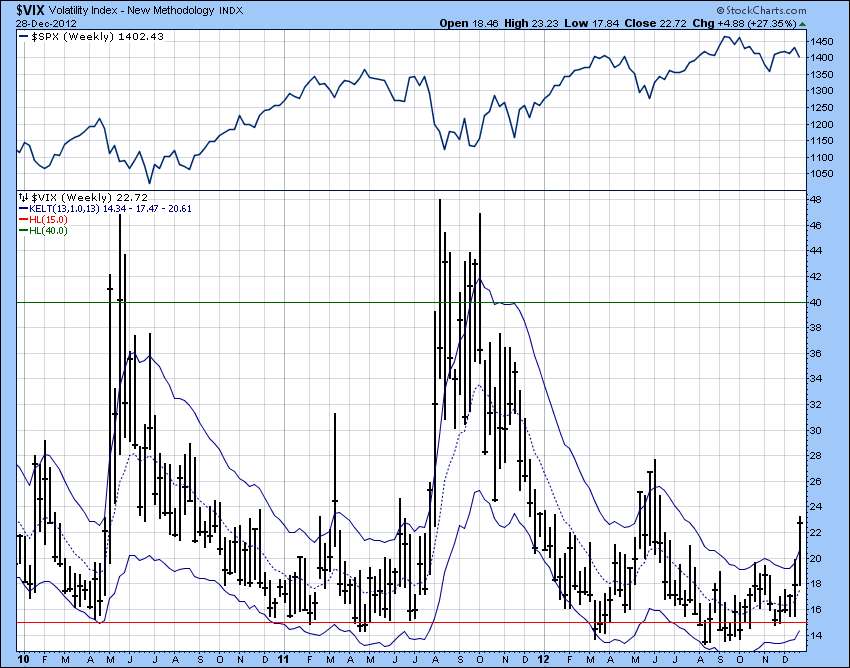

VIX Buy and Sell Indicator

Back in July we discussed the mispricing of equity risk that was visible in the low levels of the VIX (implied volatility) index (see post). Making money by shorting equity options and riding the decay became fashionable after Draghi put in a backstop for the Eurozone periphery and the Fed started taking volatility out of the market (see discussion). But those shorting options got punished today. Demand for short-term equity options spiked, driven by the dysfunction in Washington. VIX (and VIX futures) jumped some 17% in a single day.

http://stockcharts.com/h-sc/ui?s=$VIX&p=W&b=5&g=0&id=p43244215706

Yo: Ah keep tellin' y'all dum mufuggas how easy it iz ta tyme da market. Y'all do your buyin' when the VIX iz above 40, an' y'all do your sellin' when it iz below 15, hear what I'm sayin', bro? Now wake up an' git ready ta buy, becoz da VIX iz headed up once ag'in.

|

| Source: Investing.com |

WSJ: - Late-day fiscal cliff news out of Washington Friday provoked the biggest one-day percentage gain in the market’s so-called fear since gauge November 2011.Investors don't trust Washington to get a resolution any time soon and are willing to pay a high premium to protect themselves. The risk-on trade is on.

With just three days remaining to reach a budget agreement to advert the year-end tax increases and spending cuts known as the fiscal cliff and no solution in sight, the Chicago Board Options Exchange’s Volatility Index Thursday jumped to the highest level since June.

http://stockcharts.com/h-sc/ui?s=$VIX&p=W&b=5&g=0&id=p43244215706

Yo: Ah keep tellin' y'all dum mufuggas how easy it iz ta tyme da market. Y'all do your buyin' when the VIX iz above 40, an' y'all do your sellin' when it iz below 15, hear what I'm sayin', bro? Now wake up an' git ready ta buy, becoz da VIX iz headed up once ag'in.

Swept Under The Rug But Still Doing Damage

Tepco – and West Coast of America – Slammed with Radiation

We’ve documented the spread of radiation from Fukushima to Tokyo for a year and a half. See this, this, this,this, this and this. Unfortunately, as the following recent headlines from Ene News show, things are only getting worse:

- Tokyo Bay cesium even higher than levels reported off Fukushima — Nearly entire sea floor contaminated by 2014

- Tokyo getting 5 times more radioactive fallout than prefectures closer to Fukushima

- Japanese Legal Expert: “Even residents of Tokyo are evacuating” — More and more people fleeing Fukushima

- People from Tokyo area report thyroid cysts and nodules — Japanese doctors laughing at patients

- Japan Scientists: Radiation dose has been “significantly increased” around Tokyo metropolitan area after Fukushima

And we’ve previously noted that the radiation will spread worldwide (by water and air). For example:

- “Absolutely Every One” – 15 Out of 15 – Bluefin Tuna Tested In California Waters Contaminated with Fukushima Radiation

- Fukushima Radiation: Japan Irradiates the West Coast of North America

A new study says that the West Coast will get slammed with radioactive cesium starting in 2015

Saturday, December 29, 2012

Friday, December 28, 2012

This Made Me Gag!

President Barack Obama issued an executive order to end the pay freeze on federal employees, in effect giving some federal workers a raise. One federal worker now to receive a pay increase is Vice President Joe Biden.

According to disclosure forms, Biden made a cool $225,521 last year. After the pay increase, he'll now make $231,900 per year.

Members of Congress, from the House and Senate, also will receive a little bump, as their annual salary will go from $174,000 to 174,900. Leadership in Congress, including the speaker of the House, will likewise get an increase.

Here's the list of new wages, as attached to President Obama's executive order:

Flattening Yield Curve

Last week, I looked at the yield curve as modeled by the spread between the 1-year and 10-year yields on Treasury Notes. That's not the entirety of all maturities on the entire curve, but it does give us a simple graphical representation of what the slope of the yield curve looks like. The two main points of that article were that an inverted yield curve is always bad for the stock market and for the economy, and also to note that just because the yield curve is not inverted, that does not necessarily mean that the stock market is immune to having trouble.

This week's chart gives us a good insight as to why that is. For this week's chart above, I have flipped around the yield spread plot so that we are looking at the 10-year yield minus the 1-year, whereas last week I showed it as the 1-year minus the 10-year. The result is the same, just upside down.

One other adjustment in this week's chart is that I have shifted forward that yield spread by 22 months to reveal that the movements of the DJIA seem to follow in the footsteps of this yield spread model. It is not a perfect fit, just a really good one. . . .

Looking ahead, the flattening of the yield curve during the past 2 years (thanks, Dr. Bernanke!) means that stock prices will be under downward pressure.

Thursday, December 27, 2012

Texas' Gold

The map above shows the large Eagle Ford Shale area, which is 50 miles wide and 400 miles long, and covers 23 counties in South-Central Texas, according to the Railroad Commission of Texas – the state agency that regulates the oil and gas industry in the Lone Star State. The first Eagle Ford Shale well was drilled in 2008, and the chart above shows the explosive growth in Eagle Ford oil production since then, which has increased to roughly 327,000 barrels per day this year, far more than double the output in 2011. The recently-discovered oceans of hydrocarbon-saturated shale rock below the Eagle Ford Shale area of Texas (including dozens of “monster wells”) are the main reason for the explosive growth in crude oil production in the Lone Star State – which has doubled in just the last few years to more than two million barrels per day, see CD post here.

The map above shows the large Eagle Ford Shale area, which is 50 miles wide and 400 miles long, and covers 23 counties in South-Central Texas, according to the Railroad Commission of Texas – the state agency that regulates the oil and gas industry in the Lone Star State. The first Eagle Ford Shale well was drilled in 2008, and the chart above shows the explosive growth in Eagle Ford oil production since then, which has increased to roughly 327,000 barrels per day this year, far more than double the output in 2011. The recently-discovered oceans of hydrocarbon-saturated shale rock below the Eagle Ford Shale area of Texas (including dozens of “monster wells”) are the main reason for the explosive growth in crude oil production in the Lone Star State – which has doubled in just the last few years to more than two million barrels per day, see CD post here.Yen...No Safe Haven

As discussed earlier, the yen is no longer acting as a "safe haven" or "risk-off" currency. This is difficult for some in the FX community to accept, but it's the new reality. The recent drop in the US equity market coincided with declines in the yen. In the past the yen would typically move in the opposite direction of the "risk-on" assets such as equities and commodities, but that relationship no longer holds.

Much of this is driven by Japan's fundamentals. The new government will ride the Bank of Japan (BOJ) to make sure it ramps up QE to unprecedented levels. The goal is to "print" so much yen that inflation rises from negative levels (where it is currently - chart to the left) to some fixed positive target such as 2%. Any semblance of independence BOJ had is now gone. . . .

Continue reading: http://soberlook.com/2012/12/the-yen-lost-its-status-as-safe-haven.html

|

| S&P500 futures (the big drop is the Republican rejection of the Boehner proposal) |

|

| Yen per one dollar (yen weakening) |

Much of this is driven by Japan's fundamentals. The new government will ride the Bank of Japan (BOJ) to make sure it ramps up QE to unprecedented levels. The goal is to "print" so much yen that inflation rises from negative levels (where it is currently - chart to the left) to some fixed positive target such as 2%. Any semblance of independence BOJ had is now gone. . . .

Continue reading: http://soberlook.com/2012/12/the-yen-lost-its-status-as-safe-haven.html

JS On Where We Are With Gold

My Dear Extended Family,

1. Gold did not fall on its own gravity. It was forced lower.

2. That take down had a distinct pattern outlined by CIGA Richard's note. It was high velocity, high volume offering at a market period of illiquidity. The form is a straight line down in a very short period of time.

3. This pattern is the hallmark of those seeking a lower price for gold.

4. The limit to this strategy exists in two things. The first is when the cash market fails to fully respond to the paper takedown. The second will be apparent in the form of a takedown that will present themselves. Those takedowns are short on lower volume. Seeking profits, shorts that are only hangers on will seek to duplicate the strength of the $1800 - $1775 - $1750 take down but run into cash market demand. This will be the price that pleases Asian demand promised to us from China. The paper market will not be able depress the cash market penny to penny.

5. The first signs are definitively in that the long war conducted by the US and GB against the euro has been lost. The euro is in a new birthing process, against all odds, as rising into the category of reserve demand.

6. Euroland and all the BRICs have been buyers of gold for reasons not motivated by emotion, but based on events yet to occur.

7. I have assured you that gold is migrating back into the monetary system, not as convertible, but rather as an alarm by price function. The price will be determined in the cash market as a product of speculation concerning a global M3.

8. Since construction in monetary science requires destruction, first the volatility of gold is going to be significantly more violent than even I anticipated.

9. The magnets at $2111 and floating around $4000 may simply be grade one of an educational system.

10. I have seen this type of take down before.

11. It was just prior to the major move in gold in the 70s wherein gold rose the most over the shortest period of time.

12. The operation of gold's price is not for a short to profits as its market character speaks of deep pockets only governments can have. I suspect that battle for the survival of the euro might soon be reversed into the battle for dollar survival. Euroland, Russia and Asia from central banks to connected financial entities have been buyers of gold. The tables have shifted. The signs of the new triumvirate being on the offensive sits right in front of us.

2. That take down had a distinct pattern outlined by CIGA Richard's note. It was high velocity, high volume offering at a market period of illiquidity. The form is a straight line down in a very short period of time.

3. This pattern is the hallmark of those seeking a lower price for gold.

4. The limit to this strategy exists in two things. The first is when the cash market fails to fully respond to the paper takedown. The second will be apparent in the form of a takedown that will present themselves. Those takedowns are short on lower volume. Seeking profits, shorts that are only hangers on will seek to duplicate the strength of the $1800 - $1775 - $1750 take down but run into cash market demand. This will be the price that pleases Asian demand promised to us from China. The paper market will not be able depress the cash market penny to penny.

5. The first signs are definitively in that the long war conducted by the US and GB against the euro has been lost. The euro is in a new birthing process, against all odds, as rising into the category of reserve demand.

6. Euroland and all the BRICs have been buyers of gold for reasons not motivated by emotion, but based on events yet to occur.

7. I have assured you that gold is migrating back into the monetary system, not as convertible, but rather as an alarm by price function. The price will be determined in the cash market as a product of speculation concerning a global M3.

8. Since construction in monetary science requires destruction, first the volatility of gold is going to be significantly more violent than even I anticipated.

9. The magnets at $2111 and floating around $4000 may simply be grade one of an educational system.

10. I have seen this type of take down before.

11. It was just prior to the major move in gold in the 70s wherein gold rose the most over the shortest period of time.

12. The operation of gold's price is not for a short to profits as its market character speaks of deep pockets only governments can have. I suspect that battle for the survival of the euro might soon be reversed into the battle for dollar survival. Euroland, Russia and Asia from central banks to connected financial entities have been buyers of gold. The tables have shifted. The signs of the new triumvirate being on the offensive sits right in front of us.

This is the transition that I believe is at hand. This operation is from some mega interest not seeking to profit on a short, but to obtain the most gold possible for this market event which will play into 2015 to 2017.

Conclusion:

There is not top in gold. The gold price is going much higher than I originally anticipated. The long standing currency war has shifted now putting the dollar in harms way. Gold and those very special gold situations are going much higher. Borrowed money cannot be used without taking risk beyond reason.

Stay the course because what has so far occurred is only the appetizer.

Respectfully,

Jim

Jim

Government Outlays Rising Parabolic

It would be hard to envision that the public has not heard about the fast approaching fiscal cliff. What seems lost in the narrative of the media and their focus on raising tax rates, is the fact government spending continues to consume a larger share of the government's budget.

As the below chart indicates, the CBO is forecasting social security and medicare payments to account for a larger and larger share of the budget as far as the eye can see. Addressing the growth in these programs will be required in order to provide any dent in the current budget deficit.

|

| From The Blog of HORAN Capital Advisors |

The result of going over the fiscal cliff doesn't address the spending either. The cliff impact has tax hikes exceeding spending cuts by a 3:1 margin. One reason for this outcome is the fact Washington's "baseline" budgeting definition means simply lowering the growth rate of spending counts as a cut in spending. A recent Wall Street Journal article, The Baseline Budget Con ($), addressed this budget gimmick.

|

http://disciplinedinvesting.blogspot.com/2012/12/a-need-to-focus-on-government-outlays.html

Wednesday, December 26, 2012

Interesting Gold Graph

In addition to Tatanka’s article on derivatives, I used to use this picture in discussions. It has the base of Exters Pyramid. Although following the figures from the BIS and see all new Swap arrangements between CB’s, I can hardly imagine all is in there. Nevertheless these figures are already beyond any imagination and even far beyond the point of no return.

Your following few days ago: "It will not last because it cannot last. That which destroys everything it touches must end up destroying itself. That is axiomatic." seems to comply with the Cosmic Dance of Shiva Where the tipping point of reversal has taken place already or soon will be. (Ying Yang picture).

Have a good time with family and your pet friends!

Namasté,

CIGA Shanti

CIGA Shanti

http://www.jsmineset.com/

Tuesday, December 25, 2012

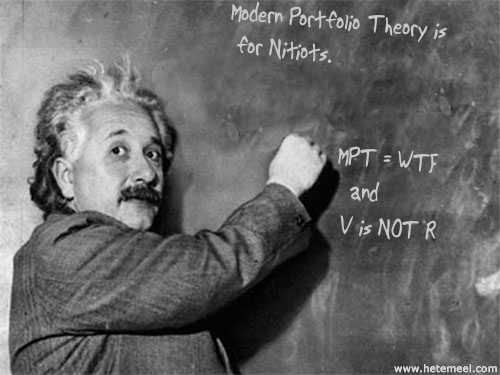

Modern Portfolio Theory is for Nitiots

Modern Portfolio Theory is for Nitiots

December 20, 2012

By Jack Sparrow

In the following paragraphs, we shall defend the assertion that Modern Portfolio Theory is for Nitiots.

To begin, let us define our terms:

Modern Portfolio Theory (via investopedia): “A theory on how risk averse investors can construct portfolios to optimize or maximize expected return based on a given level of market risk, emphasizing that risk is an inherent part of higher reward.”

Nit: In poker parlance, an über-conservative player who constantly folds and only enters pots with “premium” hands.

Nitiot: The player who is so fearful of risk, he (or she) will make terrible decisions to avoid it – laboring under the mistaken assumption that volatility and risk are the same thing.

At the poker table, the Nitiot plays timidly as a rule, which creates two bad results: 1) the tendency to get pushed out of pots, and 2) the inability to get paid off with premium hands (because the rare display of strength sticks out like a sore thumb).

In markets, the Nitiot makes supposedly “conservative” decisions — guided by the conventional wisdom of MPT — and often winds up poorer for their efforts.

The Nitiot’s central failing is also a central plank of Modern Portfolio Theory: The wrong-headed notion that volatility equates to risk.

In contrast to what ivory tower types and passive investors believe, winning poker players, winning traders and winning investors all have something in common: They understand that the presence of volatility means opportunity, not risk — so long as it is handled in the proper context.

John Maynard Keynes (no slouch of a trader himself) put it simply:

“It is largely the fluctuations which throw up the bargains and the uncertainty due to fluctuations which prevents other people from taking advantage of them.”

Warren Buffett — a value investor who knows a thing or two about markets — further agrees with his mentor, Ben Graham, that risk is the potential forpermanent capital loss, which has no necessary correlation to volatility at all.

Which market environment was “riskier,” for instance, from a value investor’s perspective: March 2007, when volatility was at rock-bottom lows with market valuations sky high… or March 2009 (the nadir of the global financial crisis) when conditions were exactly reversed?

Or, to illustrate it in poker terms:

You are in a deep-stacked No Limit Texas Hold ‘Em poker game. You call a multiway $500 preflop raise with the Ace-King of hearts. The flop comes Q-J-T of hearts. Your first opponent bets $2,000. Your second opponent raises to $5,000, dramatically increasing the volatility of the hand.You have a royal flush – the ultimate nuts. Has the presence of volatility somehow increased your risk? Are you supposed to be unhappy about this?

All truly robust (long-term profitable) poker, trading and investing strategies must endure “drawdowns” — periods of adverse volatility excursion, i.e. dips and troughs in the equity curve. The strategies that appear to be flawless (drawdown free) wind up being Ponzi schemes, blow-ups in waiting, or both. (Investors in the Bear Stearns High Grade Structured Credit Strategies Enhanced Master Fund — try saying that three times fast! — saw silky-smooth returns of 1% per month for +40 months in a row before it all went kablooey.)

In a strange way, then, the presence of equity curve volatility (and carefully managed drawdowns) can actually be a positive, to the degree that survival signals robustness. A methodology that undergoes routine “stress testing,” yet continues to grind out new equity highs, is far more desirable than a “perfect” methodology that has never been tested at all.

What’s more, as Keynes alluded earlier, the presence of volatility in and of itself creates opportunity, via the ability to make superior decisions.

Why? Because trading and investing, like poker, are minus sum games. It is statistically impossible for a majority to outperform (though a majority can certainly underperform), and everyone pays the vigorish (slippage, commissions, rake and tokes etc).

In a minus sum game, the winner must have an “edge” over his or her collective opponents — a means of making superior decisions (higher expected value decisions) consistently over time.

Volatility thus creates opportunity not just by throwing up bargains, as Keynes suggested, but also by highlighting skill differentials: In a volatile environment, the less-skilled are more likely to make mistakes than the highly skilled. These mistakes, on balance, transfer profit from one group to another.

On a related point, for the trader or investor who wishes to improve, the only way to close this skill gap is by enduring volatility and learning how to handle it. (As the saying goes: “A calm sea never made a skilled mariner.”)

But getting back to Nitiots: On top of wrongly equating volatility with risk, these folks make an even nuttier mistake. The MPT Nitiot assumes skill has no bearing on outcome… perhaps the most fool-headed assumption academia has ever put forth!

According to these goofballs, factors like asset valuation, supply and demand, entry and exit prices, and basic risk management — all of which require skill to assess — don’t matter to the process at all. All that stuff is skipped in favor of “asset allocation,” where the chief decision is whether to (passively) accept a mix of 60 percent equities, 40 percent bonds or what have you.

This ivory tower nonsense was popularized in a 1985 book by Charles Ellis titled “Investment Policy: How to Win the Loser’s Game.” According to Nitiots, the way to win the “loser’s game” is not to become a winner yourself (by studying other winners and developing a skillset)… it’s to pretend skill is somehow irrelevantand choose to play the game blindfolded!

But it gets worse, oh yes…

In the futures trading biz, all money managers are forced to prominently disclose that “PAST PERFORMANCE DOES NOT GUARANTEE FUTURE RESULTS.” And yet this is exactly the crumbling edifice that Modern Portfolio Theory is built on — the dangerous notion that the future (in terms of asset class performance) will look reliably like the past.

MPT advocates love to cite long term studies — the “Ibbotson Study” one of the most popular — as justification for both their passive market approach and optimistic assumptions as to future stock and bond returns. In other words: The blindfold method worked great for the last X decades, so why not expect more of the same?

The trouble with this is sheer lack of sample size. From a statistical validity perspective, the 20th century — a period of unprecedented USA prosperity — offers a sample size of one!

Will the next twenty-five year period look just like the last one, in which we saw the build-up of a “debt supercycle” alongside one of the greatest equity bull runs of all time? There is ample reason to believe it won’t be the same at all… and while passive investing Nitiots “hope” it will, is hope really a strategy?

Blatant dismissal of valuation — whether an investment is high or low priced relative to historic benchmarks, cash flows etcetera — is another serious issue. For example: According to MPT logic, US real estate was just as attractive an asset class in late 2006 / early 2007 (near the peak of the housing bubble) as at any other time — or perhaps even more so, because the track record of rising home prices was longer!

As for the fact that housing bubble warning signs (remember condoflip.com?) and countless valuation metrics (price-to-rent, rent-to-income, LTV ratios, the California 50-year mortgage) had gone Screaming Mimi vertical? Meh… such counted as skill-based assessment, and was thus completely ignored.

MPT valuation blindness, and its follow-on gross overexposure to uber-crowded areas such as private equity, was a big reason many university endowment funds plunged into the abyss in 2008. The Nitiots thought they were being prudent, while inhaling risk by the lungful!

Meanwhile, as of this writing, MPTers are setting up their portfolios for another valuation-based massacre, this time in “safe” government bonds. To borrow a James Grant quip, US Treasuries have migrated from “risk free return” to “return free risk.” But once again, such an assessment is skill based… requiring the ability to turn one’s head and see the freight train coming down the track… and thus for Nitiots not allowed.

Modern Portfolio Theory has yet another, more cynical element in our view. It is a tool used to sucker the hapless retirement investor.

Most skill contests are understood to be dangerous, in respect to adverse consequences if you don’t know what you are doing. If a novice sits down at a high stakes poker game, or opens up a futures trading account, and proceeds to get educated at the cost of all his dough, few will feel sympathy. “You pays your money and you takes your chances.”

But when it comes to retirement investing, tens of millions of Americans — and tens of millions in other countries too — have little choice in the matter. By dint of amassing a pool of savings to live on in old age, these individuals, who may have never analyzed a stock or bond in their lives, with no desire to start now, are nonetheless forced to “sit down at the table” that is markets. It is either that, or see their purchasing power cruelly eaten away by the ravages of inflation.

For Wall Street, this gigantic pool of forced retirement savings creates a juicy dilemma. There are nowhere near enough truly skilled managers to run all that money properly… but there is plenty of incentive to run it poorly!

Of course, you can’t admit to Mr. and Mrs. Pensioner that your plan is to toss their savings into the maw of a faceless, bloated, fee-generating mediocrity machine. So instead, you explain to them why skill doesn’t actually matter… why “asset allocation” is the holy grail… why stocks always go up “in the long run” and so on… thus making Amalgamated Juggernaut Advisors the best choice.

Modern Portfolio Theory is wonderfully enabling for all this, emphasizing, as it does, the mass allocation of gigantic sums in robotic fashion, as if skill (and maneuverability) did not matter at all.

In a final word to MPT Nitiots, we offer the perspective of Robert L. Bacon, author of the 1956 classic “Secrets of Professional Turf Betting:”

I don’t want to be like Pittsburgh Phil and win a million dollars at the races. I’d just like to grind out $25 a day for myself without any risk!How many times have you heard something like that from turf fans who were trying to be “conservative” at racing? …Oh Brother! You can add this “grind” idea to the long list of other unsound notions held by the public play…. One sure thing that a smart player engraves deeply into his skull, is the fact that you MUST speculate at the races. You CAN’T grind!The player at the races can’t grind or chisel because [that girl] is taken. The racetrack has all grind and chisel privileges! The mutuel take and the breakage add up to a percentage that continually grinds and chisels the betting money… The grind privileges are spoken for and taken, so the professional bettor must speculate. The mutuel grinding only goes one way – against the bettor. But any percentage can be overcome by enough winners at fat enough prices!Fortune favors the speculator over the grinder because of the plain old arithmetical percentages. The speculator has a percentage chance to win. The grinder has no chance.To beat the percentage of the mutuels, the player must ALWAYS have an overlay. He must always have an extra percentage in his favor, to counteract the “take” percentage. Forget about this idea of “grinding out a day’s pay.” If you want to make a day’s pay at the races, get a job watering horses, or pitching manure into trucks. But never try to grind it out of the mutuels.You Must Speculate — You CAN’T GRIND!

“Speculate” is a dirty word in conventional investment circles. But there is a difference between smart speculation and foolish speculation. We humbly suggest that trusting one’s savings to Modern Portfolio Theory – i.e. being a Nitiot – is the most foolish speculation of all.

http://www.mercenarytrader.com/

Subscribe to:

Posts (Atom)