'It only happens about twice in the average lifetime, but it’s the single most powerful stock investment strategy I’ve ever discovered.

In the past 80 years, it only occurred twice, but if you had simply bought and sold stocks according to this strategy, you would have turned a $1,000 initial investment into over $21 million with just seven transactions.

You would have missed the biggest run-ups in the stock market, but you would have also missed all of the biggest draw-downs.

The best part is that it’s an incredibly simple strategy to follow. It requires no special math skills and it can be used by anyone with even a discount brokerage account. A small initial stake is not a hindrance either. The two most important components (as with any long-term investment) are time and patience. . . .

Okay, enough disclaimers, here’s my strategy.

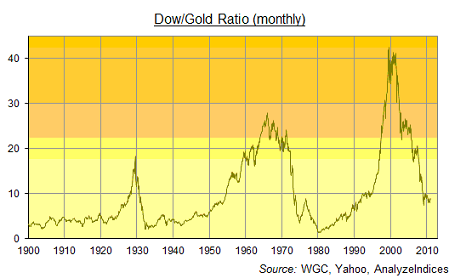

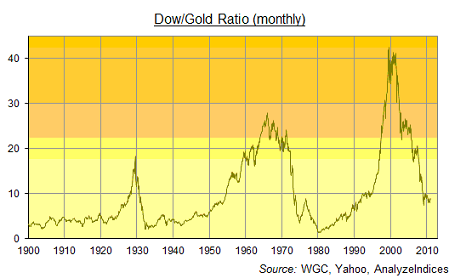

It’s based entirely on the Dow/Gold ratio.

In short, when the Dow/Gold ratio is at parity, that is, when one ounce of gold is equal to the Dow index number, I’m buying the Dow.

When the ratio hits 25 or higher, I’m selling stocks and buying gold.

I’ll only sell my gold and buy stocks when the ratio gets back down near parity.

So how does that stone-simple strategy turn $1,000 into over $21 million?

It’s pretty simple: $1,000 into the stock market in 1932 turned into $20,000 in 1966 as the Dow moved from 50 up to nearly 1000. That $20,000 put into gold turned into over $450,000 in 1980 as gold went from $35 an ounce to $800.

Again, the Dow/Gold ratio was near parity in 1980, so we’re buying the Dow.

Over the next 20 years, the Dow went from about 800 to 8,000 – which turns our $450,000 stake into $4.5 million.

But we’re not done.

We did miss out on the Dow’s run-up from 8,000 to nearly 12,000 in late 1999/early 2000. But instead, we bought gold at $300 an ounce in 1998. Today, we’d be sitting on about $21 million worth of gold.

And so now, we just have to wait for the Dow/Gold ratio to get back close to parity in order to get into stocks.

The downsides to this strategy are pretty obvious – namely, it could take 50 years or longer for the Dow to get back to parity with gold. Right now, we’re only 31 years into the cycle, so if 50 years is the “normal” Dow/Gold cycle, then we have 19 years left to wait.

But that’s why you have other investments.'