Investment and Humor Blog Devoted to Lost Souls Searching For a Home.

Total Pageviews

Tuesday, May 31, 2011

Monday, May 30, 2011

Chart

http://www.themarketguardian.com/2011/05/gold-strengthens-in-real-terms/

Why should we care?

Since early 2009, Gold has actually underperformed equities and Commodities. When the economy rebounds, Commodities will outperform Gold. When the economy is stagnant and there is the threat of inflation or deflation, Gold will outperform. Also, as we’ve written numerous times, the real price of Gold is a leading indicator for the gold shares. The real price of Gold was stagnant over the past nine months and that is why the gold shares haven’t performed as well as anticipated.

With equities nearing multi-year resistance and the economy at risk of rolling over, Gold is currently quietly reasserting its strength against all other classes (except Bonds). This is the type of activity that precedes big moves in the metal and in the shares. This is setting the stage for the move out of conventional assets like equities and Bonds and into Gold.

Sunday, May 29, 2011

Memorial Day Edges

Memorial week has some seasonal tendencies of which traders should be aware. I’ll be going in to some of these in this weekend’s subscriber letter, but below is a study that takes a broad look at the week as a whole. You’ll note that the study goes back to 1983. The reason it doesn’t go back further is that before 1983 the market did not exhibit a seasonally strong tendency during Memorial week.

Despite last year being down the circled stats are all impressive. An average gain of nearly 1.2% for the 4-day week along with a profit factor of 5 is very good. I’ll be discussing this and other Memorial week tendencies in this weekend’s letter.

http://quantifiableedges.blogspot.com/2011/05/memorial-week-seasonally-strong.html

Saturday, May 28, 2011

Drive Drunk Legally?

Long a staple of science fiction, self-driving vehicles that act as robot chauffeurs have been a cultural dream for decades. For most of that time, however, the dream seemed a part of some unattainable future.

But now, led in large part by Google's sudden and unexpected charge, autonomous robot cars come tantalizingly close to reality. As various mapping, sensing and location-based technologies have converged recently, Google has begun to position itself as the leader of our robo-chauffeur future. Yet for all of the technology's promise, it still has some major—and perhaps insurmountable—hurdles to overcome.

Google estimates that one million lives could be saved around the globe by driverless cars each year. According to the National Highway Traffic Safety Administration (NHTSA), in the U.S. alone there were 5.8 million crashes in 2008. Of those, about 34,000 resulted in fatalities, 1.6 million resulted in injuries and 4.2 million entailed some sort of property damage. The NHTSA says these numbers have come down over time—attesting at least partly to the ever-increasing safety of all vehicles—but they clearly still

http://www.scientificamerican.com/article.cfm?id=google-driverless-robot-car

Interesting Foreshadowing...

"There are some informational jewels in the CFTC's weekly Commitment of Traders (COT) Report, and sometimes in ways that most people would not imagine. This week's chart looks at data on commercial traders' net positions in eurodollar futures, but with a twist: that data is shifted forward by one year to reveal that it actually leads the movements of the stock market.

Readers of our twice monthly newsletter are already familiar with this relationship, since we have been showing it regularly in that publication. It is one of the more interesting and powerful leading indications we have discovered. If you are not currently a subscriber to that publication, now would be a good time to sign up to see this and other insights about what lies ahead for the stock, bond, and gold markets.

The term "eurodollars" should not be confused with the exchange rate between the dollar and the euro. It refers to dollar denominated time deposits in European banks, and the term predates the creation of the euro currency. Eurodollar deposits typically follow the LIBOR interest rates.

The CFTC classifies all futures traders as either commercial (big firms and market makers), non-commercial (large speculators), or non-reportable (small speculators). The commercial traders are usually presumed to be the smart money, and so a lot of people who watch the COT data like to trade in sync with whatever the commercials' net position is.

The interesting point about this week's chart is that I am taking data from the eurodollar market, and applying it to an analysis of the US stock market. The key discovery that I made a few years ago is that the movements of the SP500 tend to echo what the commercial eurodollar traders were doing previously. I played around with alignments to get the best fit, and found that a one-year lead time gave the best correlation.

Let's pause a minute to let that deep point sink in. Commercial eurodollar traders seem to "know" a year in advance what the stock market is going to do. It is not a perfect correlation, but it is a darned good one. I'm not sure what makes this work, but I have seen that it has worked great since about 1997. It may help to understand that the commercial traders of eurodollar futures are typically the big banks, who are using these futures contracts to manage their assets and fund flows. So what we are seeing in their futures trading are responses to immediate banking liquidity conditions, and those actions give us a glimpse of future liquidity conditions for the stock market. These liquidity conditions are revealed first in the banking system, and then the liquidity waves travel through the stock market a year later. But even if we cannot identify exactly what makes something work, after a few years of seeing that it does work we can learn to accept it.

The reason I picked this chart to show this week is that it is shouting to us now that something big is coming up for the stock market between June and October. In June 2010, the commercial eurodollar futures traders had gotten all the way up to a neutral position overall. Then between June and October 2010, they moved back to a big net short position. You can look back at the left end of the chart to see what it means to have the commercials move toward a bigger net short position.

It just so happens that this indication of a big top due in early June coincides with the end of positive annual seasonality in June every year, and also the end of the Fed's QE2 program. So the market is going to have two bullish factors (seasonality and POMOs) expiring at the same time that this chart's indication of banking liquidity flows says that the stock market is about to enter an illiquid period. Yikes!

The good news for the bullish case is that once that October low is put in, this eurodollar leading indication says we should see a really strong rally into the end of the year. But we'll have to get through some rough months this summer before it is time to play that year-end rally."

http://www.mcoscillator.com/learning_center/weekly_chart/commercial_traders_foretell_markets_movements/

Friday, May 27, 2011

Thursday, May 26, 2011

Wednesday, May 25, 2011

Tuesday, May 24, 2011

Monday, May 23, 2011

Sunday, May 22, 2011

Saturday, May 21, 2011

Friday, May 20, 2011

You Can't Make This Shit Up!

'Edward Smith, who lives with his current "girlfriend" – a white Volkswagen Beetle named Vanilla, insisted that he was not "sick" and had no desire to change his ways.

"I appreciate beauty and I go a little bit beyond appreciating the beauty of a car only to the point of what I feel is an expression of love," he said.

"Maybe I'm a little bit off the wall but when I see movies like Herbie and Knight Rider, where cars become loveable, huggable characters it's just wonderful.

"I'm a romantic. I write poetry about cars, I sing to them and talk to them just like a girlfriend. I know what's in my heart and I have no desire to change."

He added: "I'm not sick and I don't want to hurt anyone, cars are just my preference."

Mr Smith, 57, first had sex with a car at the age of 15, and claims he has never been attracted to women or men.

But his wandering eye has spread beyond cars to other vehicles. He says that his most intense sexual experience was "making love" to the helicopter from 1980s TV hit Airwolf.

As well as Vanilla, he regularly spends time with his other vehicles – a 1973 Opal GT, named Cinnamon, and 1993 Ford Ranger Splash, named Ginger.

Before Vanilla, he had a five-year relationship with Victoria, a 1969 VW Beetle he bought from a family of Jehovah's Witnesses.

But he confesses that many of the cars he has had sex with have belonged to strangers or car showrooms.

His last relationship with a woman was 12 years ago - and he could not bring himself to consummate it, although he did have sex with girls in his younger days.

Mr Smith, from Washington state in the US, kept quiet about his secret fetish for years, but agreed to be interviewed as part of a channel Five documentary into “mechaphilia”. He is shown meeting other enthusiasts at a rally in California

Talking about how his unusual passion developed, Mr Smith said: "It's something that grew as a part of me when I was a kid and I could not shake it.

"I just loved cute cars right from the beginning, but over the years it got stronger once I got into my teenage years and was my first having sexual urges.

"When I turned 13 and the famous Corvette Stingray came about, that car was pure sex and just an incredible machine. I wanted it.

"I didn't fully understand it myself except that I know I'm not hurting anyone and I do not intend to."

He added: "There are moments way out in the middle of nowhere when I see a little car parked and I swear it needs loving.

"There have been certain cars that attracted me and I would wait until night time, creep up to them and just hug and kiss them.

"As far as women go, they never really interested me much. And I'm not gay.”

Mr Smith is now part of a global community of more than 500 “car lovers” brought together by internet forums.'

Franchise Possibility?

Selecting a potential father for your children, it turns out, is not unlike shopping online.

"A lot of our clients typically want their donor to be at least 180cm [5ft 11in] tall and have blue eyes," says Peter Bower, director of Nordic Cryobank, who is showing me his database of sperm donors.

Customers narrow their computer search to eliminate men who are under or over a certain

They can click on a candidate's profile and, for a fee,

Staff also provide a few sentences giving their impression of donors - a physical description or an illuminating detail, Mr Bower says, such as "that he enjoys chatting in the lab after he has donated, dresses nicely or is very interested in a particular sort of music".

But crucially, none of the information will identify an individual, unless he has chosen to be traceable.

In Denmark, sperm donation does not have to come with a name and telephone number - unlike in Britain and in a fast-increasing number of other European countries.

That has made Denmark something of a Mecca for foreign women who want to conceive by

http://www.bbc.co.uk/news/world-europe-13460455

Thursday, May 19, 2011

Update On Fukishima...Yeah The Nuclear Disaster in Japan In Case You Forgot

'The fuel in reactors No 2 and 3 is suspected to have melted amid reports that the operators Tokyo Electric Power Company (TEPCO) failed to cool the plant in the aftermath of the March 11 earthquake and tsunami.

The news came only days after it was confirmed for the first time that a meltdown had taken place in the No 1 reactor only 16 hours after the earthquake and tsunami hit the plant.

"The findings at the No. 1 reactor indicate the likelihood that the water level readings in the other reactors aren't accurate," said Junichi Matsumoto, a general manager at Tepco. "It could be that a meltdown similar to that in the No 1 reactor has occurred." . . .'

http://www.telegraph.co.uk/news/worldnews/asia/japan/8517861/Japan-meltdown-feared-at-two-more-Fukushima-reactors.html

Wednesday, May 18, 2011

Tuesday, May 17, 2011

Sunday, May 15, 2011

Saturday, May 14, 2011

Monday, May 9, 2011

Sunday, May 8, 2011

Some Stocks I Like

Love this stock around $7.50

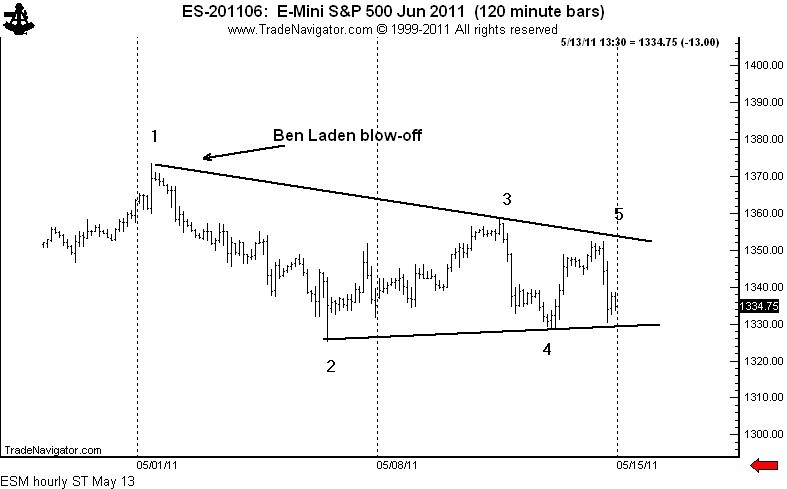

Might See A Bounce Around Here...Good Support Area...

It's quite clear to me that when the bull market was in full swing, aggressive sectors led the rally while defensive sectors lagged. This is what I refer to as a "healthy" advance. But note what happened from the mid-February high to the late April high. Defensive groups have emerged as the relative leaders. Money is rotating out of riskier stocks and into the more conservative ones. This suggests a risk-off trading strategy that does not give me the warm and fuzzies as we look ahead. CNBC and the like just look at the numbers, see fresh two year highs and proclaim the bull market perfectly intact. I believe this to be a very serious warning sign that merits close attention, if nothing else. . . ."

http://blogs.stockcharts.com/chartwatchers/2011/05/the-tale-of-two-markets.html

Friday, May 6, 2011

Thursday, May 5, 2011

The Future

The world's first interactive paper computer is set to revolutionize the world of interactive computing.

"This is the future. Everything is going to look and feel like this within five years," says creator Roel Vertegaal, the director of Queen's University Human Media Lab. "This computer looks, feels and operates like a small sheet of interactive paper. You interact with it by bending it into a cell phone, flipping the corner to turn pages, or writing on it with a pen." . . .

http://www.sciencedaily.com/releases/2011/05/110504111147.htm

Wednesday, May 4, 2011

Pearl Of Wisdom

"A good trader values his losses more than his wins. This might sound stupid, but wins are a celebration,

rarely time for reflection. A loss contains

VALUE. You paid for it dearly. Learn why you

made your decision and strive to implement

that new costly knowledge. In this wave, we

give meaning to that phase – Ah to be young

again; but with what I know today!"

Martin Armstrong

http://www.martinarmstrong.org/files/The%20Next%20Wave%2004-21-2011.pdf

Tuesday, May 3, 2011

Monday, May 2, 2011

Sunday, May 1, 2011

Subscribe to:

Posts (Atom)

![clip_image002[1]](http://www.jsmineset.com/wp-content/uploads/2011/05/clip_image0021_thumb.jpg)