Investment and Humor Blog Devoted to Lost Souls Searching For a Home.

Total Pageviews

Wednesday, November 30, 2011

I thought we smelled like McDonald's?

A street performer has painted his face white in an effort to tackle racist attitudes.

Nate Hill, who is African-American, has been walking around the streets of Harlem, New York in whiteface, wearing a suit and with a sign around his neck that reads: 'White People Do Not Smell Like Wet Dog'.

Mr Hill uses creative and often wacky ways of highlighting social prejudices and issues. . . .

Makes Me Want To Barf

Figures from Senate lobbying disclosure website highlight the top four lobbying organizations, plus Bank of America, which is seventh.

>

>

Bank Spending on Lobbyists 2010 vs *2011

American Bankers Association

•2010: $6,040,000

•2011: $6,690,000

Wells Fargo & Co.

•2010: $3,260,000

•2011: $5,890,000

JPMorgan Chase & Co.

•2010: $5,770,000

•2011: $5,800,000

Citigroup Inc.

•2010: $4,120,000

•2011: $3,800,000

Bank of America Corp.

•2010: $2,720,000

•2011: $2,210,000

* Figures for 2011 include the first three quarters only.

http://www.ritholtz.com/blog/2011/11/bank-spending-on-lobbyists-2010-vs-2011/

Tuesday, November 29, 2011

Pee Entertainment

The idea appeared in Amsterdam's Schiphol airport - painted on the inside of the men's urinals are little bluebottles.

The idea appeared in Amsterdam's Schiphol airport - painted on the inside of the men's urinals are little bluebottles.The airport designers found that simply giving men something to 'aim' at meant that there was less mess on the floor for the cleaners to deal with.

Now a British company has gone one step further: and created a urinal equipped with a video screen, so 'aiming' left and right steers a snowboarder down a slope.

More expert marksmen can also answer quiz questions.

The system has taken four years to develop - and, thankfully, won't need Britain's publicans to take a sledgehammer to their existing porcelain.

The system works by a clip-on LED screen at the top of the urinal, and a motion sensor aimed down into the 'business' area of the urinal.

Because it doesn't use liquid sensors or cameras, the makers hope that disagreeable cleaning tasks will be kept to a minimum.

What effect this will have on the hygiene of the facilities remains to be seen - although makers Captive Media are confident that it will persuade men to aim broadly in the 'right' direction.

Above the urinal is a 12-inch LED screen, which displays the game - with a quick advert first, as hard-up pub owners aren't going to install the things for fun. . . .

Read more: http://www.dailymail.co.uk/sciencetech/article-2067283/The-snowboarding-game-really-makes-splash--controller-urinal.html#ixzz1f5NELzd7

Monday, November 28, 2011

Internet Growth Still

“1. Only 35 percent of the world’s population uses the Internet today. Yet, of those on the Web, the majority currently lives in a developing country.

2. China has the largest number of Internet users—485 million to be exact—but this is only one-third of the country’s population. After the U.S., India comes in third with 100 million users, but this is less than 10 percent of its population. Brazil holds the number five position with nearly 76 million users—only one-third of its population.

3. The adoption of smartphones is expected to grow rapidly in emerging markets. According to Bloomberg News, within a four-month timeframe, five million Chinese bought Apple’s iPhone 4 from China Mobile. The company plans to have 1 million new Wi-Fi hotspots across China over the next three years, says Bloomberg, so the consumer can surf the Web via Wi-Fi without having 3G access.”

Sunday, November 27, 2011

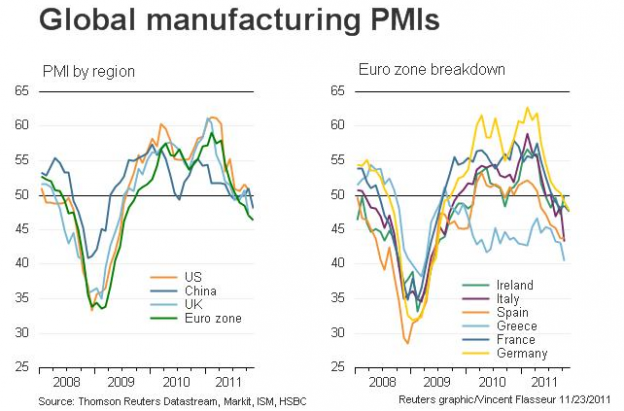

Why Germany Does Not Want To Print

The REAL reason, as explained by strategist Lorcan Roche Kelly in a note for Trend Macro, is that early last decade, Germany embarked on a policy called Agenda 2010, which basically offered German workers a trade: They'd get very little real wage growth, but in exchange, unemployment would be kept low.

And indeed, Germany has had the lowest wage growth in Europe, as this chart from Triplecrisis.com shows nicely...

And as you know (or may not know) Germany has kept up its end of the bargain, keeping unemployment at remarkably low levels, even as other Western nations has seen their numbers rise.

So any inflation caused by money printing would mean a real wage cut for German workers, and a violation of the deal.

Read more: http://www.businessinsider.com/why-germany-doesnt-want-the-ecb-to-print-money-2011-11#ixzz1euTVTZ7v

Saturday, November 26, 2011

2012 - Be Scared, Very Scared

1. Eurozone: The threat to the euro is greater now, in our view, than it has been at any time since the crisis started, with only the ECB now capable of averting

a catastrophe (Issue #1).

2. United States: Fiscal gridlock in election year now poses a real threat to US growth prospects (Issue #2).

3. MENA: Events remain consistent with our view that there will be a protracted period of political turmoil and uncertainty across the region, supportive of the oil price, despite growing concerns over global economic prospects (Issue #3).

4. China: We believe that China‟s leaders will do everything they can to ensure a smooth economic trajectory through to the completion of the handover of power from the 4th to the 5th generation leadership in March 2013 (Issue #4).

5. North Korea: Tensions appear still to be rising on the Korean peninsula (Issue #5).

http://pragcap.com/the-5-most-important-global-political-trends-to-watch-in-2012

Friday, November 25, 2011

Dagestan - I Did Not Know You Existed

Once it was Chechnya, today it is the republic of Dagestan on the Caspian Sea that is the most explosive place in Russia - and in Europe. There are bomb attacks almost daily, shootouts between police and militants, tales of torture and of people going missing.

Two armed men in camouflage holding Kalashnikov rifles enter the shop and tell the customers to leave. The terrified cashier stumbles past as one of the men puts a bomb on the counter and sets the timer.

He does not bother emptying the till, he just walks out of the door.

Seconds later, the shop is filled with smoke.

Attacks like this one caught on supermarket security cameras - in which Islamic fighters punish shops that sell alcohol - have become routine events in Dagestan's capital, Makhachkala. . . .

http://www.bbc.co.uk/news/magazine-15824831

Thursday, November 24, 2011

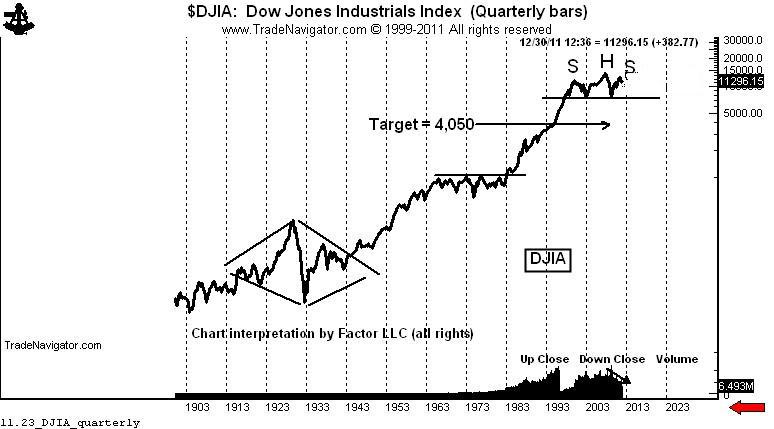

4000

Charts are NOT for price forecasting. But a chart pattern carries an implied price move. I recognize that any given chart pattern has a significant chance of failure. But until a pattern fails or is not modified by a contrary pattern, then price targets are a good guideline.

When prices act contrary to the implications of a chart, then I run for the hills. But until then, I retain strong opinions (weakly held). If you can’t understand this nuance, that is your problem, not mine.

OK, all this was a build up to your Thanksgiving gift — a price forecast in the DJIA. Please step back and take a 30,000 foot view with me.

The rally from the March 2009 low was on decreasing volume. Rallies that do not draw in the public are very suspect, and prove more often than not to be corrective rallies. In this case, the correction is of the 2008 to 2009 price decline. That’s right, the volume profile of the this 32-month rally is much more typical of a bear market rally than of a genuine bull trend.

The founders of classical charting (Schabacker, Edwards, Magee) identified something called a 3-fan principle. The 3-fan principle specifies that a corrective rally may be defined by trendlines with decreasing angles of attack. The concept also specifies that the violation of the third fan line establishes the top of the corrective rally — and that the subsequent decline will retrace the entire distance of the corrective rally.

Now, you may want to give me with all the reasons why a return to the 2009 low is not possible. That’s fine — but, keep it to yourself. I will change my mind when price makes me change my mind, not one moment before.

The fact that the daily and weekly charts completed a H&S top simultaneously with the violation of the third fan line is a confirmation that the May and July highs will not be breached. Another classical charting principle is that H&S tops and bottoms (when they meet all of the criteria for the pattern, which this H&S top did do) represent a major turning point in a trend.

Next, let’s move from a 30,000-foot view to a perspective from the space station. Should the implications of the 3-fan principle be realized, something very, very, very (do I need to repeat the word “very” again?) significant would become apparent to a chartist.

A move back to the 2009 low on the quarterly semi-log chart sets up the possibility (not probability, not certainty) of a 13-year H&S top whereby the entire advance from the March 2009 low is nothing more than the right shoulder of this massive configuration.

Should the market decline toward the 2009 low, then the massive H&S top on the quarterly chart becomes a real (but wild) possibility. The rules of classical charting specify that a decisive completion of a H&S top should lead to a decline equal to the height of the H&S.

On an arithmetic basis, the target in the Dow would become lower than 1,000. On the semi-long chart the target would be around 4,000. So I will use the higher target.

Do I really think the DJIA will decline to 4,000? I have no idea. But I do know this — that if it does it will be one wild (and hopefully profitable) ride.

Wednesday, November 23, 2011

Panic Selling and Bottoms

On the chart you can see the pullbacks in the SP500 which triggered a panic selling spike in my green indicator. What I look for is a pullback in the SP500 and for my panic selling indicator to spike over 20. When that happens I start watching the volatility index for a spike also. The good news is that the volatility index typically rises the following day making my panic indicator more of a leading one…

http://www.themarketguardian.com/2011/11/how-to-trade-using-market-sentiment-the-holiday-season/

This Headline Makes Me Crazy!

Mail Online: 'I missed our sex life': Ex-husband of world's fattest woman says her weight gain made her MORE attractive... and now he's moved back in

After divorcing her husband three years ago, Pauline Potter - already a whopping 46stone - piled on so much extra weight she became the heaviest woman in the world, weighing in at 50stone (700lb).

But for ex-husband Alex (a svelte 11stone), it only made her even more irresistible.

When he saw she had clinched the Guinness World Record for her enormous size, Mr Potter rushed to move back in with his former partner in Sacramento, California.

Sensual: The couple got back together after Alex saw she had become the heaviest woman in the world. Today, Mrs Potter (seen here in a recent picture) cannot walk or wash herself, but the pair say their sex life is amazing

Mrs Potter, whose weight at its peak has now reached 52 stone, told The Sun: 'Most women think losing weight is the way to get their ex's attention - but for me it was just the opposite.

'Becoming the world's heaviest woman is what made him fall in love with me all over again and we're now working on getting our relationship back on track.'

The 47-year-old is now so big she cannot get around - but she is still dynamite in bed, her ex-husband told the newspaper.

'She can't walk, dress herself or even go to the toilet on her own - but I'm desperate to be her lover and caretaker again,' he said.

'I miss our sex life. Pauline could be 70st and we'd still have sex every single day because it's that good. . . .

Read more: http://www.dailymail.co.uk/news/article-2064718/I-love--I-miss-sex-life-Ex-husband-worlds-fattest-woman-says-wants-back.html#ixzz1eWKez7Ao

Tuesday, November 22, 2011

Gold Has A Long Way To Go Yet

Predictions help us understand the future, even though they are necessarily fraught with speculation and error. Be cautioned that nobody knows the future precisely, but here I have divulged my methods so you can see how I came to these estimates. Use them with your own judgment.

My conclusion is that we face very serious financial problems ahead. The situation is far more out of control than any previously faced in the United States. I see no way to ever pay off the government debt, and Congress has shown itself incompetent in all things, but especially in applying the brakes to soaring deficits.

Elsewhere, the Federal Reserve has already indicated that it plans to abandon the dollar in favor of printing new money to support the economy and the banks. The combination of both doesn’t bode well for the survival of the dollar.

My fear is that the situation will turn out to be much worse than the historically projected trends referenced above, with the price of gold escalating well beyond the numbers shown. So as we go forward, you can use these benchmarks to see whether we remain on a trajectory to significantly higher gold prices.

Of course, if confidence in the fiat currencies erodes to the point approaching failure, the value of gold denominated in worthless paper approaches incalculable numbers – Zimbabwe-like numbers that would be meaningless.

Summed up, until there are fundamental changes in government fiscal and monetary policies – and a recognition that the sovereign debt is unpayable and therefore needs to be restructured – there is no reason to fear gold pullbacks and every reason to expect even more positive returns in the gold mining stocks that are still catching up to the rapid gold rise.

Even higher prices than mentioned here are possible from the flight to safety out of the euro, the seasonal rise into the new year, and the accelerating action of gold from a shift in sentiment of the investment public to a relatively small market. Gold is by far the best “answer,” and now is still the best time to invest.

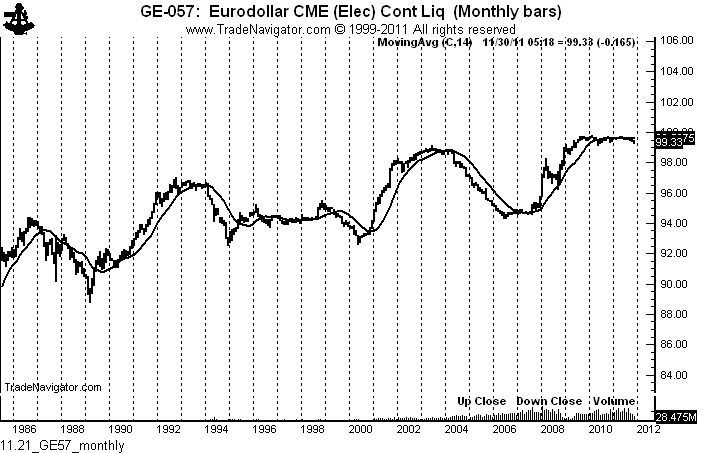

Eurodollar Trade

The Eurodollars do not change trend very often. We are on the verge of a new trend – the first downtrend since 2004.

Eurodollar futures have been one of my most favorite markets to trade over the years. The Eurodollar market reflects the interest rate on U.S. Dollars owned and deposited overseas. The market is priced at 100 minus the interest rate. So, if the interest rate is 1%, the price will be 99.00, 2% will be 98.00 and so on.

Eurodollars are among the most actively traded of all futures contracts, rivaling S&Ps and Crude Oil in volume. The Eurodollar market is unbelievably liquid. The value between minimum ticks (1/2 point) is $12.50 and the bid and offers are tight and sizable. Eurodollars cannot trade above 100.

When Eurodollars trend, they really trend. It is one of the best trending of all futures contracts. For example, using a very long-duration moving average of 65-weeks (325 days), there have been only six directional changes in the moving average since 1982 (excluding a period of interest rate uncertainty in the late 1990s). That is an average of a trend change every five years. To be more specific, the long-term moving averages have turned down only four times in 30 years.

Monday, November 21, 2011

Natural Gas...

Embrace instead the language of tar sands, shale gas, fracking and tight oil. Without quite knowing whether they were new boondoggles or potential game-changers, the debate in Washington until recently largely ignored these escalating supply shocks. Yet together, they have transformed America’s energy outlook. Because of better technology, notably breakthroughs in drilling, the U.S. all of a sudden realizes it is sitting on a century’s worth of gas supply (see chart above of domestic production). When Mr. Obama came to office, the country faced projections of rising natural gas imports from places like Qatar.

The same technology has unlocked ever-growing estimates of once inaccessible “tight” oil lurking beneath America’s rocks. In its immediate neighborhood, Alberta’s huge expanse of “tar sands” contains oil reserves that rank Canada second only to Saudi Arabia. In Brazil, recent advances in offshore oil drilling will relegate Venezuela into second place in the region.

Without any real input from Washington, windfalls just keep dropping into America’s lap. Welcome to a new age of plenty."

Conclusion: "A new era of fossil fuel appears to be upon us and nobody saw it coming."

http://mjperry.blogspot.com/2011/11/without-any-real-input-from-washington.html

Open Wide - Might Want To Think Twice Before Going To Dental School

A mouthwash concocted by a UCLA microbiologist may render cavities and tooth decay a thing of the past.

The innovation developed by Wenyuan Shi, chairman of the UCLA School of Dentistry’s oral biology section, acts as a sort of “smart bomb” against harmful bacteria like, S. mutans, a main cause of cavities and tooth decay...

“With this new antimicrobial technology, we have the prospect of actually wiping out tooth decay in our lifetime,” he said.

A successful clinical study involving a dozen people found that those who rinsed with the UCLA-developed mouthwash just once over a four-day testing period experienced a near-complete elimination of the S. mutansbacteria.

Sunday, November 20, 2011

One -Three Years Left?

That tells us about the “when”, but it does not tell us about the “how far”. The bottoms for this ratio in the 1930s and 1940s were down below 3.0, and it got all the way down to 1.3 at the low in January 1980 (based on monthly closes). If the DJIA were to stay around 12,000 for the next few years, then a ratio of 2-3 would mean gold at around $4000 to $6000 an ounce. Or the ratio could get down below 3 by having gold stay where it is, and the DJIA get cut in half, or some other combination of movements. That’s how the math works.

It is risky to forecast both the timing and the price for the end of a trend, so I’ll refrain from endorsing those numbers. I just offer them as food for thought. Nothing mandates that this ratio reach any particular level.

The more important conclusion to take from this is that the decline in this ratio does not seem to be done, and is not due to be done for a little while longer. But the end to this decline in the DJIA/gold ratio is going to come someday, probably when the Fed decides to wake up and start fighting inflation again via higher interest rates . That does not appear to be on their agenda any time soon.

Subscribe to:

Posts (Atom)