Investment and Humor Blog Devoted to Lost Souls Searching For a Home.

Total Pageviews

Saturday, September 29, 2012

TRX....One Hurdle To Go Before We Hit Clear Road

As you can see from this weekly chart $TRX is at a price point where there is a confluence of resistances....61.8% Fibonancci retracement from $7.82 high to $1.56 low and if you look closely at chart you can see TRX really fell apart at the $5.43 level last year. We tried to pierce it early this spring but failed. Now we are making a cup and handle formation which is extremely bullish and should allow us to get through this area by the end of October.

Still think we need to work off some overbought levels on Stochastics though MACD levels are improving. I do believe even if the market sells off that Gold and Silver and the miners will be a safe haven in the era of coordinated world wide money printing. Best of luck to you all! Lotion Boy!

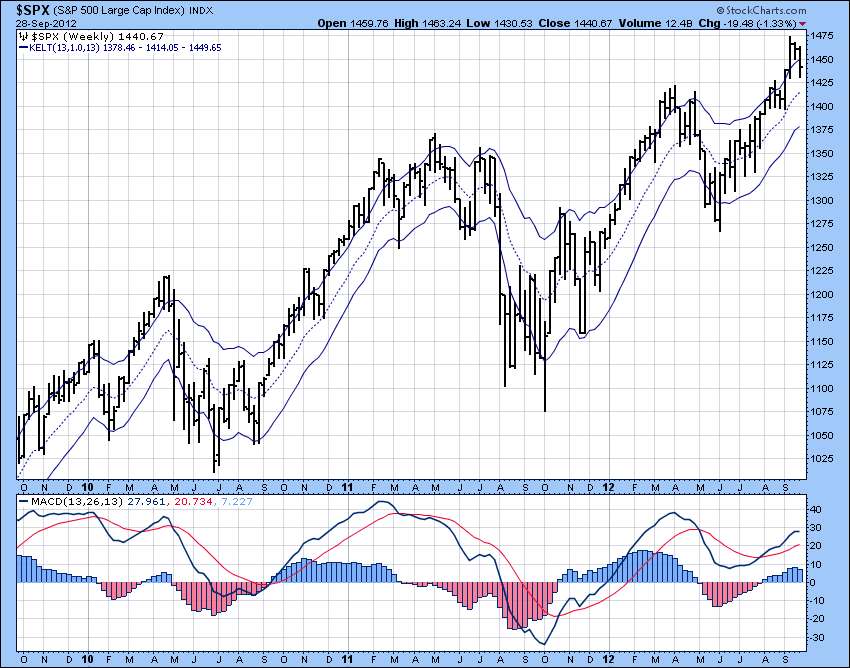

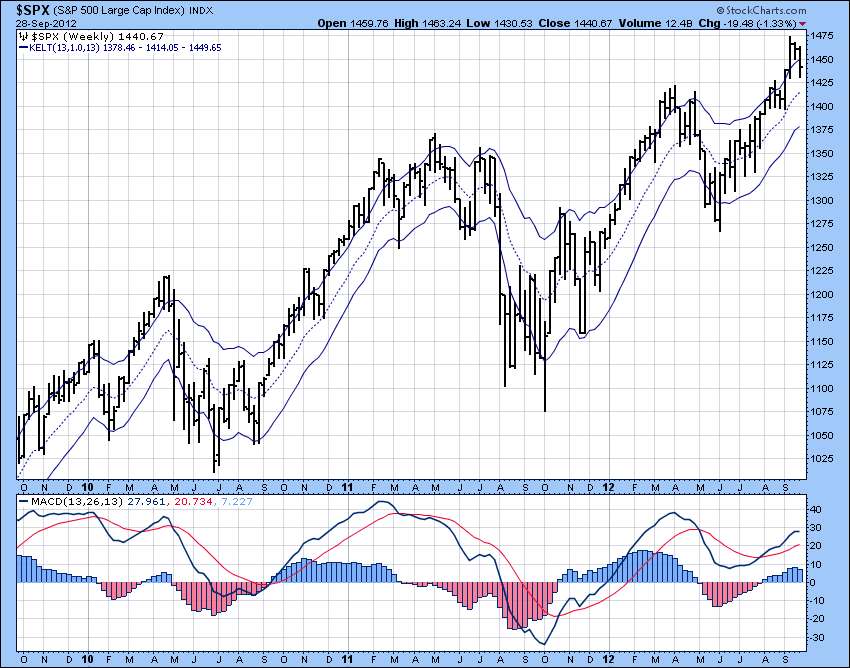

MACD Divergence

Carl Swenlin noted in a previous post, a growing number of indicators are showing serious bearish divergences, indicating that the bull market we've been enjoying could end abruptly. In my experience, weekly chart MACD divergences are the most powerful of all technical leading indicators, therefore this chart is at the top of my list of red flags. It is only a "potential" MACD divergence at this time because it will not be valid unless MACD ends the week below its trigger line. However, this phenomenon does not occur very often, and it has given some very timely warnings in the past, so it deserves to be watched closely.

Mona Lisa, Mona Lisa

PHOTO: The Mona Lisa Foundation says scientific tests indicate both these portraits were painted by da Vinci.(AFP: Mona Lisa Foundation)

PHOTO: The Mona Lisa Foundation says scientific tests indicate both these portraits were painted by da Vinci.(AFP: Mona Lisa Foundation)

A painting suspected of being a Leonardo da Vinci version of a younger looking Mona Lisa has been unveiled in Geneva.

Carefully pulling back velvet drapes, members of the Zurich-based Mona Lisa Foundation revealed what looks like a younger version of the world's most famous painting to a room crammed with reporters and television cameras.

Foundation president Markus Frey said the purpose of the event was to "present all the evidence showing that the great artist Leonardo da Vinci did in fact paint two versions of the Mona Lisa portrait".

The painting had been locked in a Swiss vault for more than 40 years and Mr Frey said it was time to "give that stunning earlier version the place in history which it deserves after such a long period in obscurity". . . .

Friday, September 28, 2012

Dividend Cliff

A great deal has been written about the "fiscal cliff" that US taxpayers, investors and companies are faced with at the end of this year. Put simply, all of the tax changes made in 2002 and 2003 expire at that time, and the tax code will, in large part, revert to what it was prior to those changes. I will leave it to others to debate the macro economic implications of going over the cliff but I want to focus on one "segment" of the code that has implications to valuation.

In 2003, the tax code was altered to bring the tax rate on dividend income down to 15%, to match the tax rate on capital gains. That was, in a sense, a revolutionary move, at least for the US, since dividends had been taxed much more heavily than capital gains for much of the previous century. Idid write a paper in 2003 about the potential implications of the tax law change for businesses that you can read. In effect, I argued that the tax change would have a positive effect on stock prices, that the effect would be greater for "high" dividend paying stocks than for non-dividend paying stocks and that corporate dividend policy would be altered by the change. Now that there is the possibility that the law will be reversed, it is time to revisit the issue.

Dividends, Expected Returns and Stock Prices: Why taxes matter...

To understand the impact of investor taxes on dividends, let's begin by looking at how you would price stocks in a world where interest income, dividend income and capital gains are not taxed. Let's assume that the risk free rate is 1.5% and that stocks are collectively paying a dividend yield of 2%. To induce you, as a risk averse investor, to invest in stocks, you would need to be offered a premium (at least on an expected basis) over the risk free rate. Let's assume that you would demand a premium of 4.5%, after personal taxes, to shift from the riskfree asset to risky equities. Thus, you would need to earn a 6% return (1.5%+4.5%), after personal taxes, to invest in stocks. Since this is a world with no taxes, your pre-tax expected return would also by 6%; with a dividend yield of 2%, the expected price appreciation on stocks would have to be 4%.

Now, introduce a uniform tax rate of 15% on interest income, dividend income and capital gains into this world. Since you need to earn 6% after taxes, you would need to earn 7.06% before taxes:

Expected pre-tax return = Expected after-tax return/ (1- Uniform tax rate) = 6%/ (1-.15) = 7.06%

Thus, if stocks continue to pay a 2% dividend, the expected price appreciation would need to 5.06%. The higher required return would mean that stock prices would have to drop, relative to what they were in a world with no taxes. With the existing tax law, we are close to this tax regime (with the only difference being that interest income is taxed at a higher tax rate). This is close to the current tax regime.

Let's now change to law to reflect what the tax rate will be on January 1, 2013, if we do revert back to pre-2003 levels. The tax rate on dividends, for individual investors, will revert back to the ordinary income tax rate. At the margin, for unmarried (married - joint filing) investors generating more than $ 85,650 ($142,700) and in income, that rate will be close to 35% (counting just Federal taxes and incorporating the additional taxes that the new health care law will impose on dividends and other investment income) and approach 40% for those with income levels exceeding $178,650 ($217,450). The tax rate on long term capital gains will also go up, but only to the 20% rate that prevailed prior to 2003. If companies continue with a dividend yield of 2% and the price appreciation stays at the 5.06%, investors will earn a much lower after-tax return:

After-tax return with pre-2003 tax rates = 2%(1-.40) + 5.06% (1-.20) = 5.25%

If investors risk preferences have not changed, they will have to want to continue to earn 6% after taxes, but the pre-tax return would have to increase to compensate for the higher taxes. In fact, if we assume that the dividend yield stays fixed at 2%, we can solve for the required price appreciation

2% (1-.40) + X (1-.20) = 6%

Solving for X, we get a required pre-tax price appreciation of 6% and a required pre-tax return of 8%. That would translate into a significant drop in stock prices.

Making it real: The dividend cliff and the S&P 500

To make this less abstract, let's work with some real numbers. At the start of every month, I back out the expected return on stocks from the level of the index (S&P 500) and expected cash flows. At the start of September 2012, when the S&P 500 was at 1406.58, I computed an expected return on stocks of 7.30% (yielding an equity risk premium of 5.75% over the risk free rate of 1.55%). This expected return is what investors are demanding on a pre-tax basis on stocks. Since the current dividend yield on the S&P 500 is about 2.01%, the expected price appreciation on a pre-tax basis is 5.29%. Since both dividends and capital gains are taxed at 15%, under the pre-cliff tax law, the post tax return is 6.21%:

After-tax return in September 2012 with current tax law = 2.00% (1-.15) + 5.29% (1-.15) = 6.21%

Now, let's assume that investors will continue to demand this after-tax return in 2013, that the tax laws revert back to pre-2003 levels and that companies continue to maintain a dividend yield of 2.01%:

2.01% (1-.40) + Expected pre-tax price appreciation (1-.20) = 6.21%

The expected pre-tax price appreciation would have to be 6.25% and the required return on a pre-tax basis would have to be 8.26% on the S&P 500, yielding an equity risk premium of 6.71% over the riskfree rate of 1.55%. Holding the cash flows the same and changing the equity risk premium to 6.71% yields a value of 1201.22 for the S&P 500, a drop of about 14.60% in the index from current levels. If you don't agree with the assumptions I have made, not a big deal. I have attached the spreadsheet that I used and you can compute your own estimate.

Differential impact: High dividend versus non-dividend paying stocks

Note, though, that the effect of the reversal in the tax law will not be uniform, since every company does not have a dividend yield of 2%. Companies with high dividend yields, that continue to pay those dividends, will see expected returns increase more and stock prices drop by a more significant margin. In the graph below, I have compute the percentage change in stock prices you can expect in stocks with dividend yields of 0% to 4%.

Note that the stocks with the 4% dividend yield, holding all else constant, will see stock prices drop by 18%,, whereas the stocks with the 0% dividend yield will see a price drop of only 7%. Again, you can use the spreadsheet and alter my assumptions, if you so desire, and compute the effect on any individual stock.

The Weak Links

This analysis suggests that a sharp correction is ahead for stocks collectively and especially so for high dividend paying stocks. It is, however, based on a set of assumptions about tax law and markets that may not be correct. So, what are the weakest links in this analysis?

1. There is no chance that the fiscal cliff will become reality: This is not the first time that we have faced the possibility of the tax laws reverting back to pre-2003 levels. At the end of 2011, faced with the possibility, Congress and the administration pushed off the day of reckoning at the last moment. It is possible that faced with the catastrophic consequences of going over the cliff, Congress will find a way to avoid it again, but is it guaranteed? Having seen the political dysfunction at both ends of Pennsylvania Avenue over the last decade, I am not as confident as others may be that common sense will prevail and that the cliff will be avoided.

2. Not all investors pay taxes on investment income: In my analysis, I used the tax rates on wealthy individual investors to make my assessment, but tax rates vary widely across investors. There are two critiques that can be mounted. The first is that about 60-70% of stocks are held by non-individuals: mutual funds, pension funds and corporations and the tax rates that these investors may not be affected (or at least not as much) by the change in the tax law. The second is that companies that pay high dividends attract investors who like those high dividends and it is possible that these investors make less income and face less of a hit from the change in the tax law. Note, though, that even if we factor in these investors, the basic analysis still holds but the impact will be lightened. In fact, one way to alter the analysis is to take a weighted average tax rate across all investors in the market, which would buffer the impact. The graph below estimates the effect on the market, stocks with a dividend yield of 4% and stocks with a dividend yield of 0% of assuming lower tax rates in the post-cliff period.

3. Investors may already have built in the expectation that tax laws will change into current stock prices: To the extent that the fiscal cliff has been in the news and widely reported, it is possible that the market has already incorporated the possibility of it coming to fruition into stock prices and the expected return. I would have been inclined to believe this if I had seen the equity risk premium climb, and stock prices drop, over the course of the year, but they have not. In fact, we started the year with a much higher equity risk premium of 6.04% and have seen the premium drift down to 5.75%.1. There is no chance that the fiscal cliff will become reality: This is not the first time that we have faced the possibility of the tax laws reverting back to pre-2003 levels. At the end of 2011, faced with the possibility, Congress and the administration pushed off the day of reckoning at the last moment. It is possible that faced with the catastrophic consequences of going over the cliff, Congress will find a way to avoid it again, but is it guaranteed? Having seen the political dysfunction at both ends of Pennsylvania Avenue over the last decade, I am not as confident as others may be that common sense will prevail and that the cliff will be avoided.

2. Not all investors pay taxes on investment income: In my analysis, I used the tax rates on wealthy individual investors to make my assessment, but tax rates vary widely across investors. There are two critiques that can be mounted. The first is that about 60-70% of stocks are held by non-individuals: mutual funds, pension funds and corporations and the tax rates that these investors may not be affected (or at least not as much) by the change in the tax law. The second is that companies that pay high dividends attract investors who like those high dividends and it is possible that these investors make less income and face less of a hit from the change in the tax law. Note, though, that even if we factor in these investors, the basic analysis still holds but the impact will be lightened. In fact, one way to alter the analysis is to take a weighted average tax rate across all investors in the market, which would buffer the impact. The graph below estimates the effect on the market, stocks with a dividend yield of 4% and stocks with a dividend yield of 0% of assuming lower tax rates in the post-cliff period.

4. Companies may change their dividend policy: I did predicate my analysis on companies maintaining their dividends at 2012 levels, even if the tax law changes to tax dividends more highly in 2013. In fact, if companies were completely flexible, they could stop paying dividends and largely nullify the impact of the tax law change. History suggests that this is unlikely. If there is a word that best describes dividends, it is that they are "sticky", i.e.. that companies are reluctant to change dividends and especially to cut them. In fact, the 2003 law did not to lead to a surge in dividends (though a few companies pay special dividends in the immediate aftermath) and I don't think that a reversal of the law will lead to a sudden reassessment of dividend policy.

Bottom line: I may be overly pessimistic, but the dividend cliff scares me and I am planning for the eventuality that the tax code will change drastically on January 1, 2013. I am and will continue pruning my portfolio, shifting my money from large dividend-paying US stocks to non-dividend paying or low-dividend paying foreign stocks. I won't go overboard and sell short/ buy puts on high dividend paying stocks. After all, the dividend tax effect is one of many forces that will affect equity markets over the next few months and it is possible that one of these effects will drown out the tax effect.

Thursday, September 27, 2012

It's Going To A Wild Ride

10 Ways the Next 10 Years Are Going To Be Mind-Blowing

We are living in an extremely exciting time in terms of science and technology. Things that have always been considered science fiction are becoming normal day-to-day components of our lives. And while we have been seeing invention after breakthrough over and over in the last couple of decades, this next ten years is going to blow everything else out of the water.

We are living in an extremely exciting time in terms of science and technology. Things that have always been considered science fiction are becoming normal day-to-day components of our lives. And while we have been seeing invention after breakthrough over and over in the last couple of decades, this next ten years is going to blow everything else out of the water.

The awesome thing about all these scientific discoveries it that they create technology that allows us to make more breakthroughs even faster. Our ability to innovate is increasing exponentially as the years go by. To give you an idea of the magnitude of this reality, here are 10 amazing innovations to different sectors of life. They should give you a pretty good idea of what changes will be made by 2020.

1) Bio Technology

Bionic Hand controlled by brain signals

Bionic Hand controlled by brain signals

Okay, it doesn’t let you crush rocks like you would think, BUT it does allow people without fingers to have fully functional hands that can pick up and handle delicate objects. It is completely controlled by the brain and requires no surgery. Touch Bionics, the company the produces the Pro Digits hand, is able to install the hand complete with “living skin,” a plastic covering resembling human skin, for under $50,000. A small price to pay for a new hand I think.

2) Architecture

Revolving Tower in Dubai

Revolving Tower in Dubai

While Dubai is currently known for it’s ridiculous extravagance, developers in the region are building a tower that has fancy andextremely practical applications.

This beautiful building is going to be made of 59 independently rotating modules/floors so that inhabitants will have a constantly shifting view of the outside world. Each floor will rotate at approximately 6 meters per minute so that the inhabitants will not notice the movement. The independent rotations will also give the building an ever-changing exterior that can warp into very complex designs.

All of that aesthetic stuff is great and all, but the real innovation comes from the wind turbines built in between each floor. The resulting pollution-free energy will be enough to power the tower and several buildings in the surrounding area. Just Wow.

3) Computer Speed, Size and Usability

Speed

Most people tech-nerds know of Moore’s Law from 1965 (the number of transistors we are able to cheaply put in computer chips doubles every year, thereby doubling the speed). However, most people don’t know that Moore, himself, came out and said his law will most likely fail finally in 2020 where the number of transistors we can put on chips will be limited by the laws of physics. Does this mean the exponential rise in computer processing speed will come to a halt in ten years?

Not a chance, says Jim Tully, chief of research for semi-conductors at Gartner. “The technology which will replace this is a bottom-up approach, where chips will be assembled using individual atoms or molecules, a type of nanotechnology.”

Ray Kurzweil, a well-respected Futurist, stated in 2008 that when this molecular computing technology comes out in 2020, computers will have the intellectual capability of human beings. You might want to digest that for a minute before moving onto the next section.

Size and Usability

That Macbook Air is pretty damn thin. So thin, in fact, that it makes you wonder if physical computers will even exist in 2020. Well according to developers at Intel, the keyboard and mouse surely won’t. Who needs QWERTY when you can control a computer with your mind?

“We’re trying to prove you can do interesting things with brain waves,” said Intel researcher Dean Pomerleau. “Eventually people may be willing to be more committed … to brain implants. Imagine being able to surf the Web with the power of your thoughts.”

Pomerleau and countless research groups around the world are working with brain scanning devices to map blood flow in the brain. They have found that when different individual focus on the same image, they have very similar patterns of blood flow in their brains. For example, oneBritish group announced that they could discern where subjects where in a computer generated virtual environment by looking at where blood flowed in their brains.

4) Cars and Fuel

There are tons of different fuel-types for the “automobiles of tomorrow” but the only kind that seems to have any realistic chance of actually being used by the masses in the next ten years is electric. We still can’t figure out how to make hydrogen fuel cells efficient, safe and practical and hybrids/deisal cars are yesterday’s news. Fossil fuels are so 2009…

This is the Tesla Model S sedan that will be coming out in 2011 for the modest price of $57,000 (very good for a luxury, electric car).

Besides the sexy curves, you get 160, 230 or 300 miles per charge depending on the battery size you choose. And another small detail, it goes from 0 to 60 mph in 5.5 seconds while seating 7 people.

So despite all of the automaker’s best attempts at making alternative-fuel cars so hideous that no one would ever buy them, it looks like market competition will soon push some very attractive and efficient cars onto the market.

5) How We Interact With the World

The way in which we interact with the outside world has changed SO much since the introduction of the internet, smart phones, etc. In the very near future, another huge jump will be made: integrating the information on the internet with our surroundings.

By that I mean being able to look at a building, product or place and immediately seeing information about the subject on our devices and eventually just with our eyes.

If you’re still confused as to what I mean, check out the earliest innovation of this concept, Goggles by Google. This app allows you to take a picture of whatever you are looking at and instantly receive info about it on your Android phone.

Like the video says, Goggle is only scratching at the surface of this technology. Kurzweil says that “By 2020 we’ll routinely have pop ups in our visual field of view that give us background about the people and places that we’re looking at.” Your memory and the vast information bank of the internet will be one at all times.

Until we can do this with a chip in our brain, a new device has come out that overlays video onto our normal vision using special glasses. It’s called the Vuzix display Wrap 920AR and it goes on sale soon for around $800.

6) Energy

Solar energy will soon leave fossil fuels and inefficient wind farms in the dust. According to Kurzweil, “the cost per watt of solar energy is coming down rapidly and the total amount of solar energy is growing exponentially. It has in fact been doubling every two years for the past 20 years and is now only eight doublings away from meeting all of the world’s energy needs.”

Emerging technology from a company called Sandia is making the reality that much closer:

Sandia’s solar cells are made of 100 times less material than the current top solar cells while operating at the same efficiency. Since the biggest hurdle in the path of solar power is the expensive and large nature of solar panels, these new microscopic cells will make a huge difference. For example, current panels are massive and require large motors to move them to track the sun. Sandia’s cells, on the other hand, would only need to be moved a fraction of a millimeter to track the sun efficiently while weighing next to nothing.

Even more amazing, they can be suspended in liquids and printed on flexible materials, allowing the cells to be places on any surface. What if your entire car was covered in these powerhouses? Bye bye, Chevron.

7) Health

While we still can’t cure the common cold, custom-made organs are just around the corner.

A company called Organovo has developed the first commercial 3-D bio printer that builds custom organs cell-by-cell. Each individual cell is based upon sample cells from the body of the customer. Organovo reports that veins and arteries will be available in 5 years, and more complex organs like hearts and livers in 10.

On a more general note, nanotechnology is revolutionizing the health world. The awesome combination of a higher understanding of how DNA works and the ability to create very small cellular parts is painting a very bright future for medicine.

Scientists are finding specific sequences of DNA that code for conditions like schizophrenia, autism and even aging. The cures are actually in sight.

8) Success and Popularity Accessibility

By that, I mean the ability of a Joe Nobody to come from nowhere and suddenly gain recognition and become a well known someone. The internet has been continually leveling the playing field so that you don’t need million in capital or marketing to get your ideas, creations and business into the spotlight.

10 year-olds are making thousands off their viral YouTube videos. Anyone with a business idea can start a website and get going for little to no capital. Even Twitter (which I am not a big fan of) can launch people into the spotlight if they can work the system in the right way.

Many people are getting huge jobs because companies are seeing how well their content does on the web. For example, Fede Alvarez, a director from Uruguay, recently had this short film go viral and was offered $30 million from a Hollywood company to direct a film for them.

The internet is the perfect tool for capitalism, entrepreneurship, and dreaming. Whatever you can dream up, you can make possible on the World Wide Web.

9) Robots

The first decade of the 21st century has been a remarkable time for innovation in robotics. While we’re still far away from having bots helping around the house or doing our construction, big strides have been made towards that future.

Recently a robot was able to teach itself human facial expressions by randomly contorting its face and receiving feedback on what resembled real expressions.

Here’s another robot called BigDog that came out a couple of years ago, but if you haven’t seen the video, you really should. It’s a 4-legged robot that can navigate difficult terrain and correct its balance when shoved. If you can’t watch the whole video, at least fast-forward to 1:50 where the robot can be seen running and jumping.

And finally here is the bipedal version of BigDog that walks heel-to-toe just like humans do. Again, it can regain balance when shoved.

10) Clothing

Nanotechnology in Clothing

- Nano-fibres will make garments tremendously more comfortable and durable. “By this process the textile products can be made more attractive, strong and responsive to customers’ choice.”

- Fiber-based nanogenerators will build up electrical energy in clothing from physical movement, ultrasonic waves and even blood flow. “If we can combine many of these fibers in double or triple layers in clothing, we could provide a flexible, foldable and wearable power source that, for example, would allow people to generate their own electrical current while walking.”

- Fiber-based nanogenerators will build up electrical energy in clothing from physical movement, ultrasonic waves and even blood flow. “If we can combine many of these fibers in double or triple layers in clothing, we could provide a flexible, foldable and wearable power source that, for example, would allow people to generate their own electrical current while walking.”

- Extremely hydrophobic (water-resistant) nanofilaments allow for completelywaterproof clothing. It can be submerged in water for two months and still remain dry to the touch. “The water comes to rest on the top of the nanofilaments like a fakir sitting on a bed of nails.” (Whatever that means…)

www.highexistence.com/10-ways-the-next-10-years-are-going-to-be-mind-blowing/

Wednesday, September 26, 2012

How To Avoid Next Tech Bubble

Warren Buffet’s #1 rule of investing is “Don’t lose money.”

It’s good advice, though not to be taken literally; all investors lose on occasion. Still, it is a worthy goal for which to aspire. And to have any chance of reaching it, you must learn how identify and avoid bubbles.

Which is easier said than done. We’ve all seen that seductive sector that just keeps going up…and up… and up… coaxing in more and more unwitting investors along the way. At its peak, even the most strident skeptics concede that sky-high prices are the new industry norm.

And then…POP!

In an effort to avoid such unpleasant situations, here are two rules to help you detect bubbles well before they harm your wallet.

Rule #1: Watch the Sectors

We use the Casey Research Bubble Monitor to sniff out bubbles as they inflate. Essentially, it compares the size of each S&P 500 sector against the others, and we observe the change over time. It’s a simple concept with powerful results. Take a look:

The Casey Research Bubble Monitor

The swells and pinches illustrate the various sectors growing or shrinking in relation to one another.

Bubbles are easy to spot – during each, the offending sector expands and encroaches upon the others.

At their peaks, the energy, tech, and financial bubbles all claimed an unsustainably large chunk of the S&P 500. Cue the Bubble.

Our monitor is based on the assertion that no one sector should comprise much more than 20% of a large, diverse economy – and the US economy is as large and diverse as they come.

A case in point: Tech, at its August 2000 peak, comprised 35% of the S&P 500. Predictably, it plummeted to just 15% in the ensuing years.

Indeed, whenever a sector strays too far too quickly from its long-term average, it always gets knocked back into line. The energy and tech bubbles ended with blow off tops, and crashed soon after. The financial bubble persisted longer, but also popped in epic fashion.

Today, the US economy is mostly well balanced. My only concern is that tech is beginning to look a little frothy, as it has climbed above the important 20% threshold in recent months. We’ll be keeping a close watch on this situation, and if it starts to look seriously bubbly, will issue an early warning in The Casey Report.

Rule #2: Beware the phrase “This Time is Different”

A bubble begins with a paradigm shift – a totally new way of doing business that forever alters an industry’s landscape. It destroys old opportunities and ushers in new ones. That creative destruction is the lifeblood of any healthy economy. But paradigm shifts also have a dark side – they are oft used as justification for why bubbles are not really bubbles.

Think the mass adoption of the internet in the late 1990s. An endless world of possibilities opened up overnight, and investors assumed that all companies connected to this phenomenon would rake in the dough. Stock prices soared as investors anticipated wild profits. The potential seemed limitless.

You know how that story ends.

We now look back at those 2000-ers with puzzlement. How did they not see the bubble? Did they not notice the chart of every dot-com company going parabolic?

Of course they did. But they rationalized it away with the paradigm shift: “Stock prices are booming because there’s an entirely new industry! This isn’t a bubble, because these high prices are actually justified!

Or, in other words, “This time is different.”

Famous last words. In a free(ish) economy, profits can explode temporarily when a new industry is born. But those swollen profits are quickly eroded by entrepreneurs entering the field. They find new, better, and cheaper ways to do things, then lower product prices to compete with each other. Before long, profit margins plummet toward equilibrium with all other industries. And sky-high stock prices can’t persist without sky-high profit margins.

Don’t join the lemmings in rationalizing ridiculous prices. Sky-high prices = bubble. And all bubbles end the same – with a pop.

Further Reading

So we can spot when individual sectors are overvalued. But how do we know if the stock market as a whole is over- or under-valued?

If that critical question piques your curiosity, I recommend a bit of educational reading in the form of Stocks vs. Bonds, a free report by Bud Conrad, Chief Economist of Casey Research. In it, Bud employs three highly accurate indicators to determine whether US stocks are expensive, cheap, or reasonably priced.

Without spoiling his conclusion, all three indicators strongly point in the same direction today – a fact you’ll want to consider when deciding where to invest your money for the rest of 2012 and into 2013.

Tuesday, September 25, 2012

I Am A Proud Texan!!!!!!!!!!!

America's Fattest Cities

How overweight is your city?Research By Jaclyn Colletti and Maria Masters

Go to Google Maps, type in "United States," and you'll be reminded of just how big Texas is. But what you can't see is the size of the state's citizenry: Five Lone Star cities are among the nation's fattest, with Corpulent Christi at the top.

Go to Google Maps, type in "United States," and you'll be reminded of just how big Texas is. But what you can't see is the size of the state's citizenry: Five Lone Star cities are among the nation's fattest, with Corpulent Christi at the top. To arrive at our rankings, we calculated the percentage of people who are overweight, the percentage with type 2 diabetes, the percentage who haven't left the couch in a month (CDC Behavioral Risk Factor Surveillance System); the money spent on junk food (Bureau of Labor Statistics); and finally, the number of people who ate fast food nine or more times in a month (Mediamark Research).

Now for the good news: The folks at The Biggest Loser have decided to help Texas lose its tonnage. Tune in and watch America's second-largest state shrink before your eyes.

RANK

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

29

30

31

32

33

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

29

30

31

32

33

CITY

Corpus Christi, TX

Charleston, WV

El Paso, TX

Dallas, TX

Memphis, TN

Kansas City, MO

San Antonio, TX

Baltimore, MD

Houston, TX

Birmingham, AL

Durham, NC

Jacksonville, FL

Lubbock, TX

Buffalo, NY

Philadelphia, PA

Riverside, CA

Oklahoma City, OK

New Orleans, LA

Jersey City, NJ

Las Vegas, NV

Wichita, KS

Chicago, IL

Fort Wayne, IN

Indianapolis, IN

Lexington, KY

Billings, MT

Detroit, MI

Montgomery, AL

Toledo, OH

Fresno, CA

Tulsa, OK

Orlando, FL

Fargo, ND

Corpus Christi, TX

Charleston, WV

El Paso, TX

Dallas, TX

Memphis, TN

Kansas City, MO

San Antonio, TX

Baltimore, MD

Houston, TX

Birmingham, AL

Durham, NC

Jacksonville, FL

Lubbock, TX

Buffalo, NY

Philadelphia, PA

Riverside, CA

Oklahoma City, OK

New Orleans, LA

Jersey City, NJ

Las Vegas, NV

Wichita, KS

Chicago, IL

Fort Wayne, IN

Indianapolis, IN

Lexington, KY

Billings, MT

Detroit, MI

Montgomery, AL

Toledo, OH

Fresno, CA

Tulsa, OK

Orlando, FL

Fargo, ND

GRADE

F

F

F

F

F

F

F

F

D-

D-

D-

D-

D-

D

D

D

D

D

D

D

D

D+

D+

D+

D+

D+

D+

D+

D+

D+

D+

D+

C-

F

F

F

F

F

F

F

F

D-

D-

D-

D-

D-

D

D

D

D

D

D

D

D

D+

D+

D+

D+

D+

D+

D+

D+

D+

D+

D+

C-

RANK

34

35

36

37

38

39

40

41

42

43

44

45

46

47

48

49

50

51

52

53

54

55

56

57

58

59

60

61

62

63

64

65

66

34

35

36

37

38

39

40

41

42

43

44

45

46

47

48

49

50

51

52

53

54

55

56

57

58

59

60

61

62

63

64

65

66

CITY

Milwaukee, WI

Anchorage, AK

Tampa, FL

Jackson, MS

Columbia, SC

Des Moines, IA

Cheyenne, WY

Madison, WI

Newark, NJ

Bakersfield, CA

Pittsburgh, PA

Richmond, VA

Los Angeles, CA

Raleigh, NC

Modesto, CA

St. Louis, MO

Sacramento, CA

Louisville, KY

Boston, MA

Virginia Beach, VA

Arlington, TX

Grand Rapids, MI

Providence, RI

Nashville, TN

Spokane, WA

Sioux Falls, SD

Omaha, NE

St. Petersburg, FL

San Diego, CA

Columbus, OH

Tucson, AZ

Little Rock, AR

Fort Worth, TX

Milwaukee, WI

Anchorage, AK

Tampa, FL

Jackson, MS

Columbia, SC

Des Moines, IA

Cheyenne, WY

Madison, WI

Newark, NJ

Bakersfield, CA

Pittsburgh, PA

Richmond, VA

Los Angeles, CA

Raleigh, NC

Modesto, CA

St. Louis, MO

Sacramento, CA

Louisville, KY

Boston, MA

Virginia Beach, VA

Arlington, TX

Grand Rapids, MI

Providence, RI

Nashville, TN

Spokane, WA

Sioux Falls, SD

Omaha, NE

St. Petersburg, FL

San Diego, CA

Columbus, OH

Tucson, AZ

Little Rock, AR

Fort Worth, TX

GRADE

C-

C-

C-

C-

C-

C-

C-

C-

C-

C

C

C

C

C

C

C

C

C

C

C+

C+

C+

C+

C+

C+

C+

C+

C+

C+

C+

C+

B-

B-

C-

C-

C-

C-

C-

C-

C-

C-

C-

C

C

C

C

C

C

C

C

C

C

C+

C+

C+

C+

C+

C+

C+

C+

C+

C+

C+

C+

B-

B-

RANK

67

68

69

70

71

72

73

74

75

76

77

78

79

80

81

82

83

84

85

86

87

88

89

90

91

92

93

94

95

96

97

98

99

100

67

68

69

70

71

72

73

74

75

76

77

78

79

80

81

82

83

84

85

86

87

88

89

90

91

92

93

94

95

96

97

98

99

100

CITY

Lincoln, NE

Phoenix, AZ

Miami, FL

Greensboro, NC

Manchester, NH

Portland, ME

Rochester, NY

Charlotte, NC

New York, NY

Boise, ID

Cleveland, OH

Anaheim, CA

Yonkers, NY

San Jose, CA

Reno, NV

Atlanta, GA

Wilmington, DE

Hartford, CT

Salt Lake City, UT

Colorado Springs, CO

St. Paul, MN

Minneapolis, MN

Oakland, CA

Honolulu, HI

Aurora, CO

Denver, CO

Cincinnati, OH

Portland, OR

Albuquerque, NM

Austin, TX

Seattle, WA

Washington, DC

Burlington, VT

San Francisco, CA

Lincoln, NE

Phoenix, AZ

Miami, FL

Greensboro, NC

Manchester, NH

Portland, ME

Rochester, NY

Charlotte, NC

New York, NY

Boise, ID

Cleveland, OH

Anaheim, CA

Yonkers, NY

San Jose, CA

Reno, NV

Atlanta, GA

Wilmington, DE

Hartford, CT

Salt Lake City, UT

Colorado Springs, CO

St. Paul, MN

Minneapolis, MN

Oakland, CA

Honolulu, HI

Aurora, CO

Denver, CO

Cincinnati, OH

Portland, OR

Albuquerque, NM

Austin, TX

Seattle, WA

Washington, DC

Burlington, VT

San Francisco, CA

GRADE

B-

B-

B-

B-

B-

B-

B-

B-

B-

B

B

B

B

B

B

B

B

B+

B+

B+

B+

B+

B+

B+

B+

A-

A_

A_

A-

A

A

A

A+

A+

B-

B-

B-

B-

B-

B-

B-

B-

B-

B

B

B

B

B

B

B

B

B+

B+

B+

B+

B+

B+

B+

B+

A-

A_

A_

A-

A

A

A

A+

A+

You have to give Texas legislators credit: They're trying to fight the state's weight problem with a bill requiring chain restaurants to list nutrition information, including calorie counts, on their menus. Yale University researchers recently found that this dietary disclosure prompted people to order meals with nearly 15 percent fewer calories. "People may have ordered less because many of the numbers are shocking, with most appetizers containing half a day's worth of calories," says study author Christina Roberto, M.S. Go to menulabeling.org to see if your politicians are pushing for greater nutritional transparency.

Take Steps

It may not feel like "exercise," but walking does burn calories; plus, the only gear you need is a pedometer, a notepad, and a pen. In a recent British study, men who wore pedometers and then wrote down their total steps at the end of each day walked 11 percent more than those who didn't put pen to paper. "Recording your steps motivates you to beat your level of activity from the previous day," says study coauthor Stacy Clemes, Ph.D.

www.menshealth.com/fattestcities2010/

Euro Is In Charge

The market starting stalling/selling off on the 17th. The Euro started selling off on the 17th. The Euro is flagging out in a descending channel right now, from which nice powerful moves can occur… I'd expect if this rally continues it happens when this Euro wakes up.

Monday, September 24, 2012

Think There Might Be A Market For Home Use!

Chinese hospitals are introducing a new machine which can extract sperm for donors.

According to China’s Weibo social platform the automatic sperm extractors are being introduced in a Nanjing hospital, capital of Jiangsu province.

The pink, grey and white machine has a massage pipe at the front which apparently can be adjusted according to the height of its user. . . .

Read more: http://www.dailymail.co.uk/news/article-2206613/Chinese-hospitals-introduce-hands-free-automatic-sperm-extractor-donors-play-videos-help.html#ixzz27NFRHsk4

Sunday, September 23, 2012

Subscribe to:

Posts (Atom)