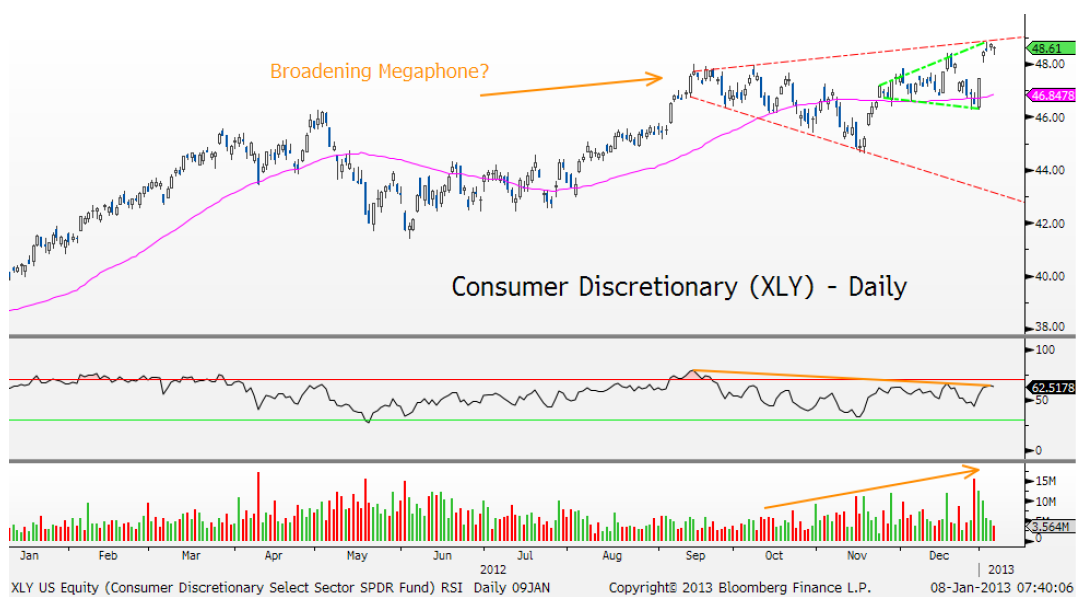

Written by JC Parets for All Star Charts 1/8/2013. Looks pretty bearish to me, especially heading into earnings season. I've had pretty good luck trading these bearish megaphone formations in the past by going about it this way: when you do see 5 very clearly defined expanding pivot points, each outside the other, you can trade the last one with a tight stop by going short when it finally does close below the low of the high day.

It’s possible that the consumer discretionary sector might be slowing down after its monster 200+% run from the 2009 lows. Technician Jonathan Krinsky of Miller Tabak has a note out this morning pointing to the broadening formation in the $XLY that normally indicates indecision between the bulls and the bears. These rare patterns histrionically show up near turning points, so I think it’s important to recognize it’s arrival in this space.

From Krinsky:

The consumer discretionary ETF, the XLY, has been making higher highs since mid-September. At the same time, however, it has been making lower lows. The result is a very rare, but potentially bearish broadening triangle, or megaphone pattern.This type of pattern indicates violent indecision between the Bulls and Bears. Notice the volume has picked up throughout the pattern as well. What is especially interesting is that within the bigger megaphone in place since September, there is a smaller one that has been forming since November.There are other warning signs as well. On the most recent highs made on January 3rd, RSI vs. the September peak made a lower high (middle pane). Relative strength vs. the SPY also made a lower high vs. November.

Krinsky compares this action in the discretionaries to what the Nasdaq100 looked like back in 2011. The broadening formation that appeared in the $NDX preceded a 16.5% decline in the tech heavy index.:

Something to be aware of…

No comments:

Post a Comment