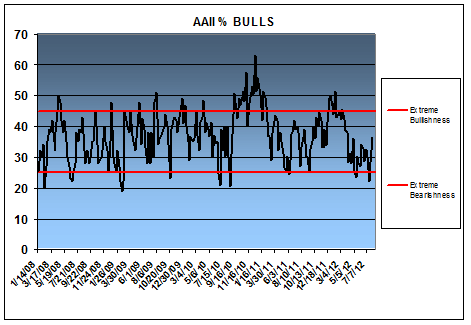

The percentage of AAII members describing themselves as bullish topped those describing themselves as bearish for the first time sinceMay 3, 2012, according to the latest AAII Sentiment Survey.

Bullish sentiment, expectations that stock prices will rise over the next six months, jumped 6.0 percentage points to 36.5%. This is the highest level of optimism registered by the survey since April 5, 2012. Even with the increase, bullish sentiment is below its historical average of 39% for the 19th consecutive week.

Neutral sentiment, expectations that stock prices will stay essentially unchanged over the next six months, rose 1.5 percentage points to 36.2%. This is the highest neutral sentiment has been since December 22, 2011. It is also the fifth time in six weeks that neutral sentiment has been above its historical average of 31%.

Bearish sentiment, expectations that stock prices will fall over the next six months, plunged 7.6 percentage points to 27.4%. Pessimism was last lower on March 29, 2012. This is the first time in 14 weeks and just the second time in 18 weeks that bearish sentiment is below its historical average of 30%.

The ongoing rise in stock prices is giving some AAII members hope about the short-term direction of stock prices and is curtailing short-term fears for others. The optimism is cautious, however, as concerns about slowing global economic growth, Washington politics, the European sovereign debt crisis and further market volatility remain very much front and center. The ongoing streak of below average bullish sentiment is the longest since a 29-week period between April 2, 1993, and October 15, 1993.

This week’s special question asked AAII members whether the recent statements by European Central Bank President Mario Draghi, including his intent to do whatever it takes to preserve the euro, have impacted their sentiment. Slightly more than half of respondents said Draghi’s words have not impacted their sentiment. Many of these individual investors perceive Draghi as simply adding to the ongoing chatter, instead of offering a solution. A sizeable minority said Draghi’s comments have made them more optimistic. A smaller minority said they have become more pessimistic.

Here is a sampling of the responses:

- “Draghi’s comments—like an elevator’s close button or Congress—are there, but are of no use.”

- “Draghi has made me even more suspect about the depth of European leaders’ willingness to admit the severity of their financial situation.”

- “He is managing the perception of certain investors, but needs to bring action before he changes my feelings.”

- “They had a positive impact on my sentiment, but I want to see what European leaders actually do before committing additional funds to the international market.”

- “It makes me feel the ECB will be proactive in saving the euro.”

- “I’m even more bearish now. More talk, less action means the day of reckoning is yet to come.”

This week’s AAII Sentiment Survey Results

- Bullish: 36.5%, up 6.0 percentage points

- Neutral: 36.2%, up 1.5 percentage points

- Bearish: 27.4%, down 7.6 percentage points

Historical averages:

- Bullish: 39%

- Neutral: 31%

- Bearish: 30%

The AAII Sentiment Survey has been conducted weekly since July 1987 and asks AAII members whether they think stock prices will rise, remain essentially flat or fall over the next six months. The survey period runs from Thursday (12:01 a.m.) to Wednesday (11:59 p.m.). The survey and its results are available online at: http://www.aaii.com/sentimentsurvey.

No comments:

Post a Comment