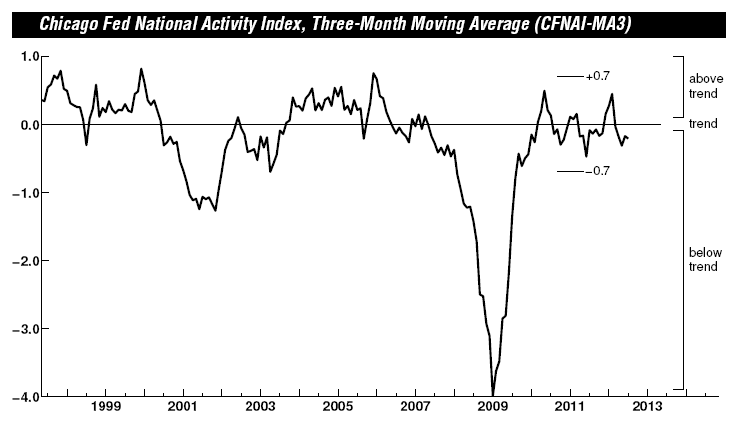

On Monday, the Chicago Fed National Activity Index (CFNAI) was released at -0.13, a slight disappointment from the consensus -0.05. With revisions made to the past months data, the 3 Month Moving Average marks at -0.21. According to the Chicago Federal Reserve, a 3-Month moving average of the index below -0.70 suggests that the U.S. economy

is in the midst of recession.

The CFNAI plummeted in May to -.45 from 0.14 of January this year. Although the negative index for the past months corresponds to growth below trend, we are hesitant to conclude a decline in national economic activities. Since the CFNAI hit rock bottom for this year in May, national economic activities have slightly rebounded, especially in July as backed by the positive showings in Housing Activities, Consumer Sentiment, and the Leading Economic Indicators.

As mentioned before, the data is not suggesting that we are headed for a recession. However, the data may be illustrating that the economy is experiencing lackluster growth. Especially with a gradual increase in Consumer spending that accounts for 70% of the GDP, and other economic activities, it appears that the economy is on stable, albeit weak footing for now.

No comments:

Post a Comment