Platinum charts are “on the edge of the cliff” for a $130 per oz. drop and possibly a $250 drubbing

Before I jump into my analysis I want to ramble about two points.

First, as many of you have noted I do not blog much anymore. This is exactly what I stated months ago that I would do. Not blogging is easier for me — it also gets rid of the riff raff from my blog site. If I blog frequently I get as many as eight times more visitors to any given blog post. Most of these additional visitors are curiosity seekers or tourists looking for a magic pill. The numeric relationship between regular readers and pedestrian traffic is consistent with the known fact that 9 out of 10 traders leave poorer for the experience as they seek for guru after guru. I stopped frequent blogging because I became tired of tossing pearls to swine (most likely not you if you are a semi-regular reader). To those of you readers who regular check this blog so that you can remind me later of my miscues I would only say to you, “oink, oink.”

Second, as I have said so many times before, a viewpoint is not a position for me. I have viewpoints on the markets all the time — sometimes my viewpoint on a given market may change during the course of a week. Most fiddle dee dee market observers do not have the first clue about trading. They consider the changing of one’s mind to be a sign of weakness. They are, for the most part, trading wanna bees. I view changing of one’s mind as a necesary part of the gorilla war fare calling speculation.

In reality, while I have thousands of market viewpoints during the course of the year on the markets. I follow (about 40 futures and forex pairs) so I only get about five signals per month, or 60 or so trades per year. Do the math, 40 markets represent more than 12,000 markets days (counting Sunday night hours). Yet, there is a one in 200 chance that I may be taking a trade in a given market on a given trading trading day .

This discrepancy between market opinion and actual trading is due to the fact that my standards for actual trading actions are much more precise and demanding than my standards for having a market opinion. For those pedestrian traders among you, this means that my comment one way or anther on a given market may have no correlation to my trading portfolio.

On to Platinum! — finally you say.

This is a market where harmony of opinion to portfolio may occur. Platinum is set to offer me one of my 60 trading signals in 2012. It has already provided me with one signal (a short in April). Two signals in the same year — wow, this is more excitement than I can handle as a medicare patient.

Here is what I see in Platinum.

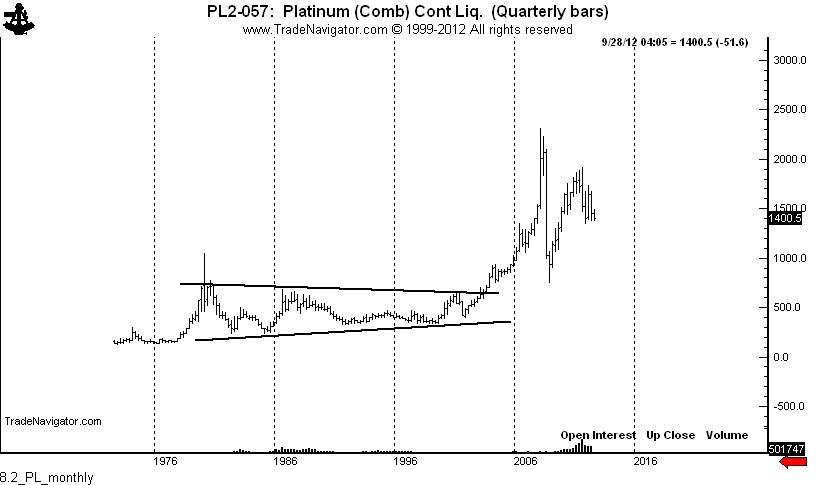

The quarterly graph shows that Platinum is in a broad trading range defined by the 2008 high and low. This trading range could contain the market for years to come — meaning that on yearly basis there is NO trend in Platinum. Note the massive symmetrical bottom completed in late 2003. Yet, there are still market fools who claim that long-term charts represent random price behavior . I don’t get it.

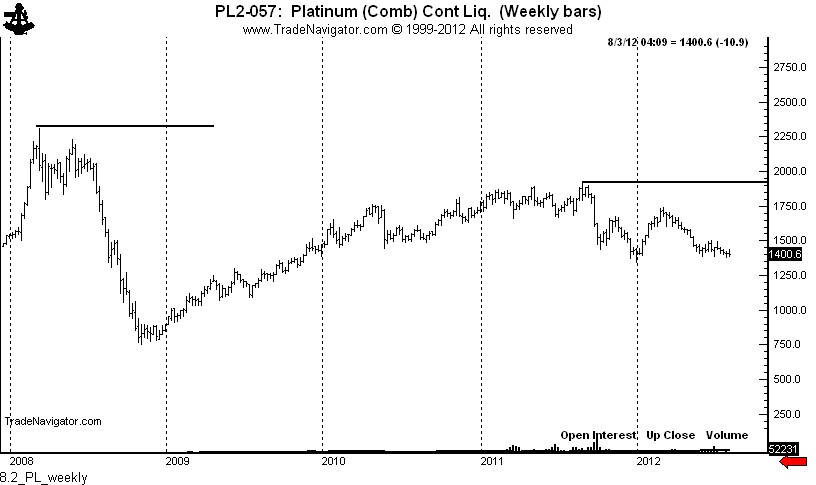

The weekly graph shows that Platinum has been the far weakest precious metal in recent years, topping in 2008 compared to an 2011 top in Silver and a September 2011 top in Gold. It is always my preference to be short the weakest member of a market category, when short the category, and long the strongest member of a category, when long the category.

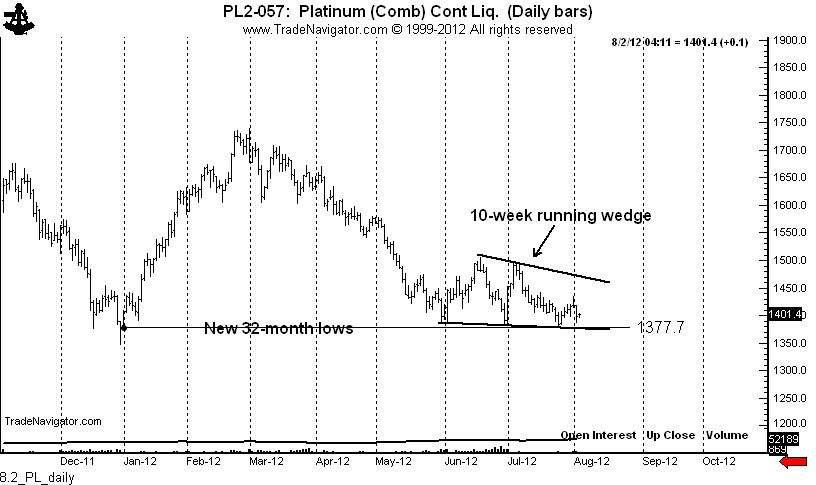

The daily chart shows the importance of the 1365 to 1375 zone. I consider the December 29 close to be the important price point — the low that day was simply a “wash-out” event. Closing prices are ALWAYS more important than intra-day highs and lows.

Also, the market has formed a 10-week running wedge. I far prefer running wedges to reversal wedges because their downside completion is accompanied by a new low, not simply a boundary penetration. In this case the wedge completion would solidify a 2-1/2 year bear trend.

Thus, I will take a close below 1375 as an official sell signal. There is always a caveat — a close below 1375 followed quickly by an “end around” would totally negate my analysis.

No comments:

Post a Comment