Stressed Out China

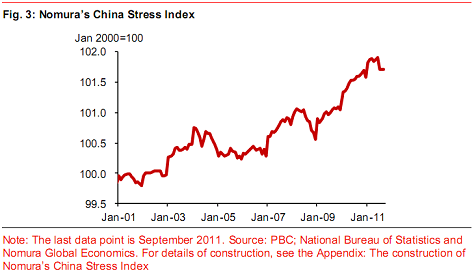

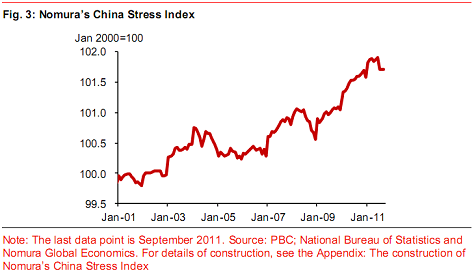

“The CSI indicates that risks in China‟s macro economy have been on a broad uptrend, and more noticeably since the global financial crisis. In Q2 2011, the CSI rose to its highest level since it was first compiled, but in Q3 it eased slightly, mainly because of a decline in the flow of new shadow banking funding (Figure 3). One limitation of the CSI is that it does not give a probability of a hard economic landing. To do so would require a reference variable measuring past episodes of hard economic landings in China, the obvious one being real GDP. Yet in the past 20 years China’s GDP growth has not fallen below 5% and before then the causes of hard landings in GDP were influenced heavily by social and political unrest.”

“The CSI indicates that risks in China‟s macro economy have been on a broad uptrend, and more noticeably since the global financial crisis. In Q2 2011, the CSI rose to its highest level since it was first compiled, but in Q3 it eased slightly, mainly because of a decline in the flow of new shadow banking funding (Figure 3). One limitation of the CSI is that it does not give a probability of a hard economic landing. To do so would require a reference variable measuring past episodes of hard economic landings in China, the obvious one being real GDP. Yet in the past 20 years China’s GDP growth has not fallen below 5% and before then the causes of hard landings in GDP were influenced heavily by social and political unrest.”

“A closer look at the components reveals that rapid increases in residential housing starts relative to sales,residential property prices, gross capital formation, property loans and domestic credit have been the main recent drivers. We are under no illusions that the CSI has its limitations and needs to be treated with caution. The results of the CSI, which we will update on a quarterly basis, should always be open to interpretation, and used as a tool among many others for analysis of China macro risks.”

http://pragcap.com/nomura-china-stress-index-is-on-the-rise

No comments:

Post a Comment