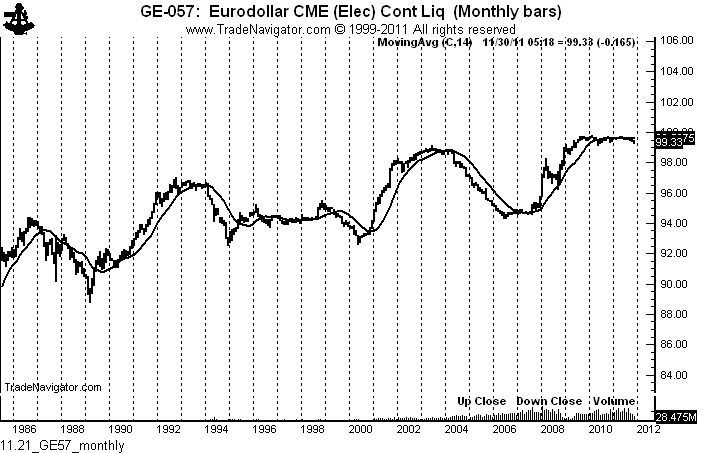

The Eurodollars do not change trend very often. We are on the verge of a new trend – the first downtrend since 2004.

Eurodollar futures have been one of my most favorite markets to trade over the years. The Eurodollar market reflects the interest rate on U.S. Dollars owned and deposited overseas. The market is priced at 100 minus the interest rate. So, if the interest rate is 1%, the price will be 99.00, 2% will be 98.00 and so on.

Eurodollars are among the most actively traded of all futures contracts, rivaling S&Ps and Crude Oil in volume. The Eurodollar market is unbelievably liquid. The value between minimum ticks (1/2 point) is $12.50 and the bid and offers are tight and sizable. Eurodollars cannot trade above 100.

When Eurodollars trend, they really trend. It is one of the best trending of all futures contracts. For example, using a very long-duration moving average of 65-weeks (325 days), there have been only six directional changes in the moving average since 1982 (excluding a period of interest rate uncertainty in the late 1990s). That is an average of a trend change every five years. To be more specific, the long-term moving averages have turned down only four times in 30 years.

No comments:

Post a Comment