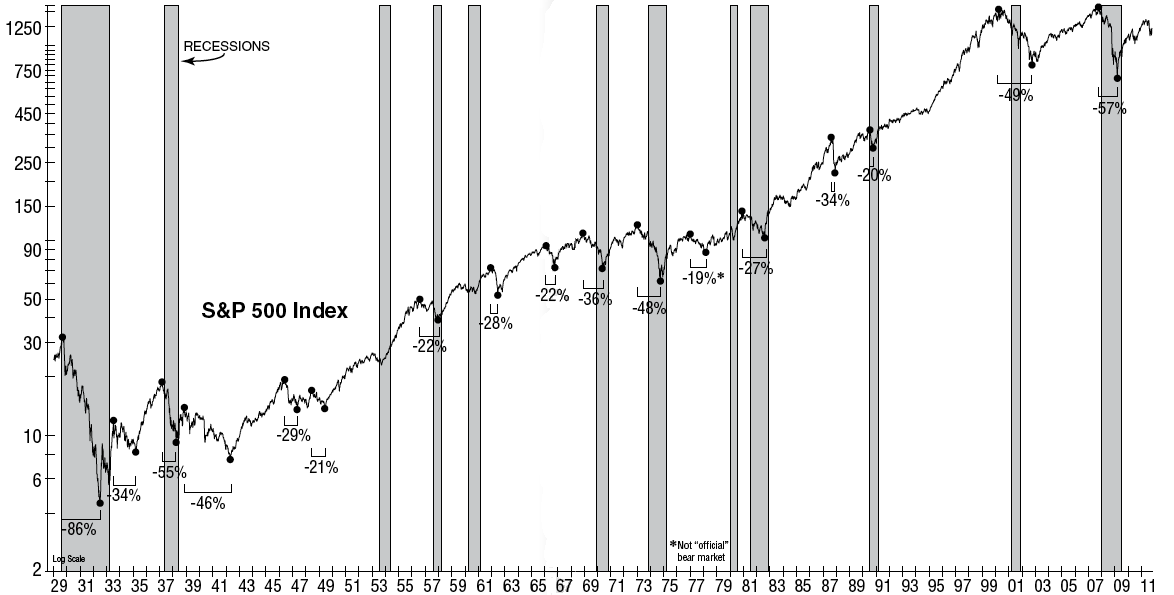

James Stack of InvesTech Research looks at past bear markets and recessions going back more than 82 years. The details of his findings?

• Generational bear markets, with losses exceeding 40% are the exception, not the norm. Since 1940, only one in four bear markets reached such a loss.

• The 2000-02 bear market was so severe because of record overvaluation extremes at the start, and the washout of the high-tech bubble with a -78% loss in the Nasdaq (of which many of the largest stocks were also components of the S&P 500).

• Unweighted indexes declined only ~25% in the 2000-02 bear market;

• The 2007-09 bear market was extreme because the collapse suddenly exposed all of themortgage derivatives on the balance sheets of major banks. The extent of this exposure was not well known — even to CEOs of the banks.

• Bear markets without recessions are more of a rarity. Since 1940, when they have occurred, the declines are usually milder. The 1987 Crash, with a loss of -34% was the exception; but ’87 was triggered in a monetary climate whereinterest rates were soaring and the U.S. dollar was tumbling.

• Average valuation, as measured by the P/E ratio of the S&P 500 Index, at the start of all the bear markets exceeding 30% was 21.8. Today, the P/E ratio of the S&P equals 14.7.

One thought on this: The fear of another giant bear market — of another 50% loss — is likely due to the recency effect and the aftermath of 2007-09 as much anything else.

No comments:

Post a Comment