World’s most liquid and actively traded futures market may be attempting a turn in trend

Sooner or later!!!!! The U.S. cannot employ a Zero Interest Rate Policy forever. I will not even attempt to delve into the macro economic fundamentals and politics of U.S. interest rates. I will simply share some charts and present some possibilities (as a trader, I deal with possibilities, not probabilities).

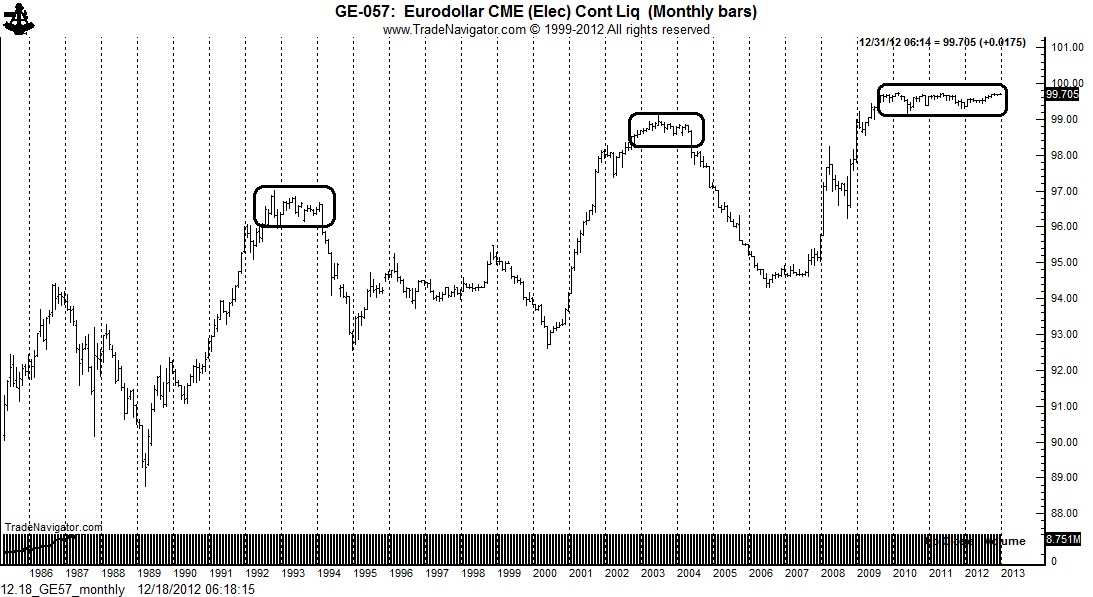

The monthly chart of Eurodollars (this is not the forex market — the Eurodollar market represents interest paid on U.S. Dollars held abroad) is a study in yo-yo behavior. The history of the market has been a series of big bull runs followed by two or more years of topping followed by big bear moves.

The current topping action has been going on for 3-1/2 years, representing the soon-to-be-doomed attempts of Uncle Bennie and Little Timmy to manipulate U.S. rates.

Who knows, the Timmy and Bennie should could go on for several more years. But eventually the Austrians win. Hurrah Austria! And when the Austrians win, the Euros go down and go down big — back to at least 96.00 (4%). Ya, ya, ya, all you “modern economic theory” gurus will tell me that interest rates can stay at near zero forever. We’ll see!

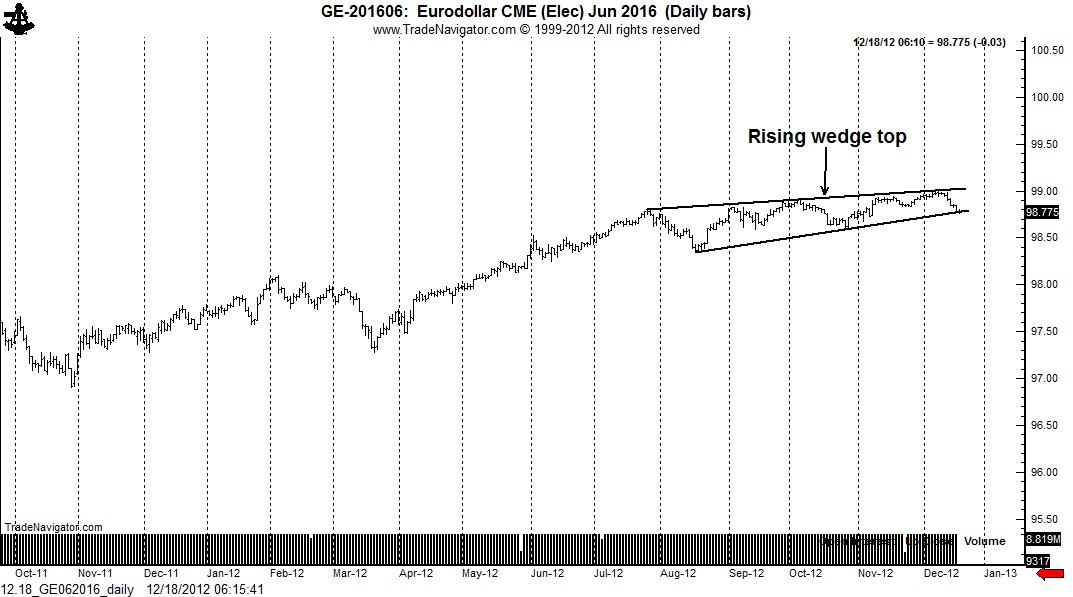

The daily charts are showing signs of a turn. The Dec. 2016 chart displays a potential rising wedge top.

It is doubtful that this pattern will be the top in and of itself. But, it could become part of the top. Priced at 1.22% yield, this chart indicates an initial move to 2% yield. How and when the futures contracts decline remains to be seen. But there is a chance that the absolute high is in place in the distant contract months.

No comments:

Post a Comment