H&S bottom provides opportunity for generational bottom

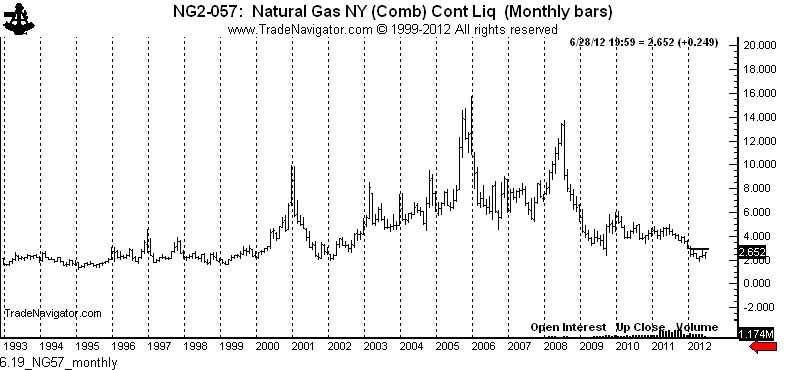

At long last, a bottom may be in sight. The Natural Gas market has been in a cyclic bear trend since late 2005, as seen on the monthly chart below. I believe strongly that the low at 1.902 will not be seen again in my trading lifetime.

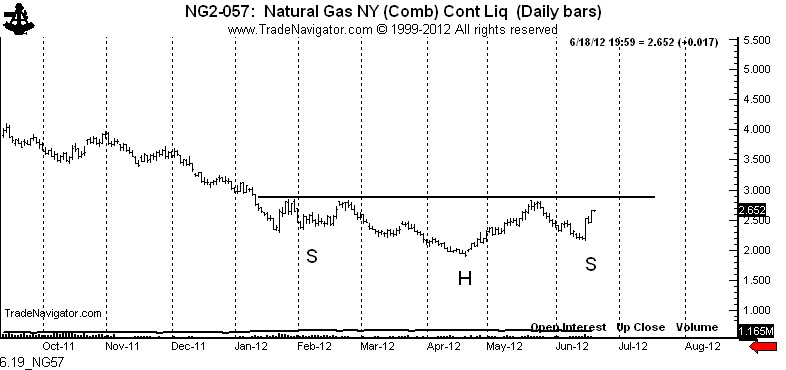

The continuation daily chart displays a classic H&S bottom. If this interpretation is correct the June low may serve as the right shoulder low.

This market is for long-term position traders willing to be long distant futures contracts at current levels without a stop order. Should the market slip back to 2.000 it would be an opportunity to add to long positions. Natural Gas should be viewed as a multi-year trade.

From a trading standpoint I am willing to extend leverage if the H&S bottom is completed on a closing basis. Shorter-term traders should wait for a retest of the June low or a completion of the H&S before taking a position.

The alternatives to play this market include owning distant futures (such as the February 2013 contract) or Natural Gas producers. I do NOT want anything to do with UNG or especially with the ultra long ETFs. In fact, I am willing to short the ultras on strong rallies.

No comments:

Post a Comment