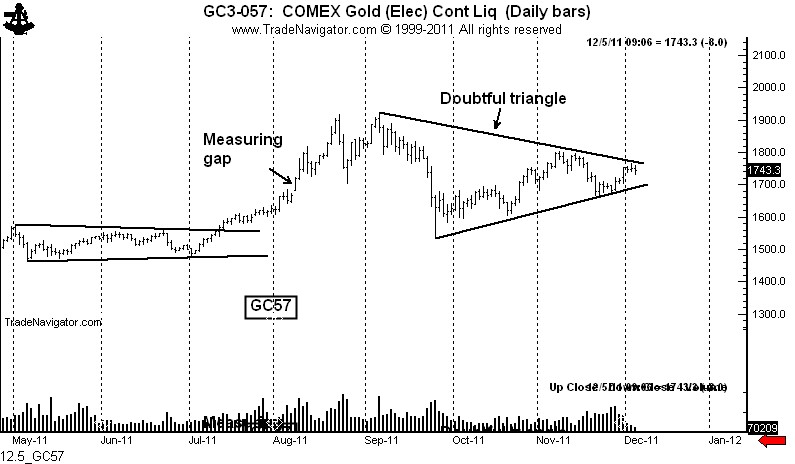

I quote from Edwards and Magee (Technical Analysis of Stock Trends):

“The further out into the apex of the Triangle prices push without bursting its boundaries, the less force or power the pattern seems to have. Instead of building up more pressure, it begins to lose its efficacy after a certain stage. The best moves (up or down) seem to ensue when prices break out decisively at a point somewhere between half and three quarters of the horizontal distance from the base (left-hand end) to the apex.”

While I could envision myself attempting to buy or sell the breakout, I would will use extreme caution, especially if prices move further into the apex and break out to the downside. Again, Edwards and Magee:

“…if the break occurs after prices have worked their way well out into the apex of a Triangle; a high volume crach then frequently — we might even say usually — develops into a two or three day ‘shake-out’ which quickly reverses itself and is followed by a genuine move in the up direction.”

The Gold market has already moved past the 75% point of this triangle. Thus, if you are a bull, the best set up for you would be a false breakout with high volume to the downside followed buy a move back up.

No comments:

Post a Comment