In recent weeks I have expressed an extremely bearish technical perspective on the U.S. stock market. Then yesterday I posted a possible bearish interpretation on the U.S. Dollar.

Apparently I stepped into something brown and sticky. I have received comments that the U.S. stock market and the U.S. Dollar have a strong inverse correlation — thus how can a bear case be made for both at the same time?

Yesterday my good friend, a fellow blogger and an excellent technician, Bob Sinn (http://bit.ly/nE7mVm or www.robertsinn.com) thought the subject could make interesting fodder. I agree. Bob and I have very constructively gone back and forth on various trading subjects in the past. I think we both (and our readers) gain from such dialog.

How can stocks and the greenback both go down? Here is my thoughts on the subject. I am looking forward to Bob’s response.

1. The idea that the two markets are polar opposites is current conventional wisdom. I don’t trust conventional wisdom.

2. I believe all markets must be traded on the merits of their own charts. I am not able to place an order for the U.S. Dollar in the S&P pit. I trade price and price alone. All the time I hear how one market cannot do such and such because another market is doing such and such.

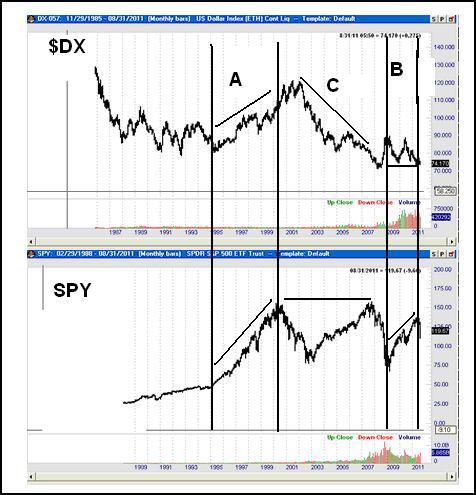

3. High inverse (or positive) correlations between two different markets do not last forever. The chart below stacks the U.S. Dollar ($DX_F, $DX) and $SPY charts. Note periods when both markets advanced (A), when the US$ dropped, but $SPY ended up going sideways (C) and when $SPYadvanced, but US$ chopped sideways (B).

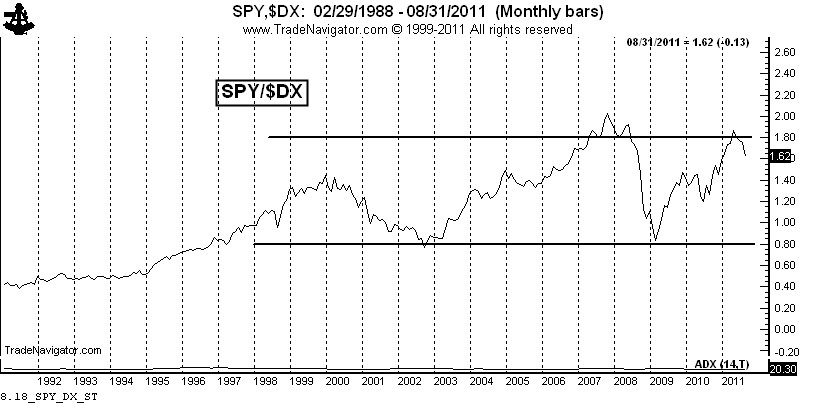

The next chart is $SPY expressed in terms of the U.S. Dollar Index price ($SPY divided by $DX). In the past 13 years $SPY has ranged from two times the price of $DX to 80 percent of the price of$DX. This is not high correlation in my mind.

4. The marketplace finds all kinds of reasons why two markets must go in different directions. And for long periods of time the inverse correlation may exist. But my experience is that when a certain correlation ends, it ends big time. And most often, the reasons for the change do not become known for a long period of time.

http://peterlbrandt.com/the-us-and-u-s-stock-market-both-down-how-is-this-possible/

No comments:

Post a Comment