All Star Charts, April 21st, 2013

US Treasury Bonds aren’t sexy. Trust me, I know. But neither were Staples and Healthcare for a long time right? And now, what’s hotter than a Johnson and Johnson, P&G, or a Coca-Cola? I almost can’t even say that with a straight face. But these are the names getting the attention these days, no question about it.

So when we think about US Treasury Bonds, we should at least give them a chance. With that said, let’s reflect for a minute and think about what just happened over the last 10 months. Last summer the world was ending, Greece was done, Eurozone was splitting up, Fiscal cliffs, debt ceilings, Elections….the media came up with every possible reason why we should sell stocks (see here). Well? We got a monster rally instead. Stocks did great. The more speculative the better actually, until just recently. But forget stocks for a minute. What about bonds? What did US Treasuries do during this 25% move in the S&P500 (30% for the Russell2000 and Mid-Cap 400)?

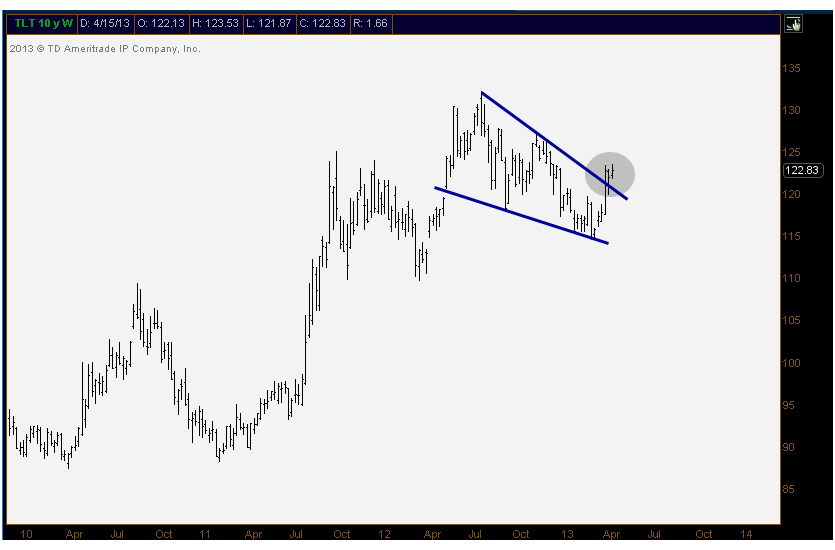

Bonds consolidated nicely. You couldn’t possibly have asked for better action out of this negatively correlated asset class. Here are two ETFs that I think tell the story well. Under market conditions where speculation ruled (in theory), the safe haven held its own. Here is a weekly bar chart of the iShares Barclays 20+ Year Treasury Bond Fund $TLT. Call me crazy, but this looks to me like your standard falling wedge within an ongoing uptrend:

And here is the shorter duration equivalent. $IEF is the iShares Barclays 7-10 Year Treasury Bond Fund. In this case, the upper and lower borders of the consolidation are parallel, forming more of a flag than a wedge, but the consequences are the same.

These look like two continuation patters to me. Obviously the breakouts in each of these have to hold. Last week we suggested that Bond yields were breaking down and this certainly ties in with that. I’m very impressed with the health in Treasury Bonds during this last leg of the US Stock Market rally. So I think to err on the bullish side of bonds right now is warranted. I keep hearing about this secular “Great Rotation” out of bonds and into stocks. I’m sure it gets clicks and sells newspapers. But as always, we’ll look to price action to help us determine what’s rotating and what isn’t.

I’ll do my best to circle back and reevaluate this market again on the blog in a couple of weeks. But right now, it’s hard not to be encouraged by the action in government bonds.

US Treasury Bonds aren’t sexy. Trust me, I know. But neither were Staples and Healthcare for a long time right? And now, what’s hotter than a Johnson and Johnson, P&G, or a Coca-Cola? I almost can’t even say that with a straight face. But these are the names getting the attention these days, no question about it.

So when we think about US Treasury Bonds, we should at least give them a chance. With that said, let’s reflect for a minute and think about what just happened over the last 10 months. Last summer the world was ending, Greece was done, Eurozone was splitting up, Fiscal cliffs, debt ceilings, Elections….the media came up with every possible reason why we should sell stocks (see here). Well? We got a monster rally instead. Stocks did great. The more speculative the better actually, until just recently. But forget stocks for a minute. What about bonds? What did US Treasuries do during this 25% move in the S&P500 (30% for the Russell2000 and Mid-Cap 400)?

Bonds consolidated nicely. You couldn’t possibly have asked for better action out of this negatively correlated asset class. Here are two ETFs that I think tell the story well. Under market conditions where speculation ruled (in theory), the safe haven held its own. Here is a weekly bar chart of the iShares Barclays 20+ Year Treasury Bond Fund $TLT. Call me crazy, but this looks to me like your standard falling wedge within an ongoing uptrend:

And here is the shorter duration equivalent. $IEF is the iShares Barclays 7-10 Year Treasury Bond Fund. In this case, the upper and lower borders of the consolidation are parallel, forming more of a flag than a wedge, but the consequences are the same.

These look like two continuation patters to me. Obviously the breakouts in each of these have to hold. Last week we suggested that Bond yields were breaking down and this certainly ties in with that. I’m very impressed with the health in Treasury Bonds during this last leg of the US Stock Market rally. So I think to err on the bullish side of bonds right now is warranted. I keep hearing about this secular “Great Rotation” out of bonds and into stocks. I’m sure it gets clicks and sells newspapers. But as always, we’ll look to price action to help us determine what’s rotating and what isn’t.

I’ll do my best to circle back and reevaluate this market again on the blog in a couple of weeks. But right now, it’s hard not to be encouraged by the action in government bonds.

No comments:

Post a Comment