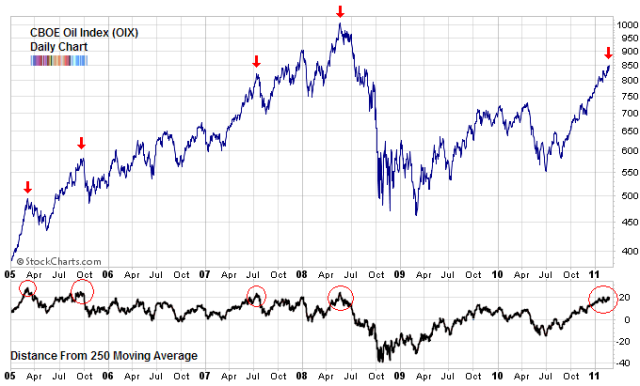

Right now it is 24% above its 250 simple moving average and 20.5% above its 250 exponential moving average. Either this sector enters into a congestion period to rest after the rally or it corrects.

A recent analysis by Bespoke Investment Group arrives at a similar conclusion. They report that there have only been 5 other times that the S&P Energy sector sub-index has managed to rally 40% over the span of 6 months. In those past instances, in the following month, 3 months and 6 months, the average return has been consistently negative.'

http://tradersnarrative.wordpress.com/2011/02/23/wouldnt-a-crude-oil-top-here-astound-everyone/

No comments:

Post a Comment