There are some stocks out there still trending higher – no doubt about it. But with every day that goes by, there are just less and less of them. And that’s not my opinion, that’s just a fact. So today I wanted to take a look at what this divergence has done to everyone’s favorite stock market average: the good ol’ Dow Jones Industrial Average.

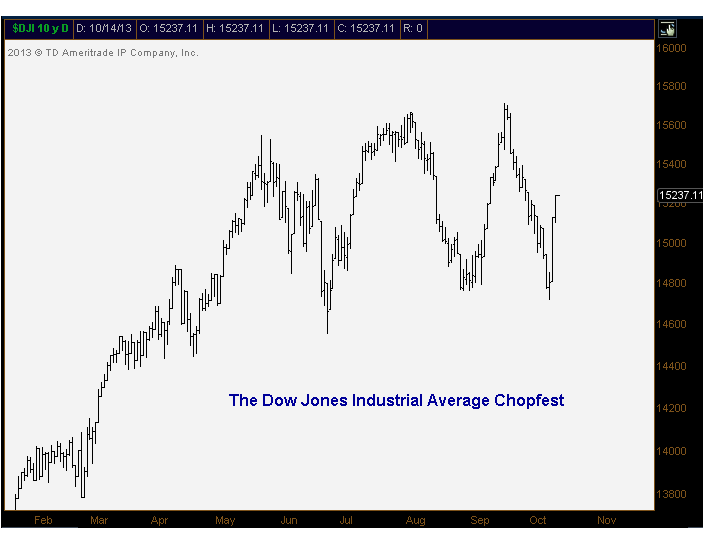

Take a look at this chopfest in the Dow since April. Talk about lack of trends:

I think it’s important to point out that, although most professionals use the S&P500 as their benchmark for US Equities, when someone asks “how the market did today”, the answer you normally hear is “the Dow was up 100″, or “Dow was down 50″. You won’t hear, “S&Ps were down 7 handles”. So from a psychological and sentiment perspective, which is something we take very seriously, the Dow is something that cannot be ignored.

But when you hear at a cocktail party, or read in the paper, how well the stock market has done this year, you have to remember, the Dow Jones Industrial Average has gone pretty much no where over the last 6 months. For a “raging bull market” that doesn’t seem very good.

I personally feel, just by looking at this chart above, that the market is vulnerable bigger picture. In my experience, wide swings like this normally show up at key turning points. This isn’t exactly a characteristic of a strong uptrending market.

Just my two cents…

No comments:

Post a Comment