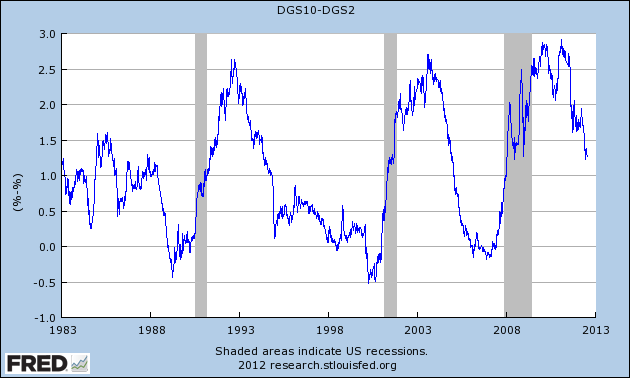

Let’s take a look at the spread between the yield on the 10-year Treasury and the 2-year Treasury — or you if want to sound cool, “2s10s.”

It’s hard to find good indicators that tell us when a recession is coming ahead of time. There are several metrics that perk up when a downturn is near, but they can often give out false alarms. The stock market is perhaps the best example. One of the better indicators is the 2/10 spread. Notice how the spread has gone negative just before the start of the last three recessions.

With the Fed keeping rates near 0%, this metric may have lost its effectiveness. I don’t know for sure. But in deference to its track record, we should note that the spread is still a long way from the danger zone, even though the 10-year yield is at record lows.

Eighteen months ago, the 2/10 spread was over 290 basis points — the highest since at least 1976. As recently as four months ago, it was at 200 basis points. Now the spread is under 130 basis points. In other words, the spread is quickly closing.

No comments:

Post a Comment