Investment and Humor Blog Devoted to Lost Souls Searching For a Home.

Total Pageviews

Saturday, June 13, 2015

Monday, June 8, 2015

Wednesday, June 3, 2015

Monday, June 1, 2015

Sunday, May 31, 2015

Monday, May 25, 2015

Friday, May 22, 2015

Thursday, May 21, 2015

Wednesday, May 20, 2015

Tuesday, May 19, 2015

Wednesday, May 13, 2015

Thursday, April 30, 2015

Monday, April 27, 2015

Sunday, April 19, 2015

Thursday, April 16, 2015

Sunday, April 12, 2015

Saturday, April 11, 2015

Thursday, April 9, 2015

19

Things weren’t perfect, but generally almost everyone in the entire country was able to take care of themselves without government assistance. We worked hard, we played hard, and our seemingly boundless prosperity was the envy of the entire planet. But over the past several decades things have completely changed. We consumed far more wealth than we produced, we shipped millions of good paying jobs overseas, we piled up the biggest mountain of debt in the history of the world, and we kept electing politicians that had absolutely no concern for the long-term future of this nation whatsoever.

So now good jobs are in very short supply, we are drowning in an ocean of red ink, the middle class is rapidly shrinking and dependence on the government is at an all-time high. Even as we stand at the precipice of the next great economic crisis, we continue to make the same mistakes. In the end, all of us are going to pay a very great price for decades of incredibly foolish decisions. Of course a tremendous amount of damage has already been done. The numbers that I am about to share with you are staggering. The following are 19 signs that American families are being economically destroyed…

#1 The poorest 40 percent of all Americans now spend more than 50 percent of their incomes just on food and housing.

#2 For those Americans that don’t own a home, 50 percent of them spend more than a third of their incomes just on rent.

#3 The price of school lunches has risen to the 3 dollar mark at many public schools across the nation.

#4 McDonald’s “Dollar Menu & More” now includes items that cost as much as 5 dollars.

#5 The price of ground beef has doubled since 2009.

#6 In 1986, child care expenses for families with employed mothers used up 6.3 percent of all income. Today, that figure is up to 7.2 percent.

#7 Incomes fell for the bottom 80 percent of all income earners in the United States during the 12 months leading up to June 2014.

#8 At this point, more than 50 percent of all American workers bring home less than $30,000 a year in wages.

#9 After adjusting for inflation, median household income has fallen by nearly $5,000 since 2007.

#10 According to the New York Times, the “typical American household” is now worth 36 percent lessthan it was worth a decade ago.

#11 47 percent of all Americans do not put a single penny out of their paychecks into savings.

#12 One survey found that 62 percent of all Americans are currently living paycheck to paycheck.

#13 According to the U.S. Department of Education, 33 percent of all Americans with student loans are currently behind on their student loan debt repayments.

#14 According to one recent report, 43 million Americans currently have unpaid medical debt on their credit reports.

#15 The rate of homeownership in the U.S. has been declining for seven years in a row, and it is now the lowest that it has been in 20 years.

#16 For each of the past six years, more businesses have closed in the United States than have opened. Prior to 2008, this had never happened before in all of U.S. history.

#17 According to the Census Bureau, 65 percent of all children in the United States are living in a home that receives some form of aid from the federal government.

#18 If you have no debt at all, and you also have 10 dollars in your wallet, that you are wealthier than 25 percent of all Americans.

#19 On top of everything else, the average American must work from January 1st to April 24th just to pay all federal, state and local taxes.

All of us know people that once were doing quite well but that are now just struggling to get by from month to month.

Perhaps this has happened to you.

If you have ever been in that position, you probably remember what it feels like to have people look down on you. Unfortunately, in our society the value that we place on individuals has a tremendous amount to do with how much money they have.

So if you don’t have much money, there are a lot of people out there that will treat you like dirt. The following excerpt comes from a Washington Post article entitled “The poor are treated like criminals everywhere, even at the grocery store“…

Want to see a look of pure hatred? Pull out an EBT card at the grocery store.Now that my kids are grown and gone, my Social Security check is enough to keep me from qualifying for government food benefits. But I remember well when we did qualify for a monthly EBT deposit, a whopping $22 — and that was before Congress cut SNAP benefits in November 2013. Like 70 percent of people receiving SNAP benefits, I couldn’t feed my family on that amount. But I remember the comments from middle-class people, the assumptions about me and my disability and what the poor should and shouldn’t be spending money on.

Have you ever seen this?

Have you ever experienced this yourself?

These days, most people on food stamps are not in that situation because they want to be. Rather, they are victims of our long-term economic collapse.

And this is just the beginning. When the next major economic crisis strikes, the suffering in this country is going to go to unprecedented levels.

As we enter that time, we are going to need a whole lot more love and compassion than we are exhibiting right now.

As a nation, we have made decades of incredibly bad decisions. As a result, we are experiencing bad consequences which are going to become increasingly more severe.

The numbers that I just shared with you are not good. But over the next several years they are going to get a whole lot worse.

Everything that can be shaken will be shaken, and life in America is about to change in a major way.

http://theeconomiccollapseblog.com/archives/19-signs-that-american-families-are-being-economically-destroyed

Wednesday, April 8, 2015

Monday, April 6, 2015

Sunday, April 5, 2015

Saturday, April 4, 2015

Friday, April 3, 2015

Jobs Are Disappering

f you think the jobs market and larger economy are bad now, just wait for the future.

In the future, virtually everyone you know may be on the dole.

There are a lots of projections and scenarios about what to expect as technology advances to practically unimaginable heights.

Already many human jobs are being displaced by computers, and most trends point to a rise of automated assembly lines, computer-run logistics and services and robots to do jobs humans did before that.

China has already ushered in a workforce of robots, with less and less reliance on humans for anything.

What does this mean for the average American?

In a word: dependence.

From The Week:

In the future, virtually everyone you know may be on the dole.

There are a lots of projections and scenarios about what to expect as technology advances to practically unimaginable heights.

Already many human jobs are being displaced by computers, and most trends point to a rise of automated assembly lines, computer-run logistics and services and robots to do jobs humans did before that.

China has already ushered in a workforce of robots, with less and less reliance on humans for anything.

What does this mean for the average American?

In a word: dependence.

From The Week:

The robopocalypse for workers may be inevitable. In this vision of the future, super-smart machines will best humans in pretty much every task. A few of us will own the machines, a few will work a bit — perhaps providing “Made by Man” artisanal goods — while the rest will live off a government-provided income.Silicon-based superintelligence and robots will dramatically alter labor markets — to name but one example, the most common job in most U.S. states probably will no longer be truck driver.The article also discusses the impact that Amazon.com, specifically, is already having on retail business:

Just look at how Amazon is disrupting brick-and-mortar retailing. And even though tech firms such as Google and Facebook generate huge revenues, they employ comparatively few people versus industrial giants of the past, such as IBM or General Motors. In the 1970s, General Motors employed more than 600,000 people, 10 times more Google and Facebook combined.Moreover, their use of robotic warehouse workers and coming use of delivery drones are sure to have further impact on jobs.

The Week also wrote:

Former Intel executive Bill Davidow… makes a strong claim: “For all its economic virtues, the internet has been long on job displacement and short on job creation. As a result, it is playing a central role in wage stagnation and the decline of the middle class.”So the very few at the top will be owners — as they are now, but with perhaps greater clout over human affairs. A token few will have human work where “manmade” might find appreciation and market, and more and more and more will become utterly dependent upon the government.

Not only will the Middle Class disappear, but so will the “working poor” as there becomes less and less meaningful work to do.

If you thought the welfare state was bad now – with a record number of homes on food stamps, many out of work or giving up on work and a significant portion of what used to be the Middle Class struggling just to make ends meet – it may be that we haven’t seen anything yet.

While we can hope for things to turn around, we should prepare for the worst.

What happens if we all become hordes of helpless masses completely dependent on government for everything?

It might sounds OK to some, but time for a reality check: life at the hands of government assistance is no kind of life at all.

From health care to food and everything else in life, government and technology will be the provider.

Ready for that?

This is why former SunMicrosystems CEO Bill Joy stated that the Future Doesn’t Need Us, quoting from Ted Kaczynski’s manifesto on the human condition under technology:

Due to improved techniques the elite will have greater control over the masses; and because human work will no longer be necessary the masses will be superfluous, a useless burden on the system.http://www.activistpost.com/2015/04/in-robotic-near-future-most-will-live.html#more

If the elite is ruthless they may simply decide to exterminate the mass of humanity.

If they are humane they may use propaganda or other psychological or biological techniques to reduce the birth rate until the mass of humanity becomes extinct, leaving the world to the elite.

Or, if the elite consists of soft-hearted liberals, they may decide to play the role of good shepherds to the rest of the human race. They will see to it that everyone’s physical needs are satisfied, that all children are raised under psychologically hygienic conditions, that everyone has a wholesome hobby to keep him busy, and that anyone who may become dissatisfied undergoes “treatment” to cure his “problem.” Of course, life will be so purposeless that people will have to be biologically or psychologically engineered either to remove their need for the power process or make them “sublimate” their drive for power into some harmless hobby. These engineered human beings may be happy in such a society, but they will most certainly not be free.

Tuesday, March 31, 2015

Monday, March 30, 2015

Sunday, March 29, 2015

Friday, March 27, 2015

Thursday, March 26, 2015

Tuesday, March 24, 2015

Monday, March 23, 2015

Saturday, March 21, 2015

Friday, March 20, 2015

Thursday, March 19, 2015

Tuesday, March 17, 2015

Monday, March 16, 2015

Sunday, March 15, 2015

Saturday, March 14, 2015

Tuesday, March 10, 2015

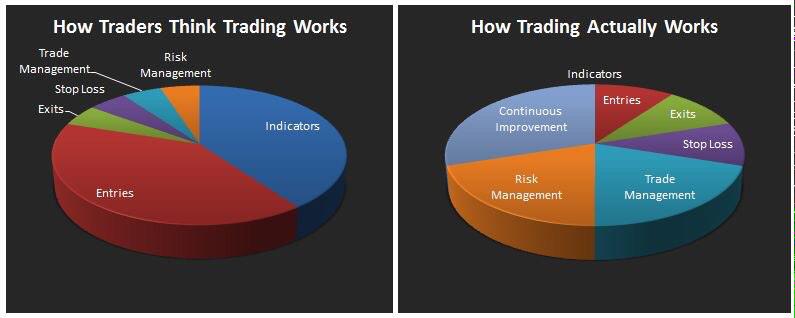

7 Signs

Is this the end of the last great run for the U.S. stock market? Are we witnessing classic “peaking behavior” that is similar to what occurred just before other major stock market crashes?

Throughout 2014 and for the early stages of 2015, stocks have been on quite a tear. Even though the overall U.S. economy continues to be deeply troubled, we have seen the Dow, the S&P 500 and the Nasdaq set record after record. But no bull market lasts forever – particularly one that has no relation to economic reality whatsoever.

This false bubble of financial prosperity has been enjoyable, and even I wish that it could last much longer. But there comes a time when we all must face reality, and the cold, hard facts are telling us that this party is about to end. The following are 7 signs that a stock market peak is happening right now…

#1 Just before a stock market crash, price/earnings ratios tend to spike, and that is precisely what we are witnessing. The following commentary and chart come from Lance Roberts…

The chart below shows Dr. Robert Shiller’s cyclically adjusted P/E ratio. The problem is that current valuations only appear cheap when compared to the peak in 2000. In order to put valuations into perspective, I have capped P/E’s at 30x trailing earnings. The dashed orange line measures 23x earnings which has been the level where secular bull markets have previously ended. I have noted the peak valuations in periods that have exceeded that 30x earnings.

At 27.85x current earning the markets are currently at valuation levels where previous bull markets have ended rather than continued. Furthermore, the markets have exceeded the pre-financial crisis peak of 27.65x earnings. If earnings continue to deteriorate, market valuations could rise rapidly even if prices remain stagnant.

#3 The median total gain during a bull market is 101.5 percent. For this bull market, it has been213 percent.

#4 Usually before a stock market crash we see a divergence between the relative strength index and the stock market itself. This happened prior to the bursting of the dotcom bubble, it happened prior to the crash of 2008, and it is happening again right now…

The first technical warning sign that we should heed is marked by a significant divergence between the relative strength index (RSI) and the market itself. This is noted by a declining pattern of lower highs in the RSI as stocks continue to make higher highs, a sign that the market is “topping out”. In the late ‘90s this divergence persisted for many years as the tech bubble reached epic valuation levels. In 2007 this divergence lasted over a much shorter period (6 months) before the market finally peaked and succumbed to massive selling. With last month’s strong rally to new records, we now have a confirmed divergence between the long-term relative strength index and the market’s price action.#5 In the past, peaks in margin debt have been very closely associated with stock market peaks. The following chart comes from Doug Short, and I included it in a previous article…

#6 As I have discussed previously, we usually witness a spike in 10-year Treasury yields just about the time that the stock market is peaking right before a crash.

Well, according to Business Insider, we just saw the largest 5 week rate rally in two decades…

Lots of guys and gals went home this past weekend thinking about the implications of the recent rise in the 10-year Treasury bond’s yield.

Chris Kimble notes it was the biggest 5-week rate rally in twenty years!#7 A lot of momentum indicators seem to be telling us that we are rapidly approaching a turning point for stocks. For example, James Stack, the editor of InvesTech Research, says that the Coppock Guide is warning us of “an impending bear market on the not-too-distant horizon”…

A momentum indicator dubbed the Coppock Guide, which serves as “a barometer of the market’s emotional state,” has also peaked, Stack says. The indicator, which, “tracks the ebb and flow of equity markets from one psychological extreme to another,” is also flashing a warning flag.

The Coppock Guide’s chart pattern is flashing a “double top,” which suggests that “psychological excesses are present” and that “secondary momentum has peaked” in this bull market, according to Stack.

“All of this is just another reason for concern about an impending bear market on the not-too-distant horizon,” Stack writes.So if we are to see a stock market crash soon, when will it happen?

Well, the truth is that nobody knows for certain.

It could happen this week, or it could be six months from now.

In fact, a whole lot of people are starting to point to the second half of 2015 as a danger zone. For example, just consider the words of David Morgan…

Momentum is one indicator and the money supply. Also, when I made my forecast, there is a big seasonality, and part of it is strict analytical detail and part of it is being in this market for 40 years. I got a pretty good idea of what is going on out there and the feedback I get. . . . I’m in Europe, I’m in Asia, I’m in South America, I’m in Mexico, I’m in Canada; and so, I get a global feel, if you will, for what people are really thinking and really dealing with. It’s like a barometer reading, and I feel there are more and more tensions all the time and less and less solutions. It’s a fundamental take on how fed up people are on a global basis. Based on that, it seems to me as I said in the January issue of the Morgan Report, September is going to be the point where people have had it.Time will tell if Morgan was right.

But without a doubt, lots of economic warning signs are starting to pop up.

One that is particularly troubling is the decline in new orders for consumer goods. This is something that Charles Hugh-Smith pointed out in one of his recent articles…

The financial news is astonishingly rosy: record trade surpluses in China, positive surprises in Europe, the best run of new jobs added to the U.S. economy since the go-go 1990s, and the gift that keeps on giving to consumers everywhere, low oil prices.

So if everything is so fantastic, why are new orders cratering? New orders are a snapshot of future demand, as opposed to current retail sales or orders that have been delivered.

This article first appeared here at the Economic Collapse Blog. Michael Snyder is a writer, speaker and activist who writes and edits his own blogs The American Dream and Economic Collapse Blog. Follow him on Twitter here.

we have been living in.

Saturday, March 7, 2015

Friday, March 6, 2015

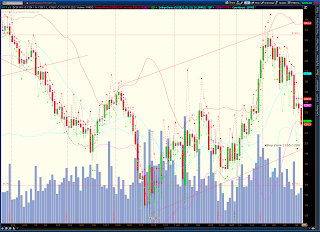

What Do These Charts Tell You

The premise of a currency war is that by devaluing its currency a country is able to sell things overseas more cheaply, which gooses its growth at the expense of its trading partners.

If it actually works that way, then you’d expect this chart of the euro plunging against the dollar…

…to be reflected in some sort of strong-dollar related downturn in the US. And right on cue, the Fed reported this morning that American manufacturers are now in the sixth month of a new-orders slowdown:

If things continue to play out according to script the coming year will be slightly better than expected for Europe (but only slightly because of all the other messes those guys have made of their common currency experiment) and quite a bit worse than expected for the US (because we actually think we’re recovering).

Then comes the next and final stage of the cycle, where the US realizes that it’s tipping back into recession, with all the unacceptable things that that implies for the equity bubble, tax revenues and campaign contributions, and shifts gears from tightening to open-the-floodgates loose, hoping to push the dollar back down against the euro, yen and yuan. The difference this time around will be that, as Europe is now discovering, easing monetary policy when interest rates are already zero means pushing into negative numbers. And that means yet another leap of faith into uncharted, experimental, very possibly disastrous territory.

http://dollarcollapse.com/currency-war-2/what-do-these-two-charts-have-in-common/

Saturday, February 28, 2015

Thursday, February 26, 2015

Deflation Has Cometh!

On Thursday, the consumer price index showed that prices fell 0.1% in January compared to last year.

And so for the first time since October 2009, deflation is back in America.

On a "core" basis, which strips out the more volatile costs of food and gas, prices actually rose 1.6% over last year, the same annual change seen in December.

And what's more, the decline in prices in January is almost all about gas.

In its report, the Bureau of Labor Statistics said the energy index fell 9.7% in January as gasoline prices decline 18.7%, the sharpest in a series of seven straight monthly declines for gas prices.

And because of this, economists were quick to point out that while this is technically deflation, it's not really deflation.

In a note to clients following the report, Paul Ashworth at Capital Economics wrote that, "this deflation is nothing to worry about. For a net importer like the US, lower gasoline prices are a good thing. Moreover, with the real economy doing well, there is little danger that this temporary bout of falling energy prices will develop into a more insidious debt-deflation spiral."

Pantheon Macro's Ian Shepherdson was more direct, writing: "In one line: Falling goods’ prices do not constitute deflation."

Read more: http://www.businessinsider.com/markets-chart-of-the-day-february-26-2015-2#ixzz3Sty9IUy7

Sunday, February 22, 2015

Monday, February 16, 2015

Friday, February 13, 2015

Wednesday, February 11, 2015

Gold...Where Art Thou Going

Quick Gold Update:

Gold is in a current uptrend channel from Nov 7. Could it just be a bear market rally? Sure. Place your bets. Gold could go below $1000 oz....but too many people are thinking that. It is just too simple. I think gold rises this year through a channel...this channel...I think it has one more glancing blow below 1200 oz and then it rises again. My plays...AEM and NSRPF....Do your own due diligence. One is a midtier miner the other might be the biggest lotto play in junior exploration.

Good Luck

Tuesday, February 10, 2015

Sunday, February 8, 2015

Saturday, February 7, 2015

Friday, February 6, 2015

Thursday, February 5, 2015

Thursday, January 29, 2015

Wednesday, January 21, 2015

Monday, January 19, 2015

Friday, January 16, 2015

Thursday, January 15, 2015

Tuesday, January 13, 2015

Monday, January 12, 2015

Sunday, January 11, 2015

Saturday, January 10, 2015

Thursday, January 8, 2015

Tuesday, January 6, 2015

Monday, January 5, 2015

Subscribe to:

Posts (Atom)