The Daily Show

Get More: Daily Show Full Episodes,The Daily Show on Facebook

Investment and Humor Blog Devoted to Lost Souls Searching For a Home.

Total Pageviews

Thursday, October 31, 2013

Wednesday, October 30, 2013

Tuesday, October 29, 2013

Sunday, October 27, 2013

Up Is Down

When I was 5 years old, my mother always told me that happiness was the key to life. When I went to school, they asked me what I wanted to be when I grew up. I wrote down ‘happy’. They told me I didn’t understand the assignment, and I told them they didn’t understand life.”

― John LennonFriday, October 25, 2013

Thursday, October 24, 2013

Wednesday, October 23, 2013

Tuesday, October 22, 2013

Monday, October 21, 2013

Friday, October 18, 2013

Wednesday, October 16, 2013

Tuesday, October 15, 2013

Monday, October 14, 2013

Something Fishy In Gold Market

The gold market was slammed shortly before the start of the “theatrical release“ of the Federal Government “shutdown”.

Historically, government shutdowns have been associated with negative financial news. Governments having to shut down due to financial reasons are generally considered to be in financial stress.

Negative financial news has historically been a time when gold and silver prices rise due to uncertainty. Gold and silver have long been safe havens against financial calamity including falling currency values, falling bond prices and even rising interest rates, as gold and silver store wealth against borrowing costs.

A quick survey of the last 17 government shutdowns going back to 1976, especially those lasting more than 3 days, we see gold prices never fell during any of those shutdowns. The longest running shutdown was from December 5th, 1995 through January 6, 1996, and during that period gold rose from $386 per ounce to $409 per ounce, a rise of nearly 6%.

The current government shutdown comes during a time period when American debt has never been higher. The Obama administration beginning in 2008 has added more debt to the Federal balance sheet than all other Presidents, from George Washington to George H. W. Bush combined, a staggering $4.2 Trillion dollars.

The issue of debt is not about total dollar amount, but about interest payments which must either be taxed in existence or borrowed into existence. By the end of the Obama Presidency, the total debt is likely to be close to $17 trillion, and over $6 trillion added during his two terms, which is as much as the total US Debt at the start of 2002.

Interest payments are the primary benefit of banker pretended debt script, except, when the game’s gone too long. In the end, interest payments finally cause the destruction of debt script, as interest rates rise exponentially until no amount of script can satisfy the the demands for more interest.

A primary concern of banker debt script managers is interest rates; keeping rates as low as possible is of the highest priority, especially when total debt ‘crosses the Rubicon’ where interest payments on debt already created, significantly affect future interest payments as previous payments are borrowed into existence. The United States Federal Reserve has crossed the Rubicon, and rising interest rates will signal the coming end of the FRN private debt-based script.

Over the past several years, it has been noted that the gold and silver and platinum and palladium have exhibited price behaviors consistent with being managed prices. Prices of gold and silver, especially, have been manipulated, both to keep the purchasing power of the dollar from falling quickly and to keep prices of US bond products high, resulting in unnaturally low and stable interest rates.

Contrary to reality-based, un-coerced, markets, where gold and silver, and other precious metals, rise as a currency is being over printed, the US Fed and complicit banks and brokerage houses have conspired to cause monetary metals to fall in prices, even as debt levels rise to all time highs more than doubling since 2002.

Rising interest rates are a sign that banker pretend debt script exists in far greater quantities than products to purchase in a market. Rising quantities of script mean more money available to purchase non increasing numbers of goods. As more money demands product, but production fails to rise, prices rise signaling shortages, as extra money supply attempts to purchase more product. Rising interest rates reduce demand for money and shrink the money supply as loans are paid off, and fewer new loans are sold.

However, when a banker pretend debt script is being borrowed into existence to meet the demands of pure spending, with no connection to products in the market, bankers and co-conspirators must manipulate interest rates lower to prevent catastrophic rises in interest payments. The end result is rising interest payments that soon become unstable because any rise in interest rates will soon fully destroy the financial system's ability to make payments on all non fixed rate debt.

Gold and silver prices are being deliberately and criminally destroyed by bankers hoping to keep the financial system alive a little longer as the wealth of the economy is transferred to bankers in the form of interest payments. Keeping the financial system functioning while manipulating gold and silver prices (and other schemes, such as interest rate derivative attached to bond purchases) is a madman scheme - soon to end with the full destruction of the bond market and dramatic collapse of dollar purchasing power.

During the “shutdown” of the government, done for political purposes including forcing Obamacare to be funded and to act as a distraction or excuse for a coming interest rate calamity, gold and silver prices have been forced lower and lower to keep interest rates stable.

Lowering prices of gold and silver is equivalent to boosting the value of the dollar and simultaneously strengthening face value of government debt. Rising dollar purchasing power is equivalent to an increase in interest rates, as bond holders receiving payments in dollars realize an increase in purchasing power. Rising or stable exchange values for the dollar keep money in dollars - rather than safe havens such as gold and silver. Destroying the price of gold and silver to maintain purchasing power of the dollar moves money from investments in gold and silver to government debt which rises in value relative to gold and silver.

*chart courtesy of StockCharts.com

Terms of Use

Terms of Use

As can be seen from the chart above, gold prices were being forced down in May as the 10-year yield (interest rate) on Treasury notes began rising, signaling an on-coming debt-interest rate calamity and the collapse of the US Bond prices. Metal prices were frantically slammed to slow the rise in interest rates on approximately June 17, 2013.

Slamming the price of gold helped slowed the rate of increase in the 10-year yield temporarily, preventing an interest rate crisis. Note again, after October 1st, interest rates stopped falling and started climbing, and, again, a gold smack down was engineered beginning in the second week.

The price of gold and silver are being pushed lower at great cost. In order to engineer the sell down, naked short selling and flash trading are being used, both of which are causing the depletion of physical gold and silver, as prices encourage foreigners and individual investors to continue buying gold and silver at significant discounts.

As the physical supply is being reduced and prices are falling below production costs of the metals, the physical supply will soon dwindle forcing rising prices, regardless of the paper traded value of gold and silver.

In the very near future, the physical shortage of gold and silver will lead to default in the commodities market exchanges (comex and other metals exchanges) creating a crisis in metals delivery and, for a short time, making gold and silver unavailable at any price.

At the same time when gold and silver prices rise exponentially and the metals exchanges default, bond prices will fall like a rock triggering financial system destroying interests rates.

The only protection bond holders and dollar holders have is to sell both before interest rates begin to rise. Since owning Federal Debt is the same as buying into a Ponzi scheme, only those that sell early will see any of their money returned.

Buying gold and, preferably, silver and other safe assets is the only hope to save your wealth. Time before collapse is not long - please hurry. - Jack Mullen Activist Post

http://www.activistpost.com/2013/10/gold-market-sunk-to-keep-bond-market.html

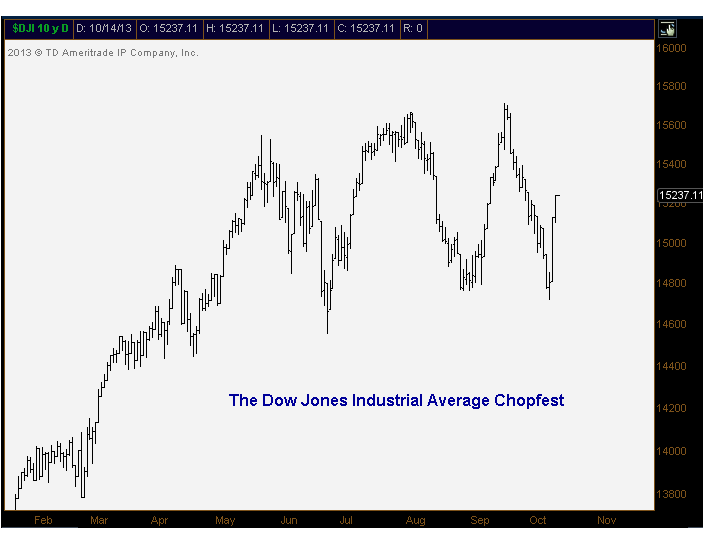

Chopfest

There are some stocks out there still trending higher – no doubt about it. But with every day that goes by, there are just less and less of them. And that’s not my opinion, that’s just a fact. So today I wanted to take a look at what this divergence has done to everyone’s favorite stock market average: the good ol’ Dow Jones Industrial Average.

Take a look at this chopfest in the Dow since April. Talk about lack of trends:

I think it’s important to point out that, although most professionals use the S&P500 as their benchmark for US Equities, when someone asks “how the market did today”, the answer you normally hear is “the Dow was up 100″, or “Dow was down 50″. You won’t hear, “S&Ps were down 7 handles”. So from a psychological and sentiment perspective, which is something we take very seriously, the Dow is something that cannot be ignored.

But when you hear at a cocktail party, or read in the paper, how well the stock market has done this year, you have to remember, the Dow Jones Industrial Average has gone pretty much no where over the last 6 months. For a “raging bull market” that doesn’t seem very good.

I personally feel, just by looking at this chart above, that the market is vulnerable bigger picture. In my experience, wide swings like this normally show up at key turning points. This isn’t exactly a characteristic of a strong uptrending market.

Just my two cents…

Sunday, October 13, 2013

Saturday, October 12, 2013

Crash on Oct 18th?

The Stock Market Crash of October 18, 2013

by John Galt

October 9, 2013 23:00 ET

While I realize that outlining a specific date leaves this website and myself open to massive attacks and criticism, there is no guarantee nor offer of financial advice nor investment ideas behind this article as there is always the probability of another disastrous political solution to the upcoming economic disruption which will begin next week. However, if the politicians and bankers decide to press the issue in order to obtain even greater control over the economy and to justify a greater role for our financial industry within a newly created international economic system, then the logical conclusion is that the system must be crashed sooner, rather than later.

The term of the day to remember is “SD” also known as “Selective Default.”

The definition of Selective Default per the ratings agency Standard & Poors:

Just what is his point in this discussion? It would appear that President Obama is setting the table to blame the Republicans for a default, even if the monies are available to pay the interest payments or principle owed. David Stockman, former head of the OMB under President Reagan provides a warning about how such a default would occur while he was a guest on Lou Dobb’s Fox Business News program on October 5th:

How does this event lead to a stock market crash so quickly? Think about what the entire construct of our economic system consists of; the full faith and credit of individuals, businesses, and governments having the ability to borrow money and pay it back. No longer is about creating goods and services to expand wealth, we have built a new system of debt, investment, financial services, and Ponzi schemes designed to multiply returns for the elites while extracting opportunity and imposing control on the masses. This hybrid capitalist approach, and I use the term “capitalism” quite loosely, was perfected by the same leaders while designing Communist China’s emergence from it’s fascist neo-feudalism period into the modern age. By introducing the same system into the European and United States the control of the world’s central bankers will extend to every modern society leaving freedom only as a fleeting memory and history to be redefined as the winners see fit.

Thus if the Obama administration and Federal Reserve are prepared for the worst, what would stop them? They have a patsy within the Republican Party known as the Tea Party movement which gives the leadership which disdains them an excuse to leave them as the scapegoats for an event which need not ever occur. By inferring that it was a small extremist block of politicians that caused this, history and the current crop of political elites will destroy the last opportunity to restore true capitalism and freedom as we once knew it.

The crash would occur as Mr. Stockman noted because Obama ordered a Treasury Department default, The economic consequences would be immediate and severe as his perceived unpredictability would rattle markets worldwide. The methodology behind the default however, is simple and swift. On October 18, 2013, for example, the following Fannie Mae with the CUSIP identifier of 3136G0AB7 has an interest payment due on October 18th (part of a 30 year 4.15% offering). Imagine the market reaction should the Treasury Department announce that their would be a suspension of this interest payment due to the debt ceiling issue and other instruments may be announced throughout the upcoming days.

Boom.

Instant 10%, 12%, 20% or daily limit down on U.S. markets and massive sell off on the Treasury market. But is the market primed for this just because of the debt ceiling and Obamacare fight in Washington? Certainly not; look at the amount of time since a substantial correction and bear market, even short term, has impacted the market in the last 5 years:

The 1-3-6 month T-Bill markets are also flashing equally disturbing signs:

The unnatural rates suppressed by the Federal Reserve and banksters are showing signs again of a strange anomaly at the end of the graph. Bond traders are perhaps the least emotional, most rational bunch I have ever met and they do not move the needle that dramatically unless they feel there is an actual risk of a default, whether planned or not. This event seems to be even more dramatic when reviewing the 4 week Treasury Bill compared to the 3 and 6 month since January 1st of this year:

For the bond market, especially the short duration Treasuries, that is a dramatic move. This fits the model for a preconceived default where a harmless instrument like a GSE bond or bill is deliberately defaulted on creating the excuse for a stock market correction of at least 20% to flush out the weak hands and 40% if there is a more insidious goal planned for the long term. Remember that under the Dodd-Frank legislation, the President and Secretary of the Treasury can waive and eradicate many of the protective banking regulations which would allow greater dominance of the core members of the Federal Reserve to control our economy and personal finances. It is a logical idea to crash the system now, kill two birds with one stone namely the Tea Party and anti-Fed movement, plus create a permanent power structure which destroys any opposition to the policies developed or desired by the highest bidder.

Tread lightly next week because another predictive element I watch, the historical relationship of gold to the stock market is flashing an equally dangerous warning sign. When gold and short term Treasuries illustrate a similar pattern of panic as they did in 2008, I tend to pay attention. Another warning signal for me was the Financial Times story about banks hoarding cash for a potential debt ceiling crisis by increasing their reserves, much like some institutions did in 2008. Hopefully, as I stated above, I am incorrect, but watch what our financial and political leaders do, not what they say.

http://johngaltfla.com/wordpress/2013/10/09/the-stock-market-crash-of-october-18-2013/

October 9, 2013 23:00 ET

While I realize that outlining a specific date leaves this website and myself open to massive attacks and criticism, there is no guarantee nor offer of financial advice nor investment ideas behind this article as there is always the probability of another disastrous political solution to the upcoming economic disruption which will begin next week. However, if the politicians and bankers decide to press the issue in order to obtain even greater control over the economy and to justify a greater role for our financial industry within a newly created international economic system, then the logical conclusion is that the system must be crashed sooner, rather than later.

The term of the day to remember is “SD” also known as “Selective Default.”

The definition of Selective Default per the ratings agency Standard & Poors:

“An obligor rated “SD” has failed to pay one or more of its financial obligations (rated or unrated) when it came due. An “SD” rating is assigned when Standard & Poor’s believes that the obligor has selectively defaulted on a specific issue or class of obligations but it will continue to meet its payment obligations on other issues or classes of obligations in a timely manner.”Why is this terminology important? Let’s review what Obama said at his press conference yesterday:

Just what is his point in this discussion? It would appear that President Obama is setting the table to blame the Republicans for a default, even if the monies are available to pay the interest payments or principle owed. David Stockman, former head of the OMB under President Reagan provides a warning about how such a default would occur while he was a guest on Lou Dobb’s Fox Business News program on October 5th:

How does this event lead to a stock market crash so quickly? Think about what the entire construct of our economic system consists of; the full faith and credit of individuals, businesses, and governments having the ability to borrow money and pay it back. No longer is about creating goods and services to expand wealth, we have built a new system of debt, investment, financial services, and Ponzi schemes designed to multiply returns for the elites while extracting opportunity and imposing control on the masses. This hybrid capitalist approach, and I use the term “capitalism” quite loosely, was perfected by the same leaders while designing Communist China’s emergence from it’s fascist neo-feudalism period into the modern age. By introducing the same system into the European and United States the control of the world’s central bankers will extend to every modern society leaving freedom only as a fleeting memory and history to be redefined as the winners see fit.

Thus if the Obama administration and Federal Reserve are prepared for the worst, what would stop them? They have a patsy within the Republican Party known as the Tea Party movement which gives the leadership which disdains them an excuse to leave them as the scapegoats for an event which need not ever occur. By inferring that it was a small extremist block of politicians that caused this, history and the current crop of political elites will destroy the last opportunity to restore true capitalism and freedom as we once knew it.

The crash would occur as Mr. Stockman noted because Obama ordered a Treasury Department default, The economic consequences would be immediate and severe as his perceived unpredictability would rattle markets worldwide. The methodology behind the default however, is simple and swift. On October 18, 2013, for example, the following Fannie Mae with the CUSIP identifier of 3136G0AB7 has an interest payment due on October 18th (part of a 30 year 4.15% offering). Imagine the market reaction should the Treasury Department announce that their would be a suspension of this interest payment due to the debt ceiling issue and other instruments may be announced throughout the upcoming days.

Boom.

Instant 10%, 12%, 20% or daily limit down on U.S. markets and massive sell off on the Treasury market. But is the market primed for this just because of the debt ceiling and Obamacare fight in Washington? Certainly not; look at the amount of time since a substantial correction and bear market, even short term, has impacted the market in the last 5 years:

The 1-3-6 month T-Bill markets are also flashing equally disturbing signs:

The unnatural rates suppressed by the Federal Reserve and banksters are showing signs again of a strange anomaly at the end of the graph. Bond traders are perhaps the least emotional, most rational bunch I have ever met and they do not move the needle that dramatically unless they feel there is an actual risk of a default, whether planned or not. This event seems to be even more dramatic when reviewing the 4 week Treasury Bill compared to the 3 and 6 month since January 1st of this year:

For the bond market, especially the short duration Treasuries, that is a dramatic move. This fits the model for a preconceived default where a harmless instrument like a GSE bond or bill is deliberately defaulted on creating the excuse for a stock market correction of at least 20% to flush out the weak hands and 40% if there is a more insidious goal planned for the long term. Remember that under the Dodd-Frank legislation, the President and Secretary of the Treasury can waive and eradicate many of the protective banking regulations which would allow greater dominance of the core members of the Federal Reserve to control our economy and personal finances. It is a logical idea to crash the system now, kill two birds with one stone namely the Tea Party and anti-Fed movement, plus create a permanent power structure which destroys any opposition to the policies developed or desired by the highest bidder.

Tread lightly next week because another predictive element I watch, the historical relationship of gold to the stock market is flashing an equally dangerous warning sign. When gold and short term Treasuries illustrate a similar pattern of panic as they did in 2008, I tend to pay attention. Another warning signal for me was the Financial Times story about banks hoarding cash for a potential debt ceiling crisis by increasing their reserves, much like some institutions did in 2008. Hopefully, as I stated above, I am incorrect, but watch what our financial and political leaders do, not what they say.

http://johngaltfla.com/wordpress/2013/10/09/the-stock-market-crash-of-october-18-2013/

Friday, October 11, 2013

Thursday, October 10, 2013

Wednesday, October 9, 2013

Tuesday, October 8, 2013

Monday, October 7, 2013

Sunday, October 6, 2013

Friday, October 4, 2013

Thursday, October 3, 2013

SUPER VOLCANO!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!

Right now, the ground underneath Yellowstone National Park is rising at a record rate. In fact, it is rising at the rate of about three inches per year. The reason why this is such a concern is because underneath the park sits the Yellowstone supervolcano – the largest volcano in North America. Scientists tell us that it is inevitable that it will erupt again one day, and when it does the devastation will be almost unimaginable. A full-blown eruption of the Yellowstone supervolcano would dump a 10 foot deep layer of volcanic ash up to 1,000 miles away, and it would render much of the United States uninhabitable. When most Americans think of Yellowstone, they tend to conjure up images of Yogi Bear and “Old Faithful”, but the truth is that sleeping underneath Yellowstone is a volcanic beast that could destroy our nation in a single day and now that beast is starting to wake up.

The Yellowstone supervolcano is so vast that it is hard to put it into words. According to the Daily Mail, the magma “hotspot” underneath Yellowstone is approximately 300 miles wide…

#1 A full-scale eruption of Yellowstone could be up to 1,000 time more powerful than the eruption of Mount St. Helens in 1980.

#2 A full-scale eruption of Yellowstone would spew volcanic ash 25 miles up into the air.

#3 The next eruption of Yellowstone seems to be getting closer with each passing year. Since 2004, some areas of Yellowstone National Park have risen by as much as 10 inches.

#4 There are approximately 3,000 earthquakes in the Yellowstone area every single year.

#5 In the event of a full-scale eruption of Yellowstone, virtually the entire northwest United States will be completely destroyed.

#6 A massive eruption of Yellowstone would mean that just about everything within a 100 mile radius of Yellowstone would be immediately killed.

#7 A full-scale eruption of Yellowstone could also potentially dump a layer of volcanic ash that is at least 10 feet deep up to 1,000 miles away.

#8 A full-scale eruption of Yellowstone would cover virtually the entire midwest United States with volcanic ash. Food production in America would be almost totally wiped out.

#9 The “volcanic winter” that a massive Yellowstone eruption would cause would radically cool the planet. Some scientists believe that global temperatures would decline by up to 20 degrees.

#10 America would never be the same again after a massive Yellowstone eruption. Some scientists believe that a full eruption by Yellowstone would render two-thirds of the United States completely uninhabitable.

#11 Scientists tell us that it is not a matter of “if” Yellowstone will erupt but rather “when” the next inevitable eruption will take place.

Wednesday, October 2, 2013

Tuesday, October 1, 2013

Subscribe to:

Posts (Atom)