Written by Adam Shell, USA TODAY, January 17, 2013.

The current bull market on Wall Street has one thing in common with late comedian Rodney Dangerfield: It don't get no respect!

Numbers don't lie. The Standard and Poor's 500, an index of large-company U.S. stocks, eked out a fresh five-year high Thursday at 1480.94. It is up 119% since the bull market began on March 9, 2009, which means it is a member of the so-called "100% Gain Club," and just one of nine bull markets in the benchmark index's history to post a triple-digit gain, according to Bespoke Investment Group.

The current bull, which followed the worst bear market, or market plunge, since the Great Depression, is also 1,407 days old, which ranks eighth and also puts it in the "1,000 Day Club."

In cash terms, the stock market has generated $10.5 trillion in paper wealth since the bear market ended, according to Wilshire Associates.

So why is this historically significant market advance, which has enabled the S&P 500 to climb within 6% of its Oct. 9, 2007, all-time high of 1565.15, so despised? So disrespected? So distrusted?

"It is the Rodney Dangerfield of bull markets," says Gene Needles, CEO of American Beacon Funds. He says most investors don't know how strong the market is because they have focused on short-term volatility. "They think the market is down. They've been reading all of the dire headlines. The financial crisis. Fiscal cliff. Debt-ceiling debate. Europe. Pick your poison. It hasn't felt like a bull market. It's not like in the 1990s when there was a ticker-tape-parade-type atmosphere every day on Wall Street."

The stellar statistics, of course, tell a story of success, not failure. But, oddly, investors, especially ones on Main Street, don't seem to care. For much of the last 44 months, most investors, many of them psychologically and financially scarred by the 2008-09 financial crisis, have sworn off the stock market.

Instead, in search of perceived safety and a good night's sleep, they have plowed the bulk of their life savings into bonds or deposited their cash in banks that pay about the same zero interest rate as the mattress-turned-piggy-bank that gained acclaim after the 1929 stock market crash.

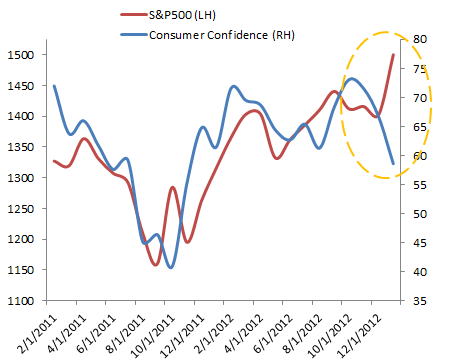

In the five years ended in 2012, individual investors have yanked an estimated $557 billion out of U.S. stock mutual funds, while $1 trillion has been funneled into bond funds, according to data from the Investment Company Institute, a fund company trade group.

It's as if investors can't forgive the market for burning them badly in the rout a few years ago; a plunge that was less than a decade removed from the tech-stock-inspired crash in 2000. Like a spurned lover, investors have been unwilling to give the stock market a second chance, or even a third chance.

"Investors don't really trust the market itself, so they don't trust the rally," says Paul Hickey, co-founder of Bespoke Investment Group.

Despite the lingering pessimistic sentiment, the fact that the stock market keeps rising ever closer to its old all-time high in the face of bad news is a positive sign, counters Needles.

"It's more of a sign of a market breakout than a top," Needles says. "Investors have a renewed appetite for risk."

There are other theories as to why stocks have lost their luster as the go-to investment to get rich, save for college and fund a retirement nest egg.

Andres Garcia-Amaya, a global markets strategist at JPMorgan Funds who happens to think the current stock market rally has a ways to go, blames investor complacency. The bond market has been in a bull market for three decades, and investors scared off by the volatility of stocks, he says, found comfort in the solid and competitive performance of bonds vs. stocks over the years, especially the big outperformance during and after the 2008 financial crisis.

Another big factor causing investors' aversion to stocks to grow in recent years is that they have been unable to shake the bad memories of past stock market plunges, says Doug Sandler, chief equity officer at RiverFront Investment Group.

"We have been conditioned over the past 12 years into thinking that buying stocks is a bad decision, because they always get beat up at some point," Sandler says.

Adds Bespoke's Hickey: "With two 50% haircuts in the last 12 years, investors think it is just a matter of time before we get the next 50% drop. So they have just given up."

The other thing that has given investors pause, Sandler adds, is the fact that the market rally since 2009 has been driven in large part by policies and actions of lawmakers in Congress and central bankers, such as the Federal Reserve and European Central Bank. Some Wall Street bears argue that the gains have been artificially inflated by the stimulus injected into markets by bankers. These drastic and unprecedented measures used by central bankers to reignite the economy, revive risk taking and boost investor confidence are akin to "steroids" or "sugar high," critics say.

What's more, having politicians and bankers determine the fate of markets makes it hard to handicap the future.

"That stuff is really hard to forecast," says Sandler. "I can't tell you what (ECB head) Mario Draghi is thinking right now. We can guess. But it is different than trying to figure out how Apple's iPhone is selling. And that scares people."

But that doesn't mean that there is not a case to be made for stocks.

Ironically, while the irrational exuberance of the go-go 1990s, or even the heady days of the real estate boom in the mid-2000s, is long gone, the market, at least by common measures used by Wall Street to measure its vital signs, is in far better shape today and it points to more gains ahead, Sandler argues. Back in late 1999 and early 2000, when tech stocks were king and nearing a pre-crash peak, the S&P 500 was trading at more than 30 times its estimated earnings.

Today the market is trading at just 13 times estimated profits for 2013, which is below the long-term average of 15 times earnings. The market's current price-to-earnings multiple is even lower than it was at the stock market's last peak in October 2007, Sandler says. Corporate earnings, which slowed sharply in the second half of 2012, are expected to re-accelerate and grow roughly 10.6% this year, according to current analyst estimates tracked by Thomson Reuters.

So the stock market is not wildly overvalued and screaming that a top is near.

"Are we bumping up against super-high valuations? The answer is no," says Sandler, adding that the market is reasonably priced.

Not only are stocks not overvalued, they also look attractive relative to bonds, which currently are trading at, or near, record-high prices and sporting historically low yields that make it tough for investors to grow their money and build enough wealth to meet their long-term goals, says Garcia-Amaya. The yield on the benchmark 10-year Treasury bond is 1.83%. In contrast, stocks in the S&P 500 that pay dividends have an average yield of 2.8%, says S&P Dow Jones Indices.

"Relative to fixed-income, stocks look favorable," says Garcia-Amaya. . . .

![clip_image001[5]](http://www.jsmineset.com/wp-content/uploads/2013/01/clip_image0015_thumb.jpg)